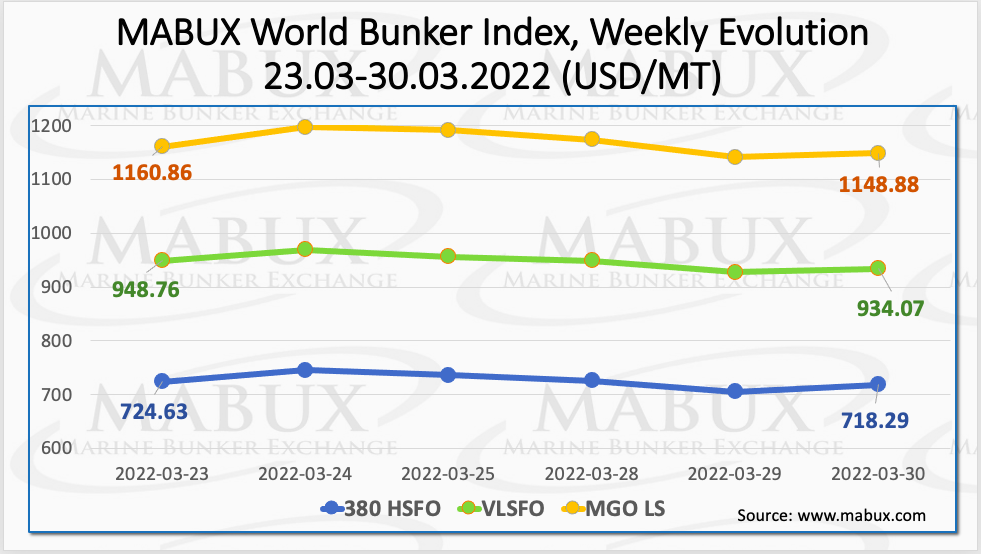

The military conflict in Ukraine hinders the formation of a stable sustainable trend in the global bunker market, as the Marine Bunker Exchange (MABUX) Bunker Index showed a slight downward correction during the thirteenth week of the year.

The 380 high-sulphur fuel oil (HSFO) index decreased to US$718.29/MT, and the very low sulphur fuel oil (VLSFO) index fell to US$934.07/MT, while the marine gas oil (MGO) index also dropped to US$1,148.88/MT.

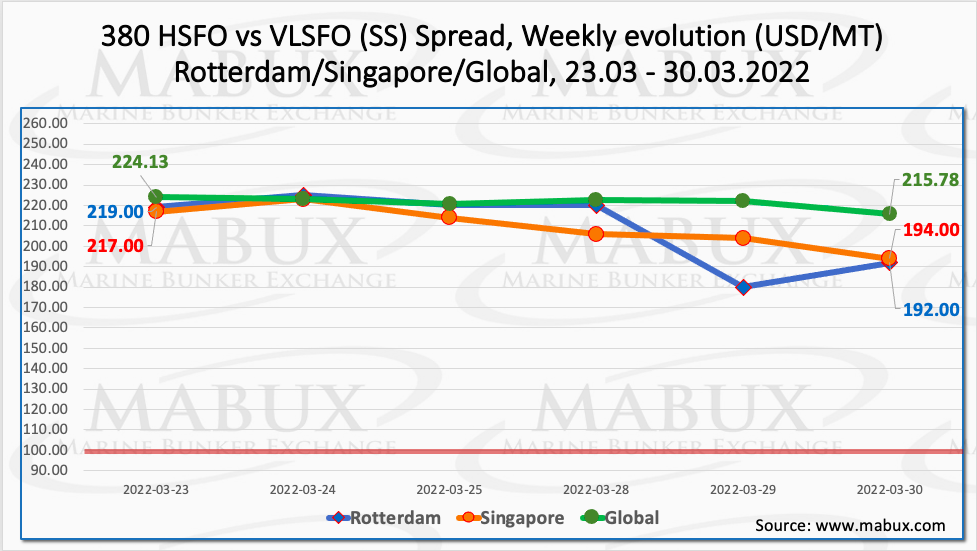

The Global Scrubber Spread (SS) weekly average, the difference between 380 HSFO and VLSFO, rose slightly over the week to US$221.46. In Rotterdam, the average SS Spread dropped to US$209.33, and in Singapore, it also dropped to US$209.67.

Minor changes in SS Spread indicate a gradual stabilisation of the market situation, according to MABUX analysts.

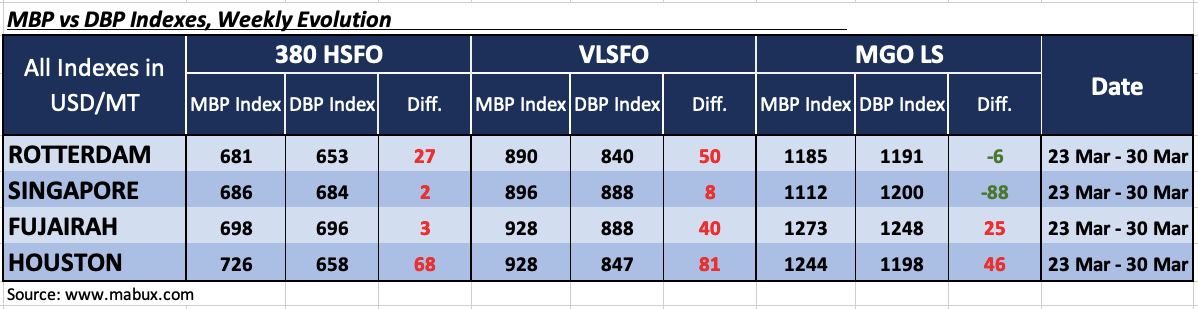

Regarding the average correlation of the MABUX market bunker prices (MBP) Index vs MABUX digital bunker benchmark (DBP) Index, it showed that the fuel overpricing trend prevailed in the global bunker market amid high volatility.

Thus, 380 HSFO fuel remained overpriced at all four selected ports, although overprice premiums decreased significantly: in Rotterdam – plus US$27, in Singapore – plus US$2, in Fujairah – plus US$3 and in Houston – plus US$68. The most significant was a 32-point reduction of 380 HSFO’s overcharge in Houston, compared to the previous week.

VLSFO fuel grade, according to the MABUX MBP/DBP Index, also remained overpriced on average in all selected ports: plus US$50 in Rotterdam, plus US$8 in Singapore, plus US$40 in Fujairah and plus US$81 in Houston.

In all selected ports, with the exception of Houston, there is a trend towards a reduction of overpricing margins, and the most significant change over the week was the increase of VLSFO’s overprice ratio in the port of Houston by 72 points.

As for MGO LS, the MABUX MBP/DBP Index recorded an overpricing of this fuel grade in two out of four ports selected: Fujairah – plus US$25 and Houston – plus US$46.

In Rotterdam and Singapore, according to the MABUX MBP/DBP Index, MGO LS fuel was undervalued by US$6 and US$88 respectively. In the segment of this fuel grade, there is also a steady trend toward a reduction in overpricing ratio and a transition to the zone of undervaluation.