If you bury your head in the sand, you’re asking for a kick up the bum, according to one joker in a UK pub. The maritime industry tried to hide from the reality of climate change, but since 2018 it has taken the bull by the horns and we are seeing some genuine effort to transform the industry.

After the surprise of the 2018 vote, when the International Maritime Organisation (IMO) agreed to cut emissions by 30% of a 2008 baseline and 50% by 2050, the debate in the maritime sector has been about how we hit these steep targets.

Driving the transition is, however, a much tougher ask with vested interests vying with genuine concern for the environment. IMO has come under fire for its lack of ambition, as the required developments of the initial strategy failed to materialise. In 2023 the IMO will revise its strategy and the debate about that revision has already begun.

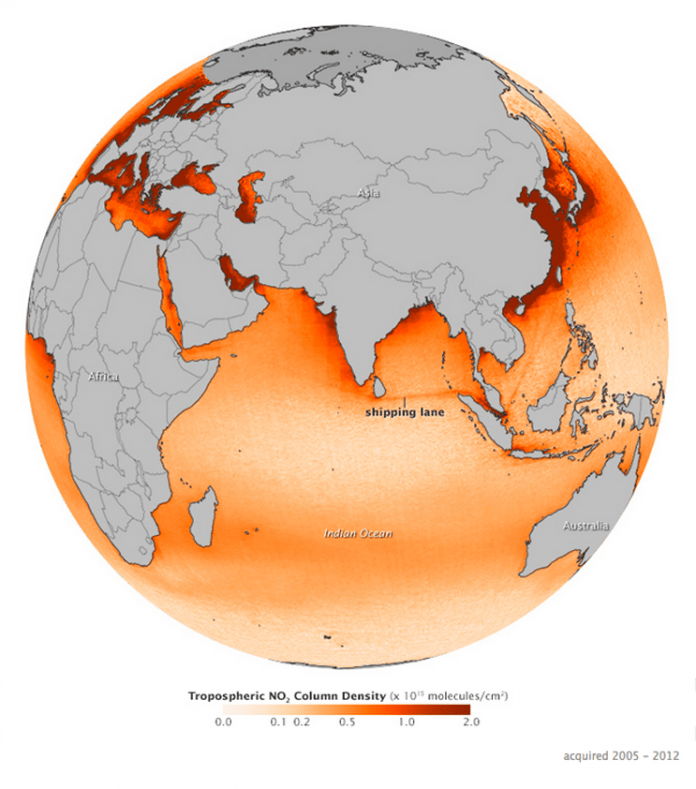

One element of the debate is whether the IMO, with its 174 member states, could be too cumbersome a tool to force through the necessary regulations that will see shipping clean up its act, in terms of the air pollution. And some believe that the industry itself must lead the way, in order for IMO to be able to follow.

Intensification of the decarbonisation debate mean that they are not so much about whether climate change is happening these days, as how we will deal with it. And the key to maritime decarbonisation is not to end up with a stranded asset after 10 years of work.

What is intriguing is the range of ideas, from using a transitional fuel, such as LNG and bio-LNG to green methanol and ammonia produced through renewable energy sources. Fuel is the key, but the IMO does not regulate the energy sector. And therein lies the challenge, transforming an industry in this environment will require collaboration between nation states, academia, industry and the public.

Perhaps this is why the IMO general secretary Kitack Lim, told a recent symposium “Combating climate change is one of IMO’s main priorities but also one of the biggest challenges, in particular for shipping.”

Lim went on to say, “IMO, as the global regulator of shipping, is demonstrating its commitment to the decarbonisation of shipping by developing an ambitious regulatory framework, that will drive innovation across all stakeholders but also by providing a forum for discussion, co-operation and collaboration.”

That view of the IMO is not shared by all in the industry. Morten Bo Christiansen, Maersk’s head of decarbonisation, said the carrier believes the regulatory authorities need to “go faster and show more ambition.”

That view of the IMO is not shared by all in the industry. Morten Bo Christiansen, Maersk’s head of decarbonisation, said the carrier believes the regulatory authorities need to “go faster and show more ambition.”

Simon Bergulf, head of regulatory affairs, A.P. Moller – Maersk added, “We know that 2023 is the IMO’s deadline for finalisation of its strategy, but also that of a possible review of the IMO targets. Work on both aspects need to start ASAP, if we are to ensure that MEPC in 2023 delivers the results needed to create a momentum for the decarbonisation of global shipping.”

Another view, presented by Dr Anne-Marie Warris, who was formerly with class society Lloyd’s Register but who now runs her own consultancy called ecoreflect, believes that virtual meetings can be effective and may even facilitate more rapid decision making.

However, she cautions, “That is not always the case where the negotiations are sensitive, and the ground is shifting to unknown territory such as what will happen at the UNFCCC [The United Nations Framework Convention on Climate Change] Conference of the Parties (COP) 26 in November. Not a question of inclusion of shipping but of countries’ Nationally Determined Contributions (NDC) and their mention of domestic shipping.”

COP26 is due to take place later this year in Glasgow, Scotland with the event expected to build on the Paris targets set in 2015 at COP21. If the targets are moving then “how detailed can a GHG (Greenhouse Gas) strategy get?” Asks Warris. She pointed out that this is not a technical agreement, but rather a plan that requires commitment.

“How clear can we expect it to get given the shifting climate scenarios we live with and the challenge of getting all countries onboard. My view is that we need clarity on direction/ targets and must accept that how to achieve those targets / direction is uncertain. A tightening of the reduction target would be a positive development, but I do not see that as an outcome of the discussion in June,” argued Warris.

More stringent targets are definitely what is required in Maersk’s view. “We know that 2023 is the IMO’s deadline for the finalisation of its strategy, but also that there will be a possible review of the IMO targets. Work on both aspects needs to start ASAP, if we are to ensure that MEPC 2023 delivers the results needed to create a momentum for decarbonisation of global shipping.”

Shipping programme director at European pressure group Transport & Environment, Faig Abbasov told Container News, that the IMO’s 2030 target had already been largely met, “so the target is inadequate,” he said.

As a result, the target must be revised upward and “complemented with binding emissions reduction measures if IMO is to have any chance to remain politically relevant. To be honest, IMO doesn’t really have a good track record on that. The current IMO measures, especially EEXI [Energy Efficiency existing ship Index] is hopelessly underwhelming and will have less than 1.5% impact on 2030 emissions.”

Currently the IMO is targeting a 40% reduction in carbon intensity by 2030, with 2008 as the baseline. On a rare occasion when environmentalists and ship operators agree, Bergulf, said, “IMO has a strategy outlining a 40% reduction vis-à-vis 2008 baseline today and we believe that this 40% reduction target will be increased.”

However, Maersk and Bergulf warned that there are pitfalls to this strategy. “We should be very cautious about increasing the target and moving the baseline year at the same time. This would warrant an in-depth technical analysis and may delay the process significantly, as it would require new impact assessments which may delay the process substantially.”

Further caution was expressed by the Lloyd’s Register’s Matthew Williams, the class society’s principal specialist for strategic regulatory projects, who cautions against “Ambition inflation”.

“The discussion that really matters is about how to turn ambition into action and build a regulatory system which can unlock the estimated 64% CO2 abatement potential of zero carbon fuels. That is a big ask and the discussion is nascent, will be challenging and is where our collective energy should be spent. Hold fire on changing ambition for now and focus on accelerating the delivery of a regulatory system which responds to the level of ambition for decarbonisation the IMO already has,” Williams argues.

The steady as she goes approach to regulation may be suitable for less pressing changes, but climate change is happening fast in planetary terms and with the 30-year term for vessel designs and operations the choices to be made, must happen in the coming years, argue many environmentalists.

IMO for its part rightly argues that the pace of change is not up to the secretariat. “It is important to remember that IMO is a specialised agency of the UN – made up of 174 member states (and three associate members) – all may have differing views,” an IMO spokeswoman explained.

In defence of the IMO it has moved on the issue, as its spokeswoman is keen to point out, “IMO adopted EEDI measures in 2011 – the first set of global sector wide energy efficiency measures aimed at cutting CO2 emissions through improving energy efficiency. In 2020, these measures were strengthened further for new build ships – more stringent mandatory energy efficiency measures for new build ships to apply as of 2022, thereby accelerating the pace new build ships will improve their energy efficiency. In 2021, we expect to see the adoption of the carbon intensity measures for all ships.”

One might say that this is all well and good, but there remain yawning gaps in the IMO’s decarbonisation strategy that will come back to bite the maritime sector and consequently the population at large.

A failure to include methane, a far more potent GHG, in the Energy Efficiency Design Index (EEDI) calculations has allowed shipping lines, including Matson and CMA CGM, to view LNG as a clean fuel. Methane slip from engines, particularly low pressure dual fuel, systems, is a real problem with the effects of the methane slip already evident in the IMO’s Fourth GHG study.

According to the IMO study, methane emissions by voyage increased from 55,000tonnes in 2012 to 140,000tonnes by 2018, a 154% increase on 2012 figures, and that was before Matson and CMA CGM had launched their LNG powered vessels. Meanwhile, on 25 February CMA CGM chairman and CEO Rodolphe Saadé announced the company would deploy a further six LNG powered, 15,000TEU vessels on the Transpacific trades by the end of the year.

The French operator already operates a series of nine 23,000TEU container ships, operating on low pressure dual fuel engines. It is likely that the IMO’s fifth GHG study will see significantly higher methane emissions than the fourth.

If the IMO and the maritime industry is serious about climate change it must surely include methane in its EEDI calculations. Even on this point experts are divided.

“We don’t address NOx through EEDI so why CH4?” Asks Williams. Adding, “Methane slip is a function of engine design, not the efficiency of a ship as an energy system. EEDI is a convenient tool to use, particularly when focused on the consequences of using LNG as fuel, but convenience does not make it the right tool. Other means, specifically non-technical requirements, should be used to influence fuel selection behaviours in favour of fuels with low- or zero-lifecycle emissions.”

Not so according to Abbasov, who believes that while methane must be a part of the calculation, it is “Probably difficult to get it through at the IMO as oil majors, key natural gas countries and major LNG engine manufacturers and shipping companies that have invested in LNG-powered ships are against it.”

For Abbasov there are too many vested interests involved in the use of LNG, including the French government, which was “against including methane in shipping regulations (when EU MRV was being revised). It is quite difficult not to connect the dots…” he said.

Maersk has already said it will not consider using LNG as a fuel which it rightly says is a fossil fuel but wants to move from today’s fuel to a carbon neutral fuel directly.

“Methane emissions are GHG’s and should be included in the EEDI. Generally, Maersk supports that life cycle assessments are integrated into of the IMO’s work on the Carbon Intensity Indicator (CII). We need to ensure that the future fuels pushed forward for shipping are truly bringing down GHG emissions and cannot only focus on the ‘tank to propeller’ part. It is however important to ensure that the IMO bases itself on existing lifecycle assessment work in international fora,” said Bergulf.

Others, DNV for example, may argue that as the fuel consumer shipping lines should not be the ones regulated, or pushed to develop a solution to climate change. After all consumers of electrical power are not asked to construct windmills in their back gardens.

It is a fair point, and one that needs to be addressed. New fuels must be produced by those that produce fuel, and fuel producers will produce that fuel if there is a market. It is then up to the regulators to develop a mechanism that will break fossil fuels’ stranglehold on the energy market.

IMO has struggled with the question of market-based measures, such as a carbon levy, not least because there is no agreement on how they will be collected and by whom. Nor is there an agreement on how they will be used.

Surprisingly, Maersk argues that the EU should shove the IMO in the ‘right’ direction with its Emissions Trading System (ETS) that will be a “milestone” for the industry. Bergulf again warns of the dangers of getting this policy wrong, “For Maersk, it is important to ensure that the ETS does not derail the work at IMO level. As such, the EU ETS must start as an intra-EU system first. Any extra-territoriality at this stage, would make negotiations at IMO level very difficult and raise questions around the EU’s ability to be a credible negotiations partner at international level.”

Less surprising is Abbasov’s support for the ETS, which he said will be a huge development for both European and global shipping. He also suggests that the ETS will separate those in the industry that lack the commitment to climate change mitigation.

“One big idea that is being discussed is using the ETS revenues to deploy zero-emission vessels by providing support schemes for the companies that want to be trail blazers. ETS will also be a litmus test for the genuine climate ambition of individual shipping companies. There has been too much greenwashing and with ETS we will see who is serious about climate and who is just talking the talk but not keen to walk the walk.”

Anne-Marie Warris, does not believe that the EU ETS will change events at IMO this year, pointing out that the consultation on the ETS has just closed.

“My personal assumption is that the first focus will be on adjustment to the current EU ETS and its linear regression. That is because I see EU aims to be climate-neutral by 2050 and its commitment to achieve 55% reduction by 2030 as driving their policy towards the biggest sectoral GHG emissions reduction they need to achieve. Which would imply a focus on land transport, specifically trucks and goods transport and moving on to tackle the challenge of agriculture and buildings. If so, EU development will not be a significant contributor to what happens at IMO in the next 12 to 18 months,” argued Warris.

All of these arguments on the ETS are irrelevant, however, according to biofuel producer Dirk Kronemeijer, the CEO and founder at Dutch biofuel producer GoodFuels.

According to Kronemeijer the ETS is already out of date. “It’s too insignificant to make a difference compared to a biofuel mandate,” he argues.

Adding, “It is an offsetting tool where you plant trees to compensate for the emissions,” he said. He went on to add, “insetting is the latest thing, where you actually reduce the carbon footprint by using low carbon fuels.”

Forward looking companies such as DHL are already using insetting as a mechanism to measure their own carbon footprint said Kronemeijer, claiming that GoodFuels is already a market leader in insetting. Also noting that GoodFuels can hardly keep up with the demand for low carbon fuels.

Kronemeijer believes that the way forward for the industry is to create a demand for genuine biofuels, by mandating that existing fuels have a low level of biofuel content, say 1%, and then regularly raising that requirement effectively creating a market demand, which will stimulate R&D and eventually production. It is the method that has been used for automotive fuels in Europe.

Lloyd’s Register are also uncertain that there will be any benefit from the EU ETS, which it says will increase voyage costs and make trading through EU ports more complex.

But Williams adds, “Whether it generates a carbon price sufficient to help tackle the missing market for low- and zero-carbon fuels remains to be seen. It is other initiatives that the EU is pursuing that may have a greater material impact: legislative proposals emerging from FuelEU Maritime around lifecycle emissions limits, and the Taxonomy Regulation are equally worthy of our attention.”

Abbasov also takes up the issues around other EU moves to battle the climate crisis, pointing out that the decision to mandate the use of low carbon fuels, which is similar to the view held by Kronemeijer at GoodFuels.

“Europe will adopt additional regional regulation mandating the uptake of zero carbon fuels by ships calling at European ports. The decision could be adopted even before 2023. That will be a watershed moment for the deployment of green vessels running on sustainable and scalable fuels such as green hydrogen or green ammonia,” said Abbasov.

Kronemeijer estimates that once 7% of fuels used are mandated to be biofuels that could be enough to create a large enough demand for biofuels to be scaled up.

“Critically the climate world we now work in is governed by the Paris Agreement where every country sets out their own targets in their Nationally Determined Contributions (NDC). The binary world of Kyoto Protocol where developing countries had targets have changed,” said Warris.

She pointed out that shipping must be alert to the developments in developing country NDC’s, which while related to domestic shipping may influence discussions at MEPC. Examples include:

- China and its 2060 carbon neutral commitment – what are the choice of fuels to achieve that – it appears to be methanol or biofuels. Will the Chinese ETS eventually include shipping intra-China voyages?

- UN Framework Convention on Climate Change analysis of NDCs in 2016 (next report due 28 Feb 2021) states that “Mitigation targets [in NDCs] vary in their scope with several parties mentioning domestic shipping.

“In summary,” said Warris, “whereas 10 years ago the direction for shipping would have been set by regulatory developments. I believe that the voluntary developments currently have the edge and may well change the shipping industry choice of propulsion and escalate the change with regulatory development catching up.”

If this is the case then the IMO risks becoming irrelevant as a regulator. If the maritime sector wants global regulation, and it says it does, then they must pressure governments to accept the inevitable and push ahead, not just to meet timid targets, but to grasp the nettle and go for real change and development. Those that bury their heads in the sand will then be unable to hinder the rest from driving forward, but will get a kickstart to drive them on too.

Nick Savvides

Managing Editor