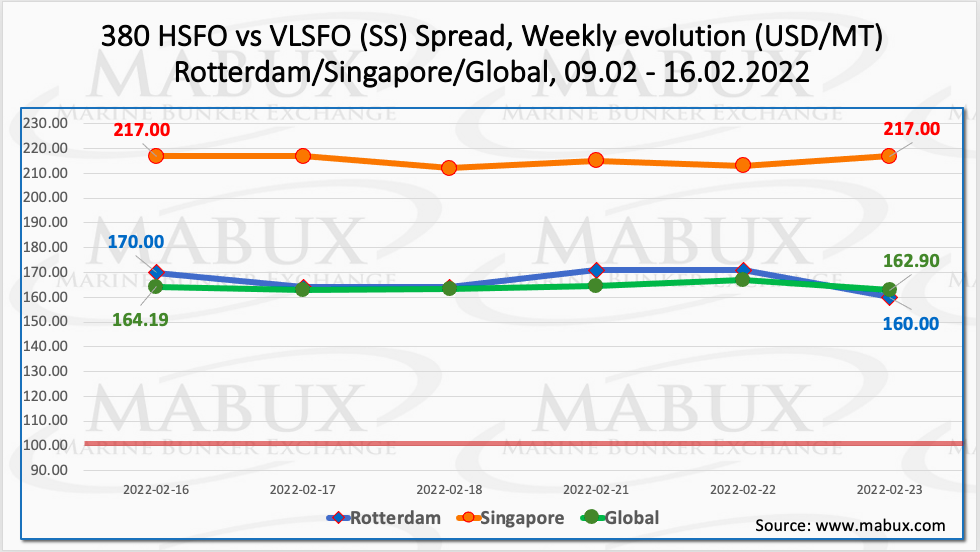

Τhe Marine Bunker Exchange (MABUX) World Bunker Index changed sideways during the eighth week of the year with no noteworthy fluctuations, and it is expected to increase due to the escalation of tensions in Eastern Europe.

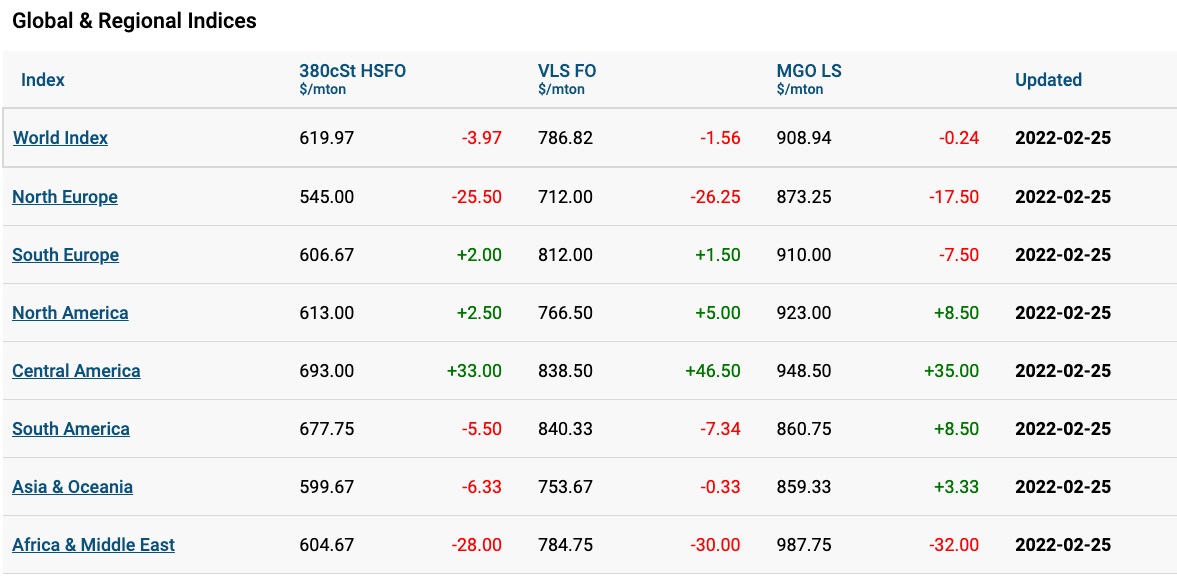

The 380 high-sulphur fuel oil (HSFO) Index rose to US$600.31/MT, the very low sulphur fuel oil (VLSFO) Index grew to US$763.21/MT, while the marine gas oil (MGO) Index fell to US$880.15/MT.

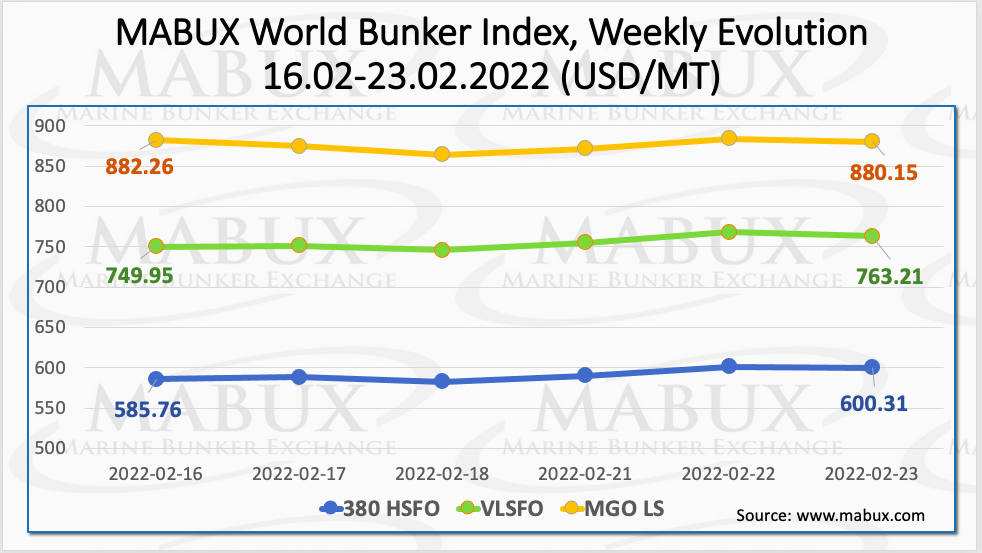

The Global Scrubber Spread (SS) weekly average, the difference in price between 380 HSFO and VLSFO, showed a slight increase during the week to US$164.13.

At the same time, in Rotterdam, the SS Spread weekly average dropped to US$166.67, while the SS Spread’s weekly average in Singapore continued widening and reached US$215.17.

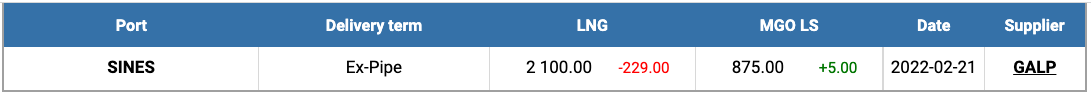

Gas prices in Europe have returned to an upward trend, approaching the mark of US$1,000 per thousand cubic meters on 23 February. Despite this, prices for liquefied natural gas (LNG) as a bunker fuel at the port of Sines in Portugal fell to US$2,100/MT on 21 February.

However, LNG prices are still significantly higher than those of traditional bunker fuel grades, given that the cost of MGO LS at the port of Sines on the same date was quoted at US$875/MT.

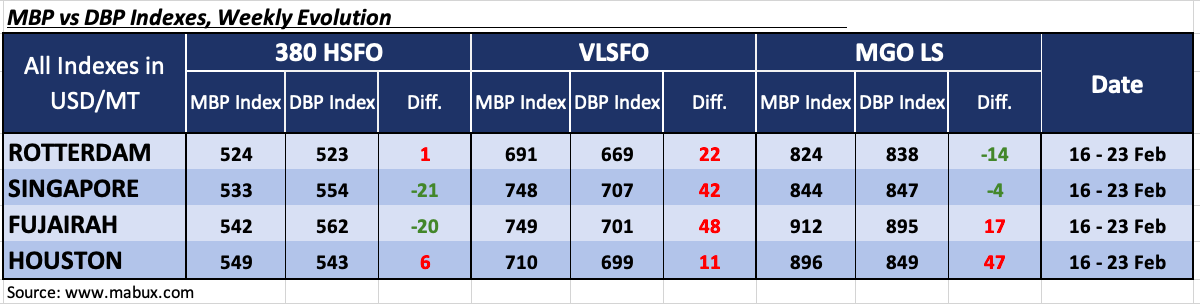

Moreover, during the eighth week, the average correlation of MABUX market bunker prices (MBP) Index vs MABUX digital bunker benchmark (DBP) Index showed that 380 HSFO fuel grade remained overpriced in two ports out of four selected, with plus US$ in Rotterdam and plus US$6 and in Houston.

In Singapore and Fujairah, the MABUX MBP/DBP Index registered an undercharge of 380 HSFO by US$21 and US$20, respectively, and the MABUX MBP/DBP Index continues to shift towards the underpricing of 380 HSFO fuel.

VLSFO fuel grade, according to the MABUX MBP/DBP Index, remains significantly overpriced at all selected ports, plus US$22 in Rotterdam, plus US$42 in Singapore, plus US$48 in Fujairah and plus US$11 in Houston, with the most notable drop of overcharge ratio being noticed at the Port of Rotterdam by 11 points.

As for MGO LS, the MABUX MBP/DBP Index registered an underestimation of this fuel grade in two of the four selected ports: Fujairah moved into the overprice zone at the end of the week: plus US$17. Houston remains another overvalued port with plus US$47.

In Rotterdam and Singapore, according to the MABUX MBP/DBP Index, MGO LS was underpriced by US$14 and US$4, respectively.