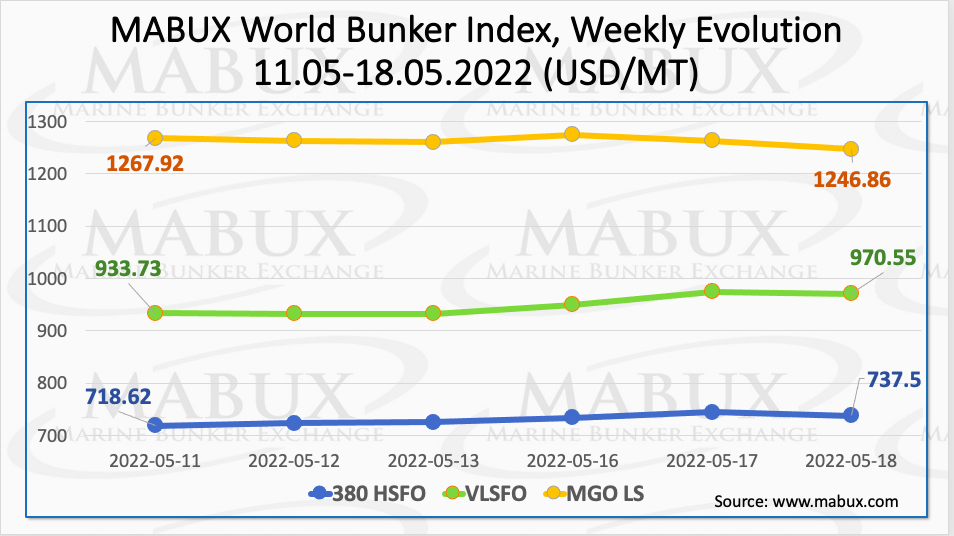

Over the Week 20, the world bunker indices did not have a firm trend and changed irregular, Sergey Ivanov, Director, MABUX, said.

The 380 HSFO index rose by US$18.88 from to US$737.50 /mt. The VLSFO index went up more significantly, by US$36.82 USD to US$970.55 /mt. The MGO index, on the contrary, fell by US$21.06 to US$1246.86 /mt. There are no signs of a sustainable trend’s formation in the global bunker market yet.

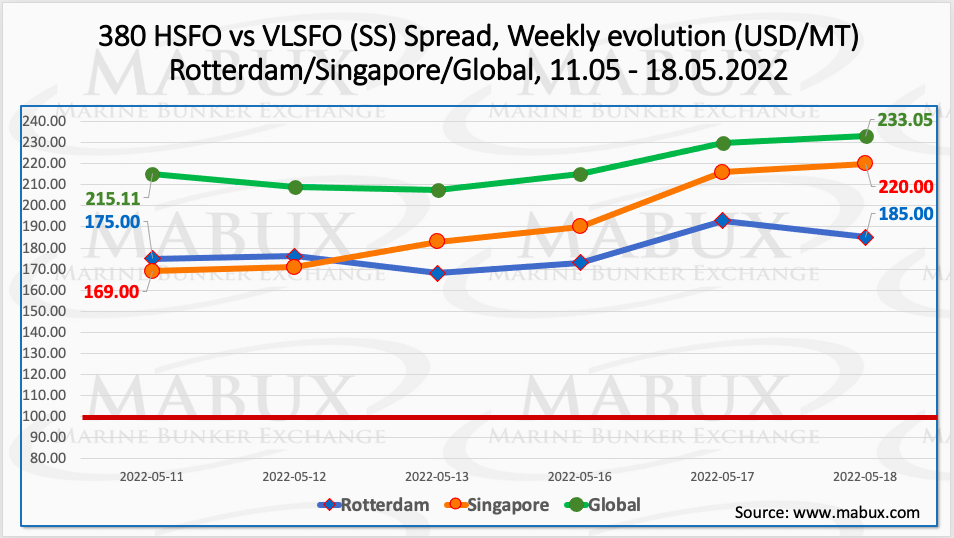

The Global Scrubber Spread (SS) weekly average – the price difference between 380 HSFO and VLSFO – continued its firm growth over the week – plus US$7.78. At the same time, in Rotterdam, the SS Spread’s average value, on the contrary, continued to decline, minus US$6.50 compared to last week. In Singapore, the average price difference of 380 HSFO/VLSFO in turn showed an unexpectedly sharp growth, up US$69.67 compared to last week. SS Spread values still don’t have a firm dynamics, according to Ivanov.

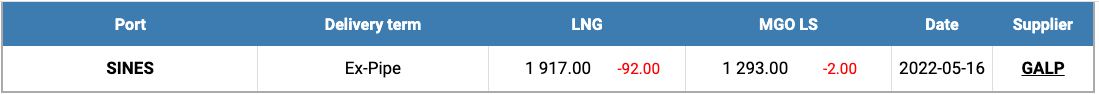

Gas prices in Europe remain at high levels amid the ongoing escalation of the conflict in Ukraine. Prices for LNG as bunker fuel in the port of Sines (Portugal) fell on May 16 by US$92 to US$1917 /mt.

Nevertheless, LNG prices are still significantly higher than those of traditional bunker fuels, Ivanov noted.

As he explained, for comparison, the MGO LS price index at the port of Sines was quoted at US$1293 /mt as of May 16.

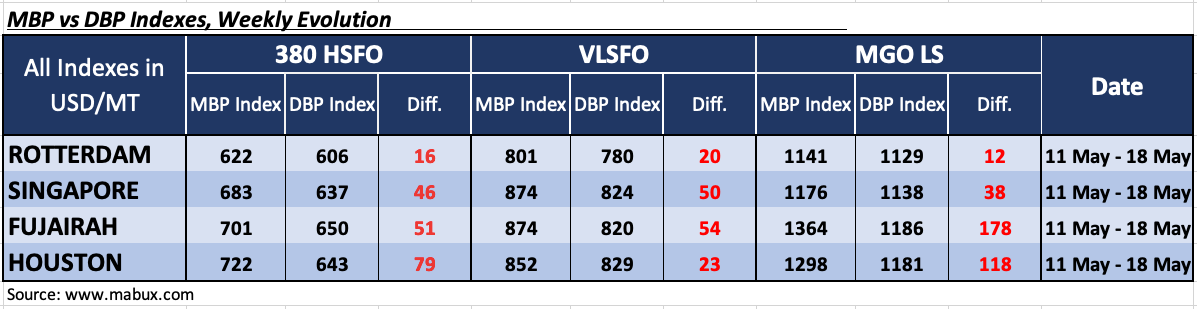

Over the week 20, the average correlation of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark) has not changed.

All major bunker fuels grades are in the overcharge area in all selected ports. Thus, 380 HSFO fuel’s overcharge margins in a week were: in Rotterdam – plus US$16 (versus plus US$29 the week before), in Singapore – plus US$46 (plus US$114), in Fujairah – plus US$51 (plus US$107) and in Houston – plus US$79 (plus US$102). In the 380 HSFO’s segment, MABUX MBP/DBP Index (MDI) showed a reduction in the overprice premium across all selected ports, highlighted Ivanov.

VLSFO fuel grade, according to MDI, remained overpriced at all selected ports, while overprice premium narrowed here as well: plus US$20 (plus US$42 a week before) in Rotterdam, plus US$50 (plus US$51) in Singapore, plus US$54 (plus US$66) in Fujairah and plus US$23 (plus US$50) in Houston.

As for MGO LS, MDI also registered an overpricing of this fuel grade over the week in all four selected ports: Rotterdam – plus US$ 12 (plus US$75 the week before), Singapore – plus US$38 (minus US$26), Fujairah – plus US$178 (plus US$126) and Houston – plus US$118 (plus US$155). As Ivanov said, here MDI did not have a firm trend and changed irregular. More specifically, there was an overcharge decline in Rotterdam and Houston and rose in Singapore and Fujairah.

In general, high volatility remains in the global bunker market, which prevents the formation of a sustainable trend in bunker prices, he added.

Some 3,742,300 metric tonnes (mt) of bunker fuel were sold in the Port of Singapore last month – 12.1% down on the 4,256,500 mt registered in April 2021. Last month’s total was also the second-lowest monthly total of 2022 after the 3,501,600 mt of bunker sales recorded in February. In March, reports of a bunker contamination crisis began to surface – and by mid-April, the Maritime and Port Authority of Singapore (MPA) estimated that the affected marine fuel had been supplied to around 200 ships of which 80 reported various issues with their fuel pumps and engines. The extent to which the episode has impacted confidence in the Singapore marine fuels market remains to be fully seen, nevertheless sales of HSFO saw a month-on-month (m-o-m) decrease. Marine fuel oil (MFO) 380 cSt fell from 962,600 mt in March to 914,500 mt in April while MFO 500 cSt sales plummeted from 124,900 mt to 27,200 mt. Despite the drop off in HSFO sales, low sulphur fuel oil (LSFO) sales held firm. Sales of LSFO 380 cSt rose from 1,741,700 mt in March to 1,832,600 mt in April. Low sulphur marine gasoil sales rose 2.5% on the month to 278,600 mt. The total amount of marine fuel sold during the first four months of the year at the Port of Singapore stands at 15,047,400 mt – 11.9% down on the 17,078,900 mt of bunker sales registered during the same period in 2021.

As a conclusion, Ivanov underlined that, we do expect bunker indices to change upwards next week amid high volatility and possible ban on Russian oil.