Malaysia Anti-Corruption Commission (MACC) is launching a large-scale investigation into

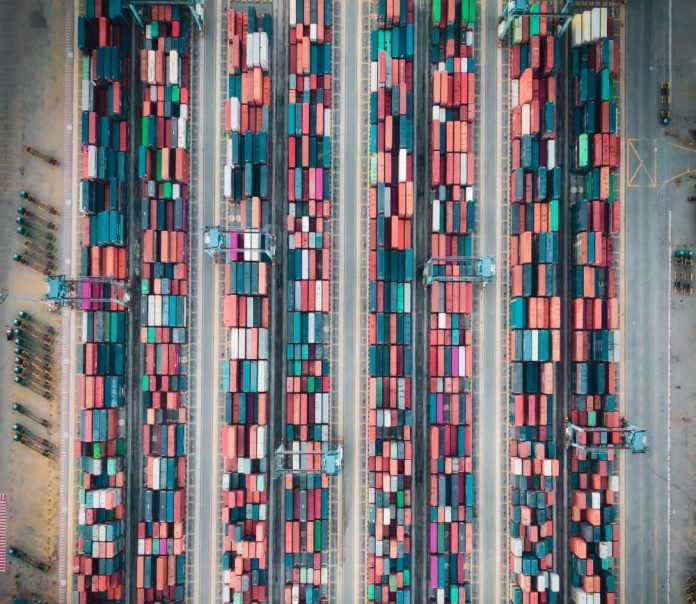

non-declaration of containerized imports, and is targeting all states with container ports.

MACC Chief Commissioner Tan Sri Azam Baki said on 10 June that often, goods are declared as other items of lower tax value, resulting in a loss of government revenue.

He was speaking after MACC uncovered a tax evasion case involving containerized imports,

and the case has been nicknamed the “flying container” case. Seven persons, including civil

servants have been arrested in the case that resulted in evaded taxes of around MYR3.5

billion (US$742 million) over 10 year period, and 19 containers in Port Klang have been

seized.

It is said to be the largest container fraud case in Selangor state. The alleged mastermind is a Singaporean who has reportedly fled Malaysia, and MACC has contacted its Singaporean counterpart, the Corrupt Practices Investigation Bureau, for help.

The syndicate behind the “flying container” case reportedly declared imports as medical

products while actually bringing in canned pork and LED lights into Malaysia. It was able to

do this as its members were said to own more than 10 forwarding companies that prepared

false declarations.

Asam said: “Many tax leakages occur when containers are improperly declared. There are

containers declared to contain wheelchairs but actually contain pork and electrical goods.

Thus, the tax payment should be higher. This modus operandi happens in many places in

Malaysia, and we warn all states, including Sabah, that one day the MACC will reach there.

This collaboration with customs and other agencies aims to combat revenue leakage caused

by corruption and the misuse of power involving those entrusted with responsibilities.”

Martina Li

Asia Correspondent