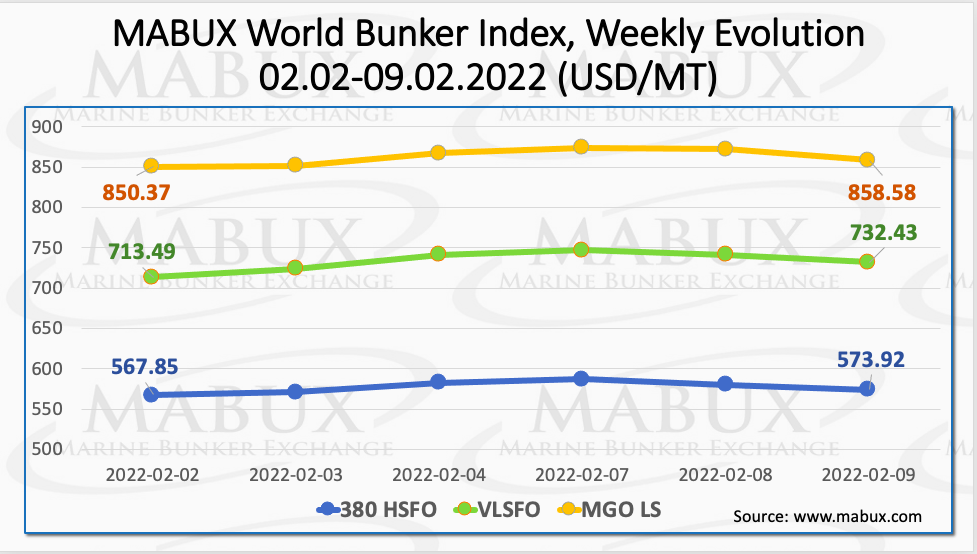

The Marine Bunker Exchange (MABUX) World Bunker Index showed a moderate upward evolution in the sixth week of the year, with the 380 high-sulphur fuel oil (HSFO) index rising to US$573.92/MT, and the very low sulphur fuel oil (VLSFO) index growing even more to US$732.43/MT.

At the same time, the marine gasoil (MGO) index was also increased to US$858.58/MT, which means that, in general, global bunker fuel prices continued to rise, following the upward trend in the global oil market.

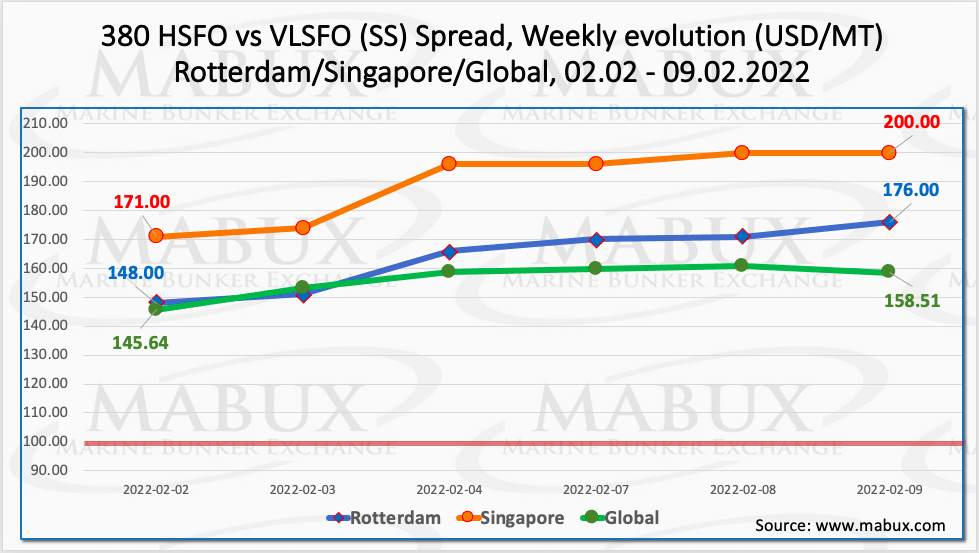

The global scrubber spread (SS) weekly average, showing the difference in price between 380 HSFO and VLSFO, reached US$156, while the average SS spread in Rotterdam widened to US$163.67. The highest growth of the SS spread average, however, was registered in Singapore to US$189.50.

Natural gas markets in Europe have stayed “rather volatile” for the past months, according to MABUX analysts, and persistent lower pipeline supplies from Russia and low inventory levels keep the price floor high.

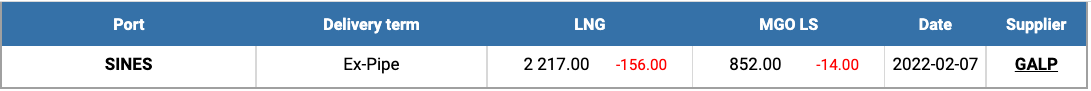

The price of LNG as bunker fuel at the Portuguese port of Sines declined to US$2,217/MT on 7 February, still exceeding the prices of traditional bunker fuels, as MGO LS was US$852/MT as of 9 February.

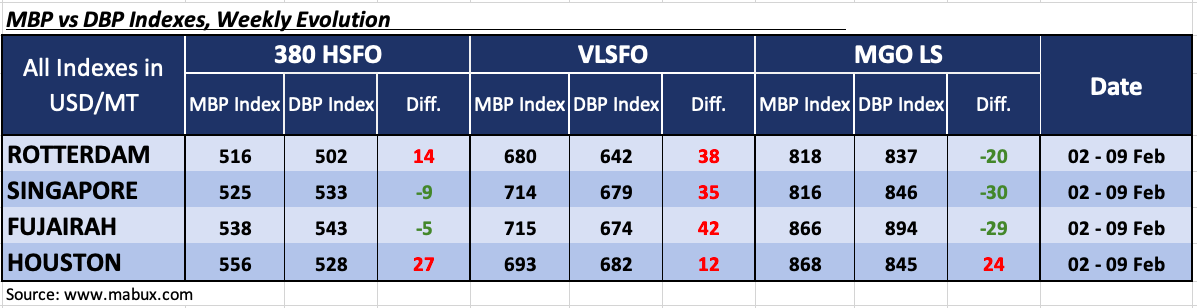

Furthermore, during the sixth week of 2022, the correlation of MABUX market bunker prices (MBP) Index vs MABUX digital bunker prices (DBP) Index showed that 380 HSFO fuel was overpriced in two ports out of four selected: in Rotterdam, with a plus of US$14 and in Houston, with a plus of US$27.

On the other hand, in Singapore and Fujairah, the MABUX MBP/DBP Index registered an underpricing of 380 HSFO by US$9 and US$5, respectively.

Meanwhile, there is a growth of the 380 HSFO’s underestimation margin registered at the Port of Singapore by eight points. “For other ports, the changes were insignificant,” said a MABUX representative.

VLSFO fuel grade, according to the MABUX MBP/DBP Index, was significantly overpriced in all selected ports: plus US$38 in Rotterdam, plus US$35 in Singapore, plus US$42 in Fujairah and plus US$12 in Houston.

On average, the overcharge ratio by port increased by US$6 – US$12, except for Houston, where the MABUX MBP/DBP Index was unchanged from last week.

As for MGO LS, the MABUX MBP/DBP Index registered an underestimation of this fuel grade in three of the four selected ports: Rotterdam – minus US$20, Singapore – minus US$30 and Fujairah – minus US$29.

However, Houston remains the only port where the MABUX MBP/DBP Index recorded overpricing – plus US$24, according to MABUX analysts.

After a record year for orders in 2021, class society DNV GL added another 40 liquefied natural gas (LNG)-fuelled vessels to its alternative fuels insights (AFI) database last month, bringing the total tally of ships to just under 700, according to a statement.

Growth in the LNG-fuelled vessel order book in January was driven by the container ship sector, notably by MSC. Noting a ‘strong start’ to the new year, it was also noted that some of the orders added to the tally in January were actually placed last year.