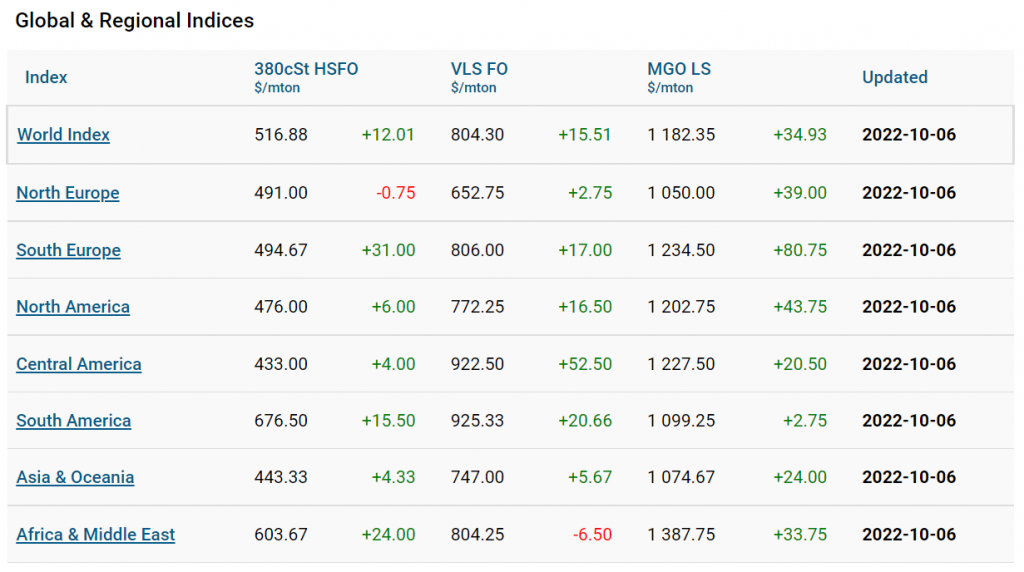

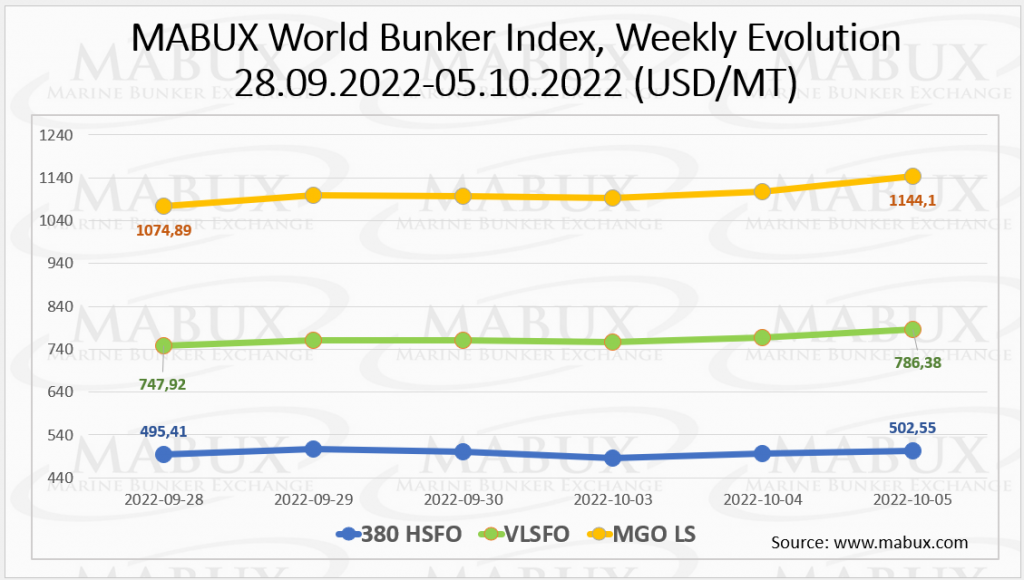

Over Week 40, Marine Bunker Exchange (MABUX) global bunker indices turned to upward evolution with the 380 HSFO index increasing last week to US$502.55/mt, the VLSFO index rising to US$786.38/mt and the MGO index growing to US$1,144.10/mt.

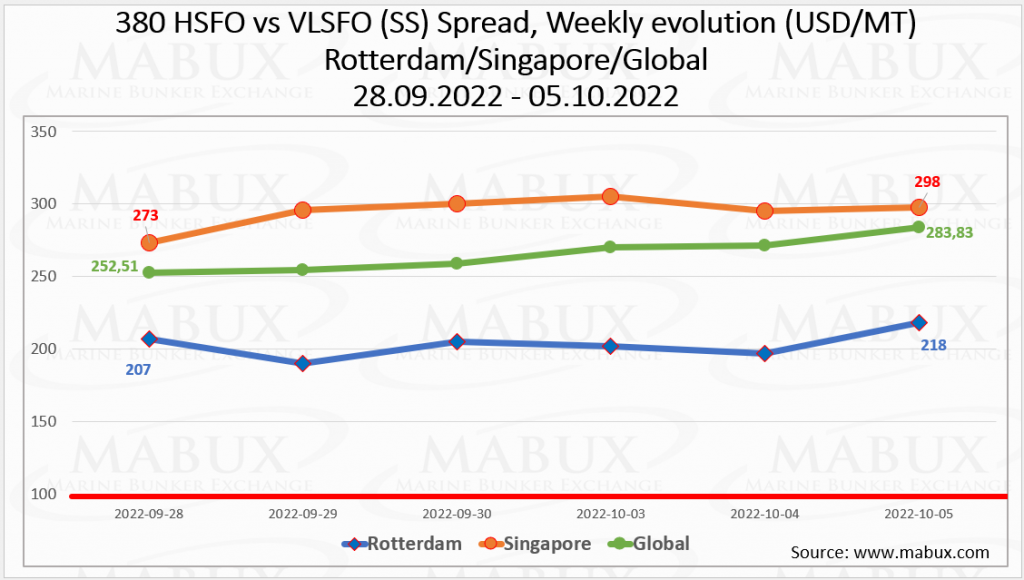

Meanwhile, the Global Scrubber Spread (SS) weekly average, the price differential between 380 HSFO and VLSFO, increased over the last week by US$6.98 to US$265.19.

In Rotterdam, the average SS Spread continued to decline to US$203.17, in Singapore, the average weekly price differential of 380 HSFO/VLSFO contrariwise, increased to US$294.50.

“The indicators of the Global SS Spread and the values of SS Spread in the largest hubs spread out from each other,” commented MABUX analysts.

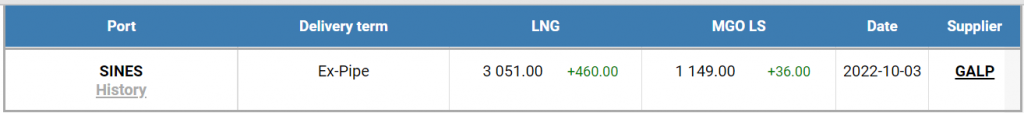

In the meantime, the price for LNG as a bunker fuel at the port of Sines in Portugal increased on 3 October by US$460/mt to US$3,051/mt.

MABUX reported that the spread between LNG price and the price for MGO is wider again with LNG prices being more than 2.5 times higher than the most expensive type of traditional bunker fuel. The price of MGO LS at the port of Sines was quoted on 5 October at US$1,149/mt.

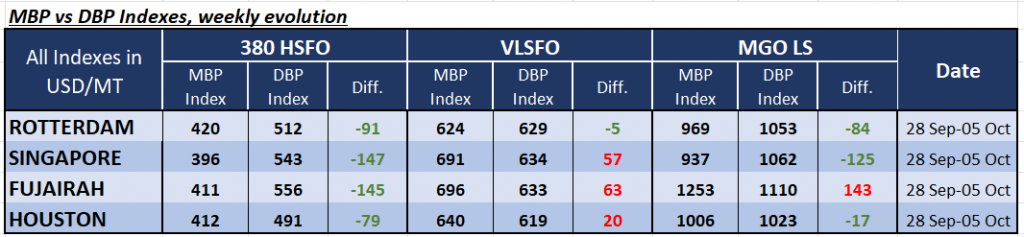

Over Week 40, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed an underpricing of 380 HSFO fuel grade in all four selected ports.

The underestimation margins increased during the week in all ports except Rotterdam, where the underpricing stayed at the same level of minus US$91. In other ports underestimation amounted for: Singapore – minus US$147, Fujairah – minus US$145 and Houston – minus US$79.

VLSFO fuel grade, according to MDI, remained, overpriced in three out of four selected ports: minus US$5 in Rotterdam, plus US$57 in Singapore, plus US$63 in Fujairah and plus US$20 in Houston.

“In this fuel segment, the MDI index still does not have any firm dynamics: MDI level is up in half of selected port,” pointed out MABUX.

In the MGO LS segment, MDI registered underpricing in three ports out of four selected over Week 40: Rotterdam – minus US$84, in Singapore – minus US$125, and Houston – minus US$17. MGO LS fuel remained overvalued in Fujairah – plus US$143. MDI level decreased for all selected ports.

Anastasia Pervova, marketing analytic of MABUX, stated, “high volatility still prevails on the global bunker market. We expect that irregular changes to continue during the next week.”