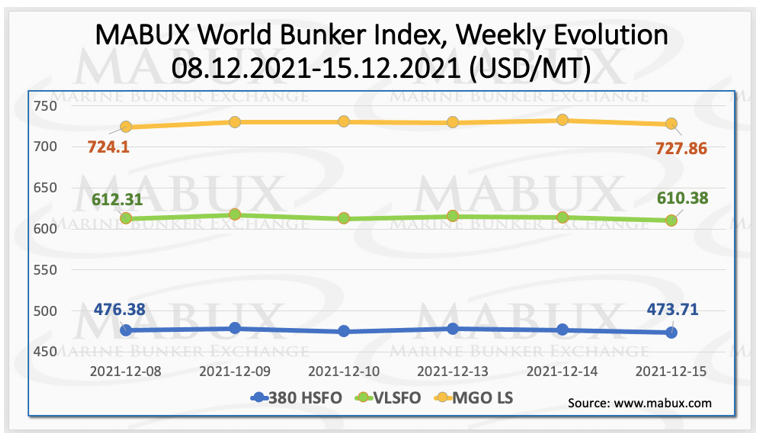

The Marine Bunker Exchange (MABUX) World Bunker Index has shown insignificant and irregular changes on week 50. The HSFO 380 Index dropped to US$473.71/MT, the VLSFO index dropped to US$610.38/MT, and the MGO index rose to US$727.86/MT.

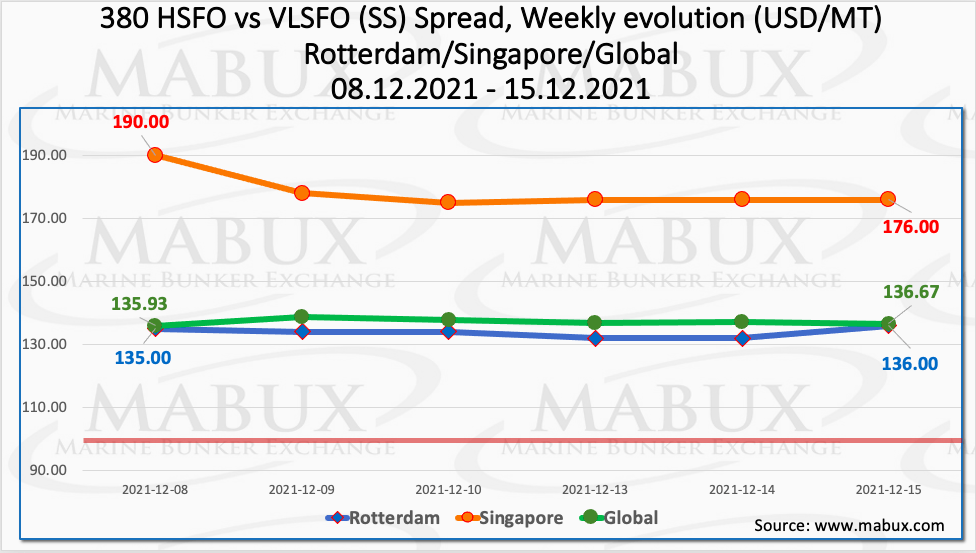

Additionally, the weekly average Global Scrubber Spread (SS) showing the difference in price between 380 HSFO and VLSFO remained stable during the week, with a slight increase to US$137.15.

At the same time, the average weekly SS Spread in Rotterdam fell to US$133.83 versus US$138.17 in the previous week. In Singapore, the average weekly SS Spread showed a more significant decline to US$178.50.

“The current fluctuations in the SS Spread are nevertheless keeping the indicator consistently above the psychological mark of US$100,” commented a MABUX representative.

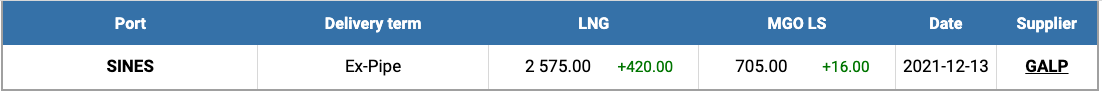

A combination of Russia’s inactive Nord Stream 2 pipeline and cooler weather forecast through the end of December sparked a rally in European natural gas futures, according to MABUX.

As a result, prices for LNG as a marine fuel at the port of Sines in Portugal rose to US$2,575/MT on 13 December. The price of bunker LNG exceeds the price of MGO LS in the port of Sines by US$1,870 (US$705/MT as of 13 December 13). LNG is still not cost-competitive with traditional bunker fuels.

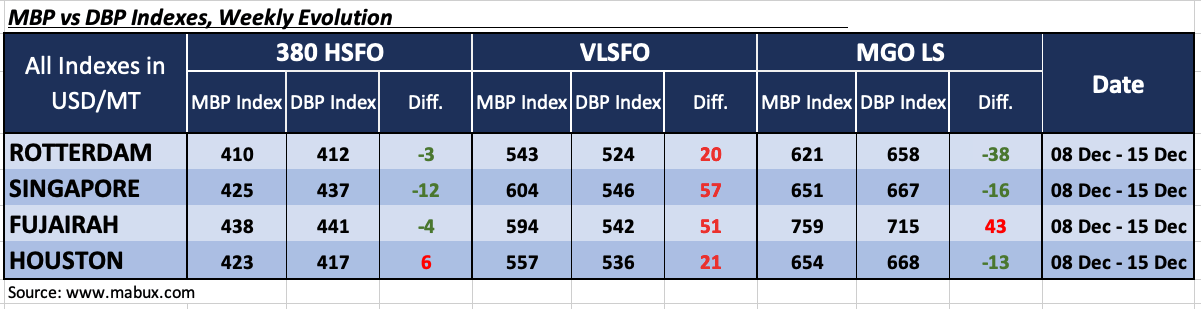

On the 50th week, the MABUX Market Bunker Prices (MBP) Index vs. MABUX Digital Bunker Benchmark (DBP) Index correlations returned to the underpricing segment in all four world’s largest hubs.

In particular, 380 HSFO fuel was underestimated in three out of four ports, in Rotterdam, by minus US$3, in Singapore, by minus US$12 and in Fujairah, by minus US$4, while Houston was the only port where the MABUX MBP / DBP Index registered an overcharge, of plus US$6.

In general, the 380 HSFO MBP / DBP Index is close to 100% correlation in all the selected ports, according to MABUX’s report.

Furthermore, VLSFO fuel grade, according to the MABUX MBP / DBP Index, remained significantly overpriced in all selected ports: plus US$20 in Rotterdam, plus US$57 in Singapore, plus US$51 in Fujairah and plus US$21 in Houston.

However, there was also a decrease in overcharge margins at all the ports compared to the previous week.

As for MGO LS, the MABUX MBP / DBP Index recorded an undercharge of this fuel grade in three out of four ports selected: in Rotterdam by minus US$38, in Singapore by minus US$16, and in Houston by minus US$13. Only in Fujairah, according to the MABUX MBP / DBP Index, MGO LS was overpriced by US$43.

In the meantime, MABUX has reported that the Mediterranean is set for more stringent sulphur limits after the littoral countries agreed to the designation of a 0.10% sulphur emission control area (MedECA) in the region.

The decision was taken at the meeting of the contracting parties of the Barcelona Convention in Antalya last week. Once the proposal has gone through the necessary steps at the IMO, the MedECA is expected to be in force in January 2025, 10 years after similar SECAs were established in northern Europe and the Americas.

However, a regulation on nitrogen emissions (NOx) from ships will not be included in the submission to the IMO – though the countries agreed to work on NOx in the next two years which could potentially bring about a NOx ECA.