As reported by Container News, Chinese ports handled 190.9 million TEUs from January to July, marking an 8.3% increase compared to the previous year. In light of this, it is important to examine China’s control over maritime trade routes and to consider the broader strategic impact of China’s investments in various ports throughout Southeast Asia and Africa.

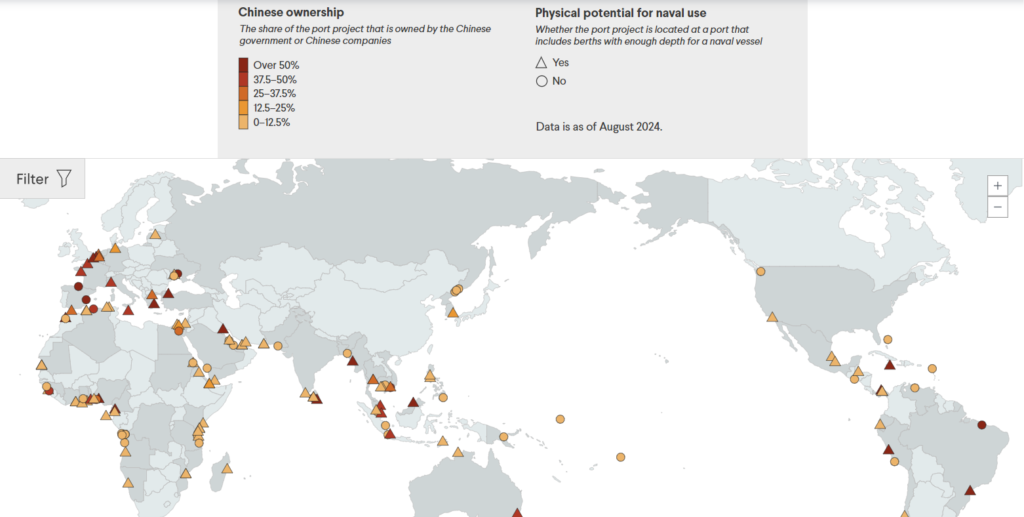

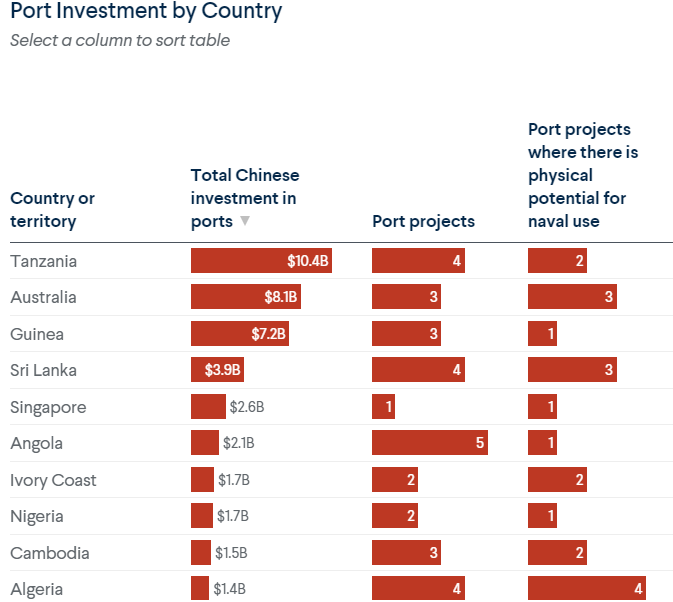

China has been involved in at least 129 port projects outside its borders to capitalize on the infrastructure of low-income countries. Currently, according to the Council on Foreign Relations, at least 17 of these projects are under majority Chinese ownership. Some of the most notable investments by Chinese authorities are in countries such as Myanmar, Sri Lanka, and Pakistan, where China has made substantial financial commitments. In several of these countries, China holds significant stakes in ports and terminals, with ownership reaching up to 40% in some cases.

As of September 2023, China has signed 70 bilateral and regional shipping agreements with 66 countries and regions aiming to enhance its traditionally important geoeconomic influence over international sea lanes and key commercial ports.

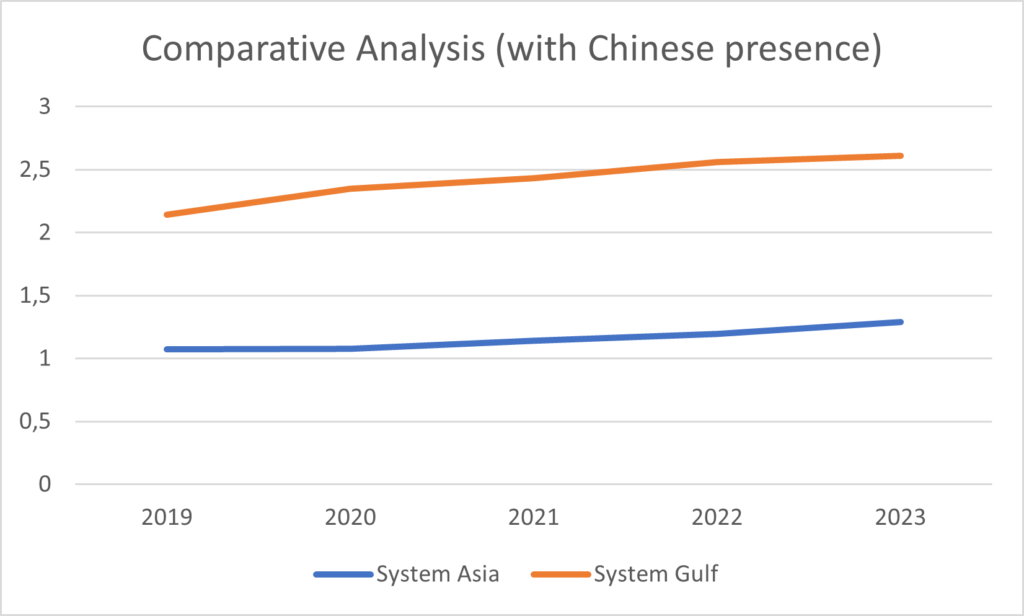

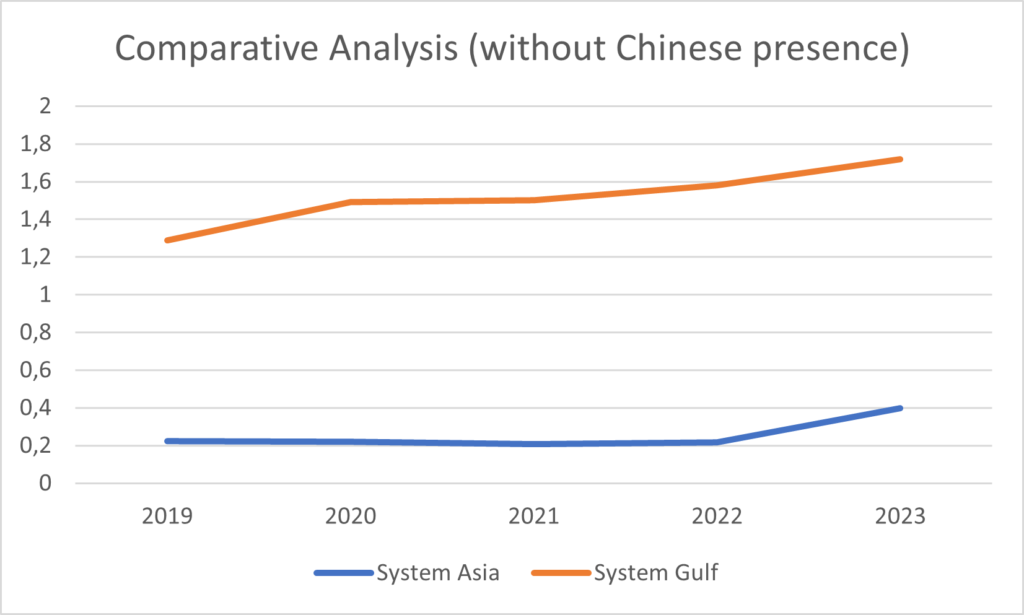

At this point, Container News has conducted a comprehensive analysis to reveal the geopolitical dimensions of Chinese maritime trade capabilities by comparing two key regions where Chinese presence is significant, the Southeastern Asia and the Gulf where China has also made substantial investments.

The analysis considered two key indicators, whose combined insights reveal geopolitical trends and tendencies in the sector. These indicators are the Linear Shipping Connectivity Index and Container Ports Throughput. All data were sourced from the UN Trade Data Center. It is important to note that during the analysis, we assigned greater weight to the Linear Shipping Connectivity Index, although the contribution of the Container Ports Throughput indicator should not be underestimated.

The Southeast Asian countries that we included in the analysis are Myanmar, Sri Lanka, Bangladesh and Pakistan. We also included Tanzania in the analysis because it ranks as the top country in which China invests in port projects. Additionally, we consider it a critical terminal point for the Southeast Asia maritime route system. The chosen timeline was the 2019-2023 period.

The analysis revealed that despite significant differences between the two regions in the Linear Shipping Connectivity Index and Container Port Throughput, Chinese presence has influenced both areas. Notably, Southeast Asia began showing a growth trend from early 2020, as did the Gulf region, coinciding with China’s active involvement. This suggests that China’s development in these two indicators has propelled growth in both regions, while its absence has led to stagnation, as highlighted by the comparative tables. The overall trends in both regions indicate that China is not only a major investor in ports and infrastructure projects related to maritime trade, but its strength as a commercial power in sea trade suggests that its presence is firmly established.

It is important to note some significant investments by China in the aforementioned countries.

- Sri Lanka: US$1.3 billion in Hambantota Port and US$700 million in Colombo Port

- Pakistan: US$250 million in Gwadar Port and US$160 million in Qasim Port

- Tanzania: US$10 billion in Bagamoyo Port, US$110 million in Kilwa Masoko Port, US$150 million in Dar Es Salaam Ports and US$95 million in Tanga Port

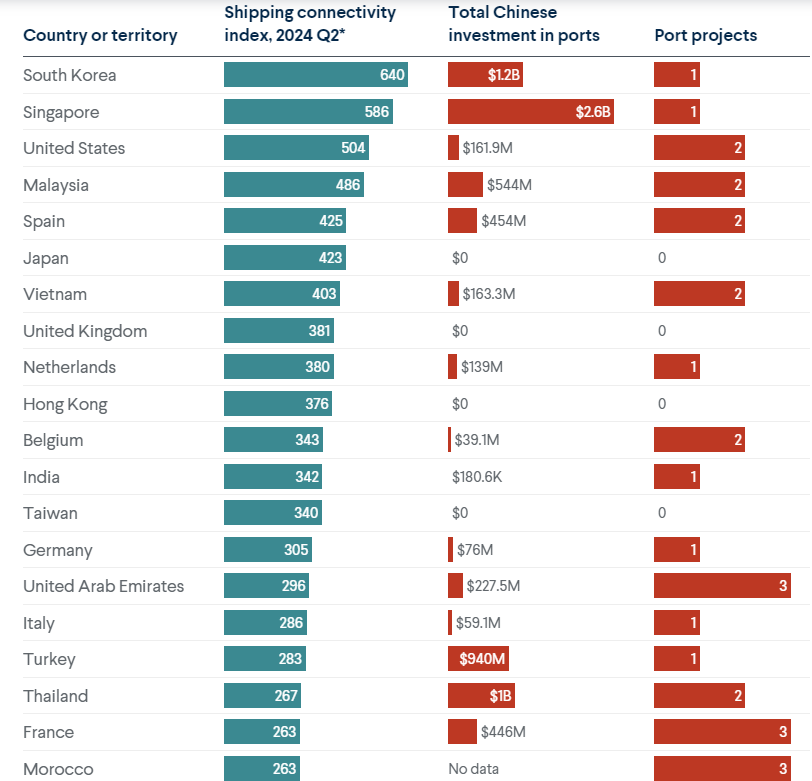

It is also worth noting that China strategically invests in countries with high shipping connectivity. This suggests that integrating external ports into China’s maritime network is highly prioritized, regardless of the individual volumes each port can handle. This is the main reason that Shipping Connectivity was taken into consideration and ranked as highly important.

Given that China tends to invest in countries with high shipping connectivity, we conducted a comparative analysis between China and the selected Gulf countries to identify any emerging trends. The analysis revealed that Saudi Arabia has strengthened its geopolitical position in the two key indicators, and it is poised to compete with China and UAE in the near future. As the table shows, China aimed to surpass UAE in 2020, but by mid-2022, economic instability caused it to lose momentum. On the other hand, despite experiencing a decline in its overall geopolitical influence, UAE managed to rebound and appears likely to maintain its competitive edge over China.

Gulf countries, particularly the UAE and Saudi Arabia, are actively working to enhance their maritime trade capabilities and strengthen their overall maritime dynamics.

For 2024, a recovery in Belt and Road Initiative investments and construction contracts appears likely. Additionally, ongoing post-pandemic investments by global financial institutions offer further infrastructure development opportunities for Chinese contractors. Concurrently, China’s continued engagements in transport infrastructure suggest that investments in regional ports are expected to rebound, as it was mentioned by the China Belt and Road Initiative (BRI) Investment Report 2023. However, the analysis indicates that China remains vulnerable in certain aspects of its economy. Each project could be significantly impacted if there is a lack of economic resilience.

Alexandros Itimoudis

Shipping Analyst