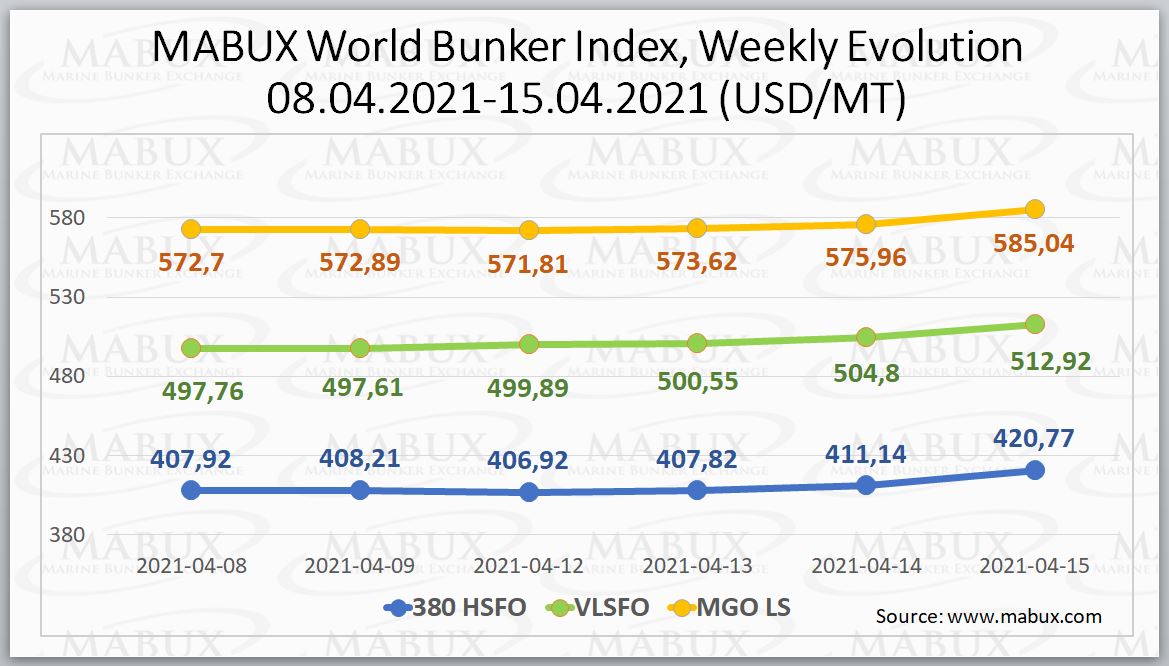

The World Bunker Index of the Marine Bunker Exchange (MABUX) has increased during the week with the 380 HSFO index jumping to US$420.77/ MT, VLSFO climbing to 512.92 USD/MT, while MGO LS increased to 585.04 USD/MT.

The Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO –has also increased during the week and averaged US$91.79.

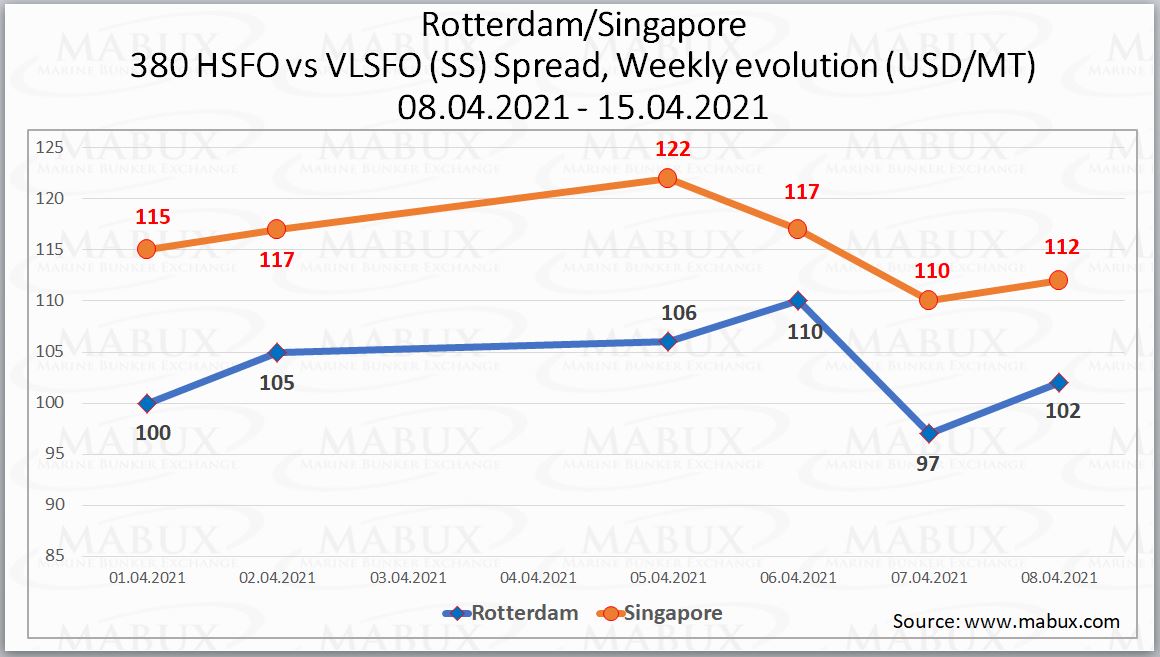

[s2If is_user_logged_in()]Meanwhile, SS Spread in Rotterdam has decreased during the week to US$100, the average SS spread for the week has increased to US$103.33. In Singapore, SS Spread has slightly decreased during the week by US$3 to US$112, while the average weekly SS index rose to US$115.5.

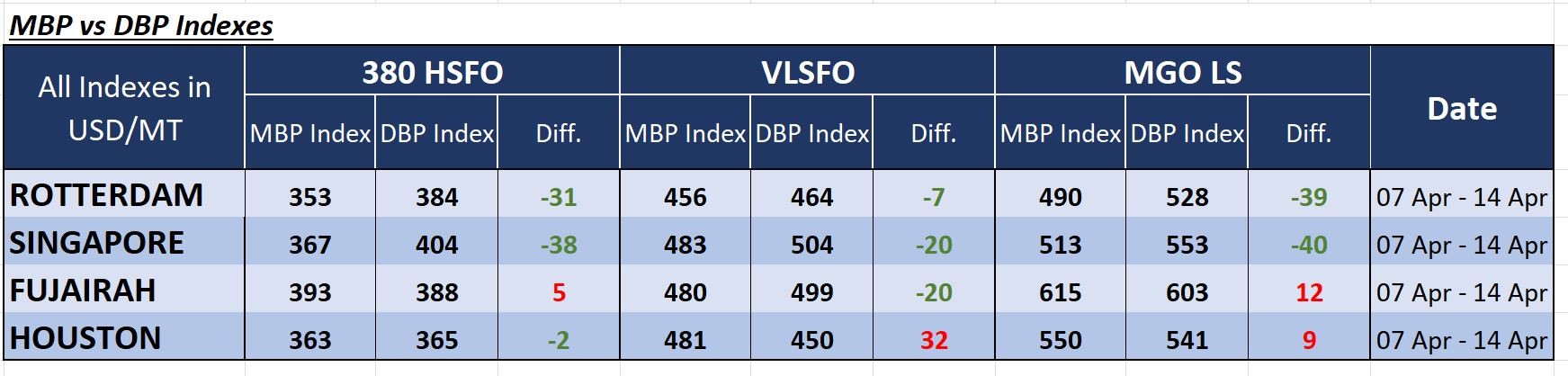

Additionally, the correlation of MBP Index (Market Bunker Prices) vs DBP Index (MABUX Digital Benchmark) in the four global largest hubs during the past week showed that 380 HSFO remain undervalued in three selected ports, except of Fujairah.

VLSFO according to DBP Index, is undervalued in all selected ports except of the port of Houston, while MGO LS was overvalued in Fujairah and Houston, but underpriced in Rotterdam and Singapore.

About 4.2 million metric tonnes (MT) of marine fuel were sold last month at the port of Singapore, which is 2.8% down from the 4.32 million MT recorded a year ago.

However, last month’s total represented a 1.9% increase on the 4.12 million mt of marine fuel sales recorded at the global bunker hub in February 2021, according to the MABUX weekly report.

A total of 12,822,400 mt of marine fuel was sold during the first three months of 2021. In contrast, during the same period in 2020, the Maritime and Port Authority of Singapore recorded 12,716,700 mt of bunker sales.

Monjasa declared that the company sold 4.9 million MT of bunker fuel in 2020 in spite of a global market contraction due to the pandemic, with volumes in its Southeast Asian business surging by 80%.

According to Monjasa’s Annual Report for 2020, in spite of the supply chain dislocation caused by the pandemic and the resulting decline in bunker demand, the company posted an increase in volumes every month last year compared to 2019 levels.

The company highlighted notable volume increases in the Americas and Southeast Asia. With high activity levels at the Panama Canal and across the US, the company’s Americas business recorded a 22% quantity hike, reaching a total volume of 1.4 million mt for the year.

[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]