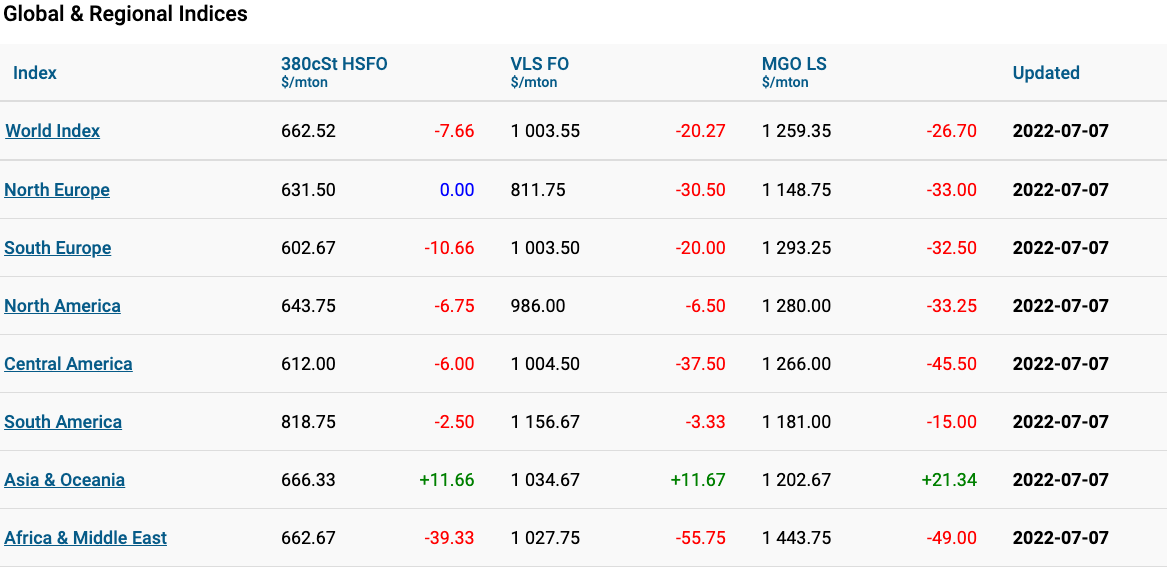

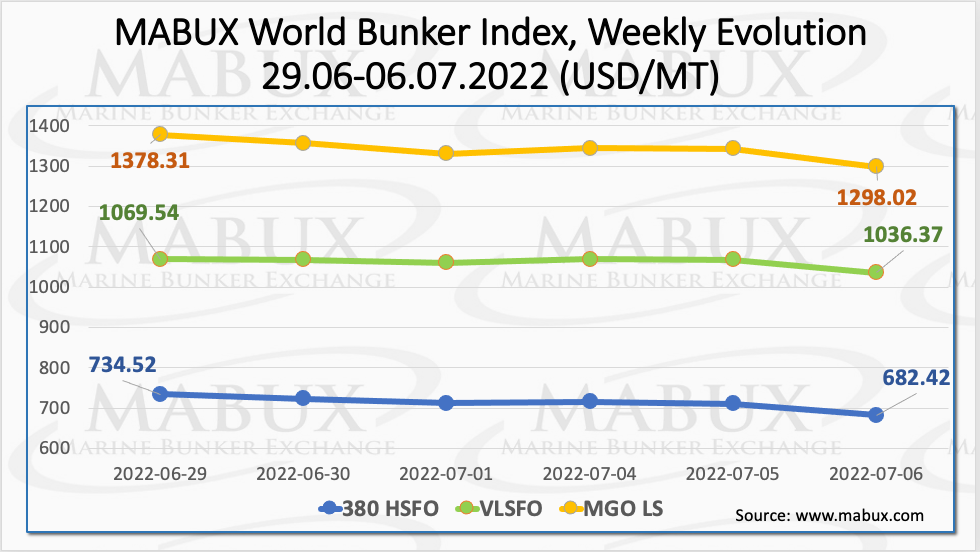

Over Week 27, the world bunker indices showed a sharp decline, primarily due to the fall in oil prices on 5 July, according to Sergey Ivanov, director of Marine Bunker Exchange (MABUX).

The 380 HSFO index fell to US$682.42 /mt, the VLSFO index decreased to US$1,036.37 /mt and the MGO Index dropped to US$1,298.02 /mt.

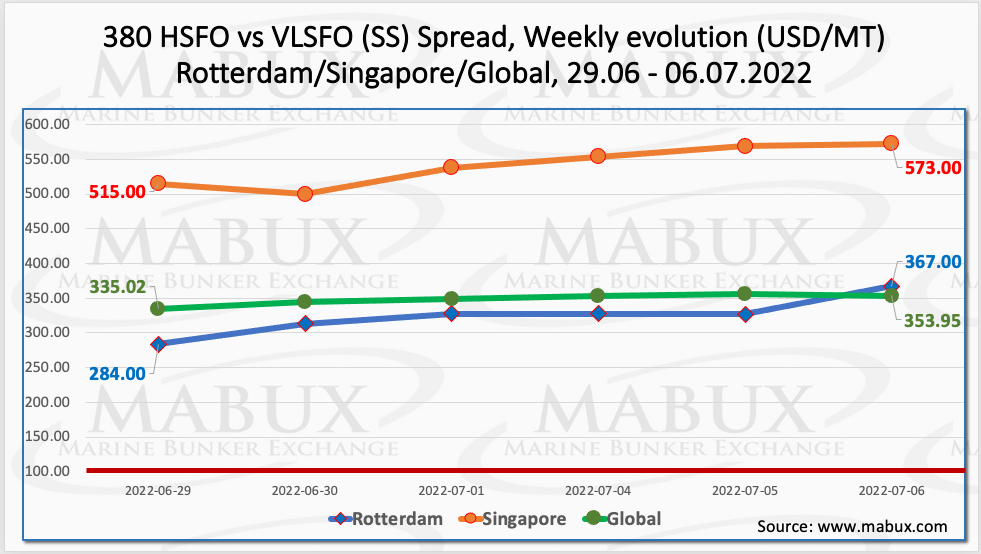

Despite the decline in fuel prices, the Global Scrubber Spread (SS) weekly average – the price difference between 380 HSFO and VLSFO – continued to increase over the week – plus US$14.70 from US$334.20 last week). In Rotterdam, the average SS Spread also rose to US$324.50 from US$307 last week. The most significant growth in the average weekly 380 HSFO/VLSFO price difference was registered in Singapore: plus US$51.67 from US$489.83 last week.

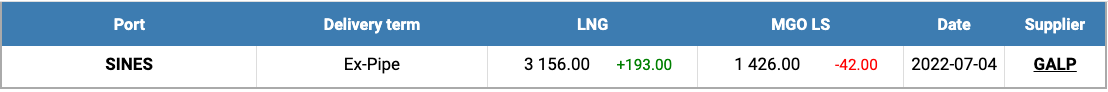

“Tight supply and energy security uncertainty pushed natural gas prices to record highs over the week,” said Ivanov. The price of LNG as bunker fuel in the port of Sines (Portugal) rose on 4 July by US$193, reaching US$3,156/mt. LNG prices are more than double those of traditional bunker fuels: MGO LS at the port of Sines was quoted on 6 July at US$1,426/mt.

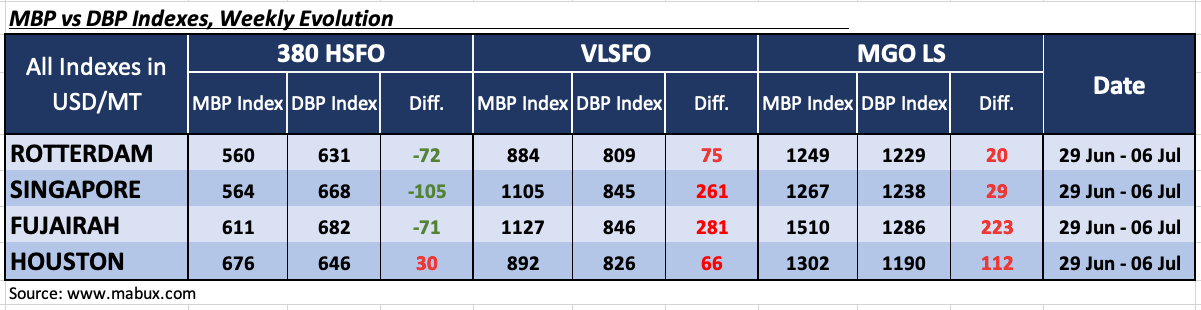

Over the Week 27, the MDI index (comparison of MABUX MBP Index [market bunker prices] vs MABUX DBP Index [MABUX digital bunker benchmark]) continued to register an underestimation of 380 HSFO fuel in three out of four ports selected: Rotterdam – minus US$72, Singapore – minus US$105 and Fujairah – minus US$71. Houston remains the only overpriced port – plus US$20.

VLSFO fuel grade, according to MDI, remained overpriced in all four selected ports: plus US$75 in Rotterdam, plus US$261 in Singapore, plus US$281 in Fujairah and plus US$66 in Houston.

“Here, the MDI index did not have a firm trend: the overprice premium increased in Rotterdam, Singapore and Fujairah, but decreased in Houston. VLSFO fuel remains the most overvalued segment in the global bunker market,” commented Ivanov.

As for MGO LS grade, MDI registered an overcharge of this fuel in all selected ports: in Rotterdam – plus US$20, in Singapore – plus US$29, in Fujairah – plus US$223 and in Houston – plus US$112. The most significant changes were in Fujairah – plus 76 points and Houston – plus 63 points. In Rotterdam and Singapore, over the week, the overcharge premium decreased, while in Fujairah and Houston it rose.

“We expect next week the global bunker market to pass into upward correction after a sharp fall this week,” pointed out Ivanov.