A.P. Moller-Maersk announced “strong business performance” in the third quarter, reporting growth across its business segments and financial results well above the previous year.

This growth was largely led by the Ocean segment, while Logistics & Services and Terminals divisions also contributed through higher earnings.

Building on the strong quarter and supported by robust container market demand and ongoing disruptions in the Red Sea region, Maersk updated its 2024 guidance.

Now, the Danish ocean carrier projects a full-year underlying EBIT between US$5.2 and 5.7 billion, up from the previous US$3-5 billion range and underlying EBITDA between US$11 and US$11.5 billion (from US$9-11 billion).

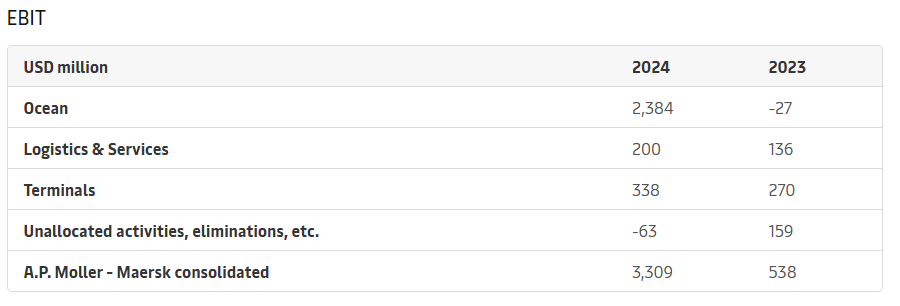

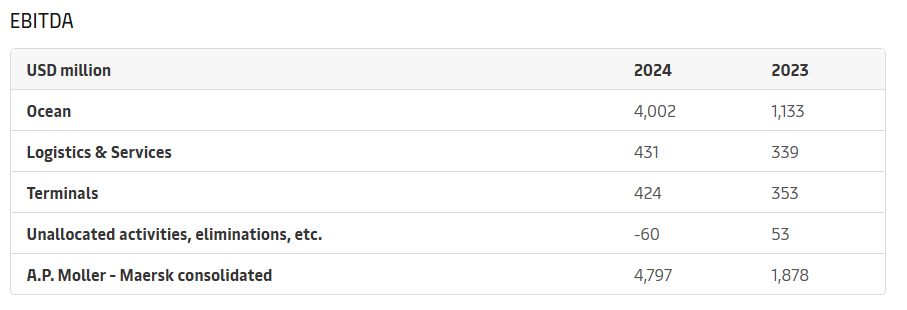

Maersk’s Ocean Segment recorded a profitability surge stemming from higher freight rates and increased volumes, leading to a 41% revenue growth. Although network rerouting south of the Cape of Good Hope added to bunker consumption and operating costs, efficient operational measures largely offset these, resulting in a US$2.9 billion EBIT increase and a margin of 25.5%.

Additionally, Maersk’s Logistics & Services division also achieved improved results in the third quarter, with revenue up 11% year-over-year and 7.2% sequentially due to higher product volumes. Profitability continued to recover, reaching an EBIT of US$200 million—US$64 million higher than the prior year—mainly from growth in Lead Logistics and Air, achieving an EBIT margin of 5.1%.

Moreover, in the Terminals segment, revenue per move reached record highs, driven by increased volumes, improved tariffs, and a favourable product mix, especially in North America. This resulted in Terminals’ best EBITDA since Q1 2022, at US$424 million, and a return on invested capital (LTM) of 13%.

In light of strong Q3 results, high container market demand, and continued challenges in the Red Sea/Gulf of Aden area, Maersk has raised its full-year 2024 container market growth forecast to around 6% (up from 4-6%), while CAPEX guidance remains unchanged.

“This quarter, we once again supported our customers through times of high volatility and low visibility. We reaffirmed our commitment to profitable growth and operational progress, driving results across all business areas through continued rigorous focus on cost discipline, productivity gains, and efficient asset utilization. In Logistics & Services, our focused effort led to steady margin improvements and growth through new customer wins. In Terminals, we drove additional improvements, building on already high performance. Our Ocean team responded to the recurring network disruptions with high agility by leveraging our hub terminals and investing in capacity and equipment to mitigate the supply chain impact on our customers while optimizing unit costs,” stated Vincent Clerc, CEO of Maersk.

![Maersk Container Industry [ Star Cool 1.1 ]](https://containtest-lwslv.projectbeta.co.uk/wp-content/uploads/2024/09/Star-Cool-1.1-696x408.jpg)