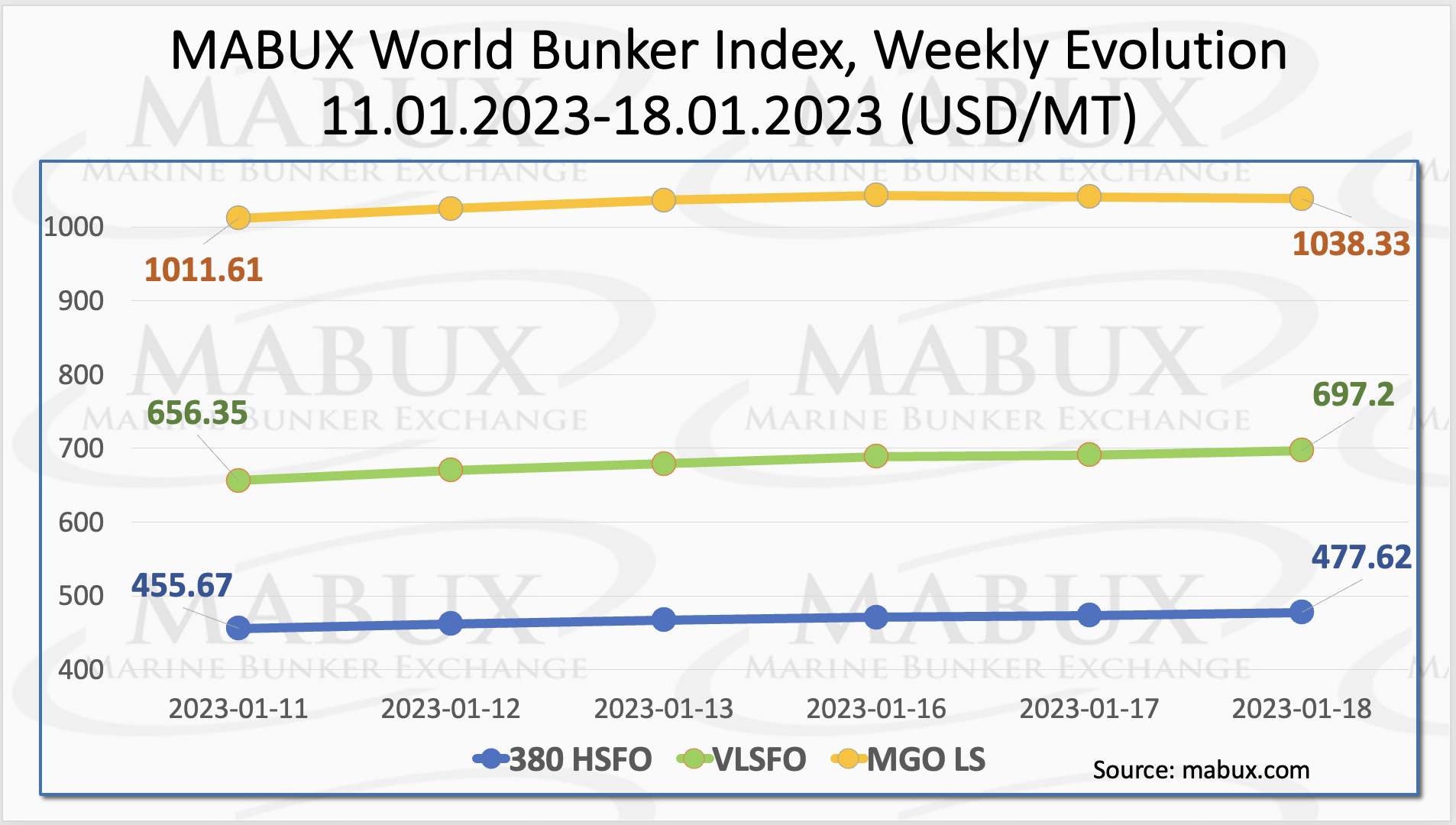

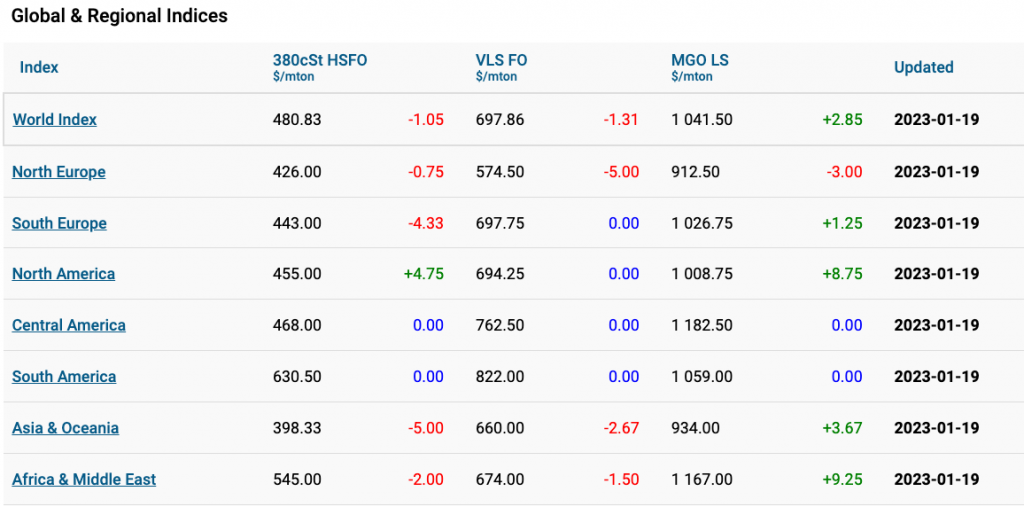

Over the third week of the year, Marine Bunker Exchange (MABUX) global bunker indices turned to upward evolution with the 380 HSFO index rising last week to US$477.62/MT, the VLSFO index increasing to US$697,20/MT and the MGO index growing to US$1,038,33/MT.

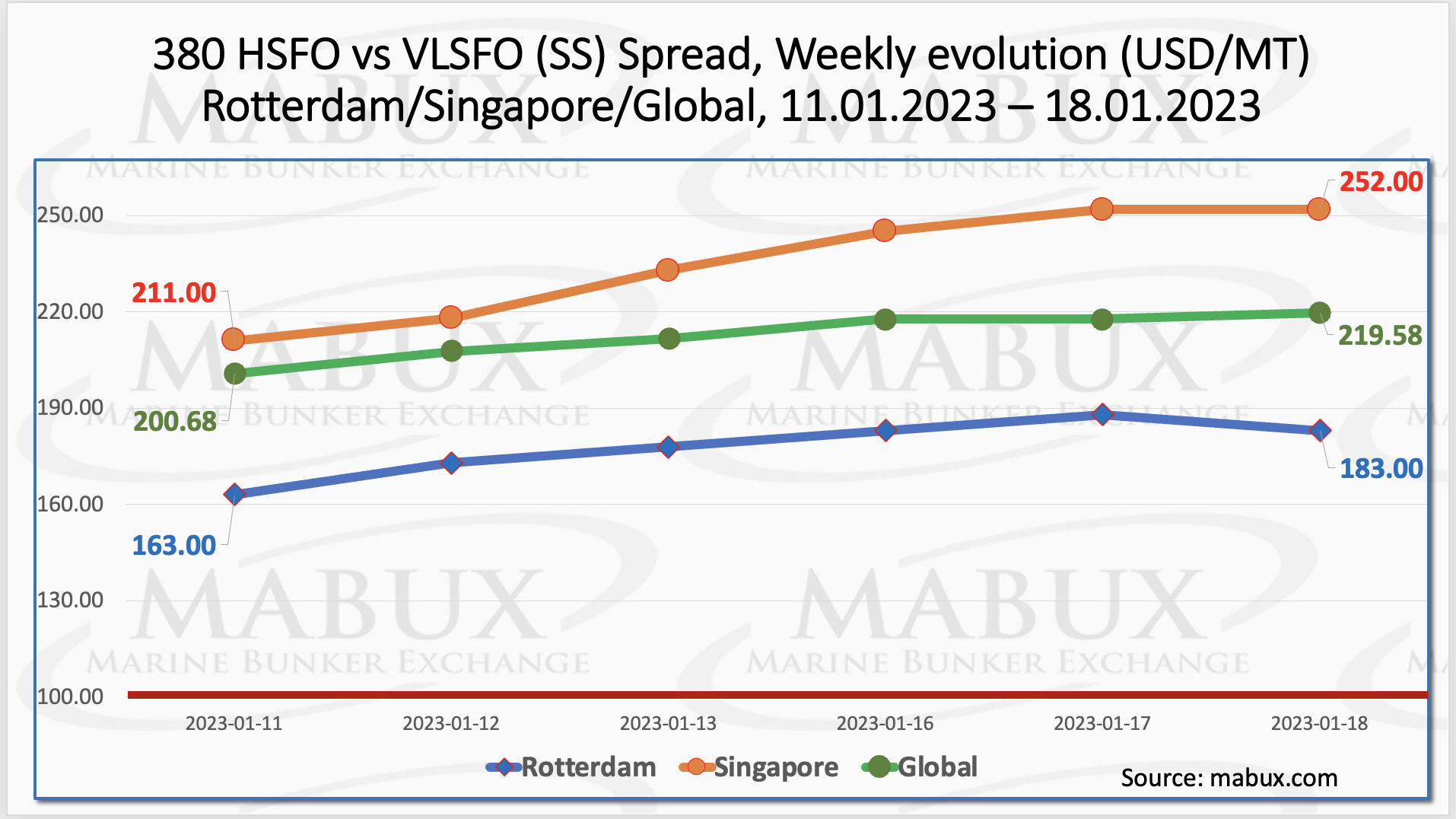

Meanwhile, the Global Scrubber Spread (SS) weekly average, the price differential between 380 HSFO and VLSFO, increased over the last week by US$18.90, once again exceeding the US$200 mark.

In Rotterdam, the average SS Spread rose by US$20 to US$183. In Singapore, the price differential of 380 HSFO/VLSFO also widened by US$41. The SS Spread weekly averages in Rotterdam and Singapore also rose by US$18.50 and US$23.50 respectively.

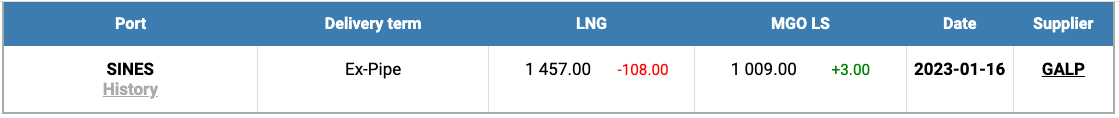

In the meantime, the price of LNG as bunker fuel in the port of Sines in Portugal continued to drop slightly on 16 January by US$1,457/MT. The price difference between LNG and conventional fuel on 16 January was US$448: MGO LS at the port of Sines was quoted at US$1,009/MT that day.

MABUX reported that 90 biofuel operations at the Port of Singapore in 2022 accounted for a total volume of 140,000 tonnes.

“However, high global gas prices last year impacted demand for LNG bunkers, with volumes dropping from 50,000 metric tonnes in 2021 to just 16,000 tonnes,” commented MABUX analysts.

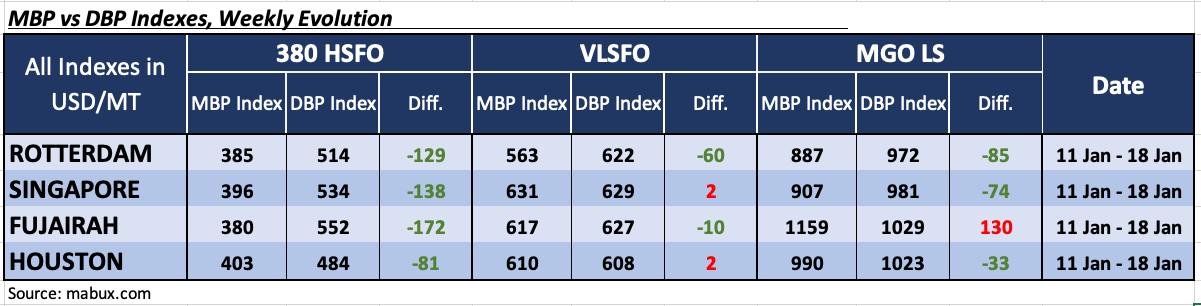

During the last week, the MDI index (comparison of MABUX market bunker pricing (MBP Index) versus MABUX digital bunker benchmark (DBP Index)) remained fuel 380 HSFO undervalued at all four ports.

Undervaluation levels extended considerably and amounted to -US$129 in Rotterdam, -US$138 in Singapore, -US$172 in Fujairah, and -US$81 in Houston.

According to MDI, Singapore and Houston have entered the overpriced zone in the VLSFO fuel grade: an additional US$2 at each port. At the same time, Rotterdam and Fujairah remained undervalued – minus US$60 and negative US$1, respectively.