It is a matter of time before MSC surpasses Maersk, becoming the largest container shipping company in the world.

After approximately 20 years, the Danish shipping giant will not be the “king” of the oceans, but “that’s not the end of the world,” according to Maersk’s CEO Soren Skou, who back in July stated that “Our focus is on having a much higher turnover per container we ship.”

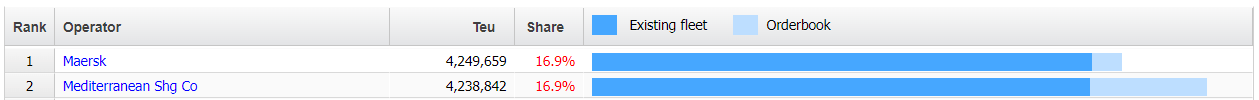

The gap between the existing fleets of the two 2M Alliance partners is now just 13,381 TEU, which translates to one New Panamax container vessel, according to Alphaliner data, which also show that the orders MSC will receive in the next months and years are, at the time of writing, significantly more than Maersk’s ones. As a result, MSC’s overtaking of the liner rankings’ top position does not seem to be a temporary condition.

However, VesselsValue (VV) estimates that both companies have similarly large order books. [1] VV reports that Maersk has a total of nine vessels on order, including eight New Panamax vessels and one Sub-Panamax vessel with a total capacity of 130,100TEU, while MSC’s order book consists of four Ultra Large Container Vessels and two New Panamax ships with a total capacity of 128,400TEU.

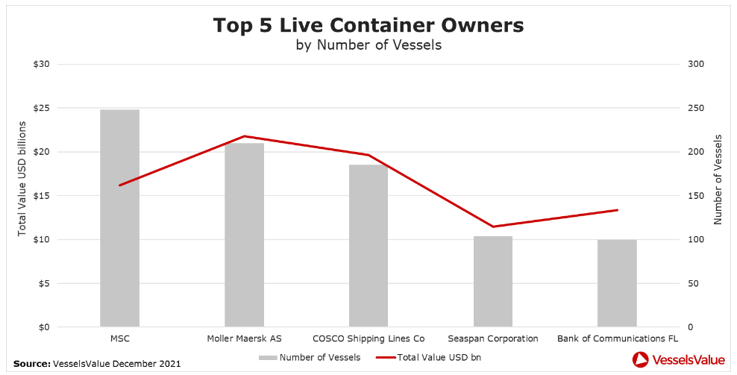

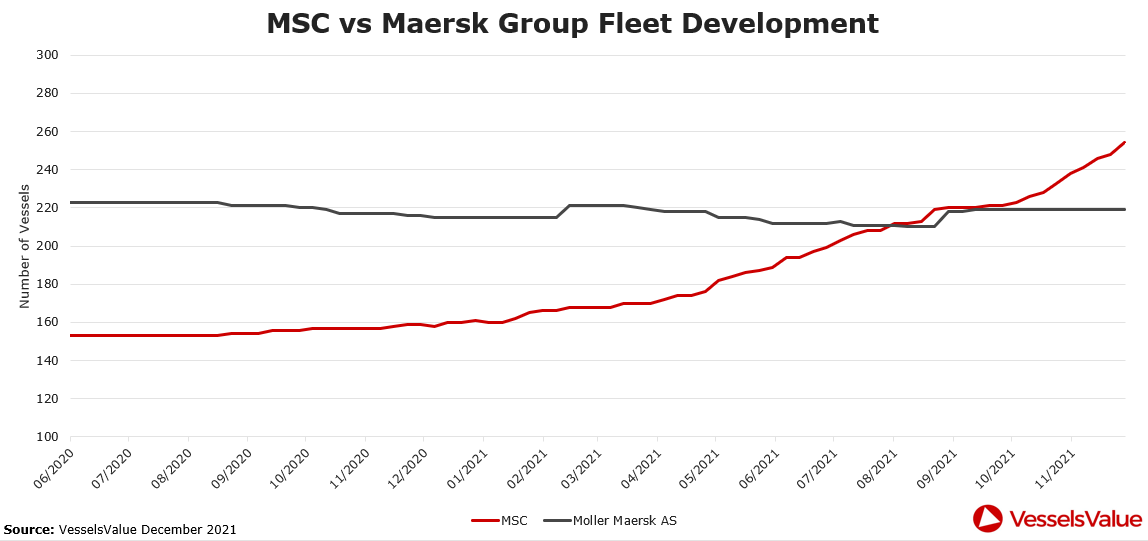

MSC is already the largest owner of container vessels by number, owning a total of 248 ships with an average age of their fleet at 16 years old. Maersk, on the other hand, currently has a total of 210 vessels in its fleet, with the average age at 11 years old.

Felix Mathes, a Container Analyst at VesselsValue, said that the significant increase in freight rates has boosted buying confidence in the S&P market with a total of 351 confirmed vessels sold year to date 2021.

“MSC has played an active role in the S&P market this year with a total of 76 confirmed vessels being bought by the company and overtaking Maersk by number of vessels owned,” Mathes told Container News.

He went on to explain that for MSC it has been cheaper to buy a vessel from the S&P market instead of chartering in vessels in the current inflated market. MSC bought the 2012-built, 1,496TEU AS Riccarda on 27 September for US$26 million. This type of vessel can currently be fixed for three years time charter (TC) at about US$27,000/day, equating to US$28.2 million.

“MSC will therefore have paid off the vessel in about three years and will retain the asset. If they would have chartered it in, they would have chartered it in at the current high rates and would not keep the vessel after the three years,” concluded Felix Mathes.

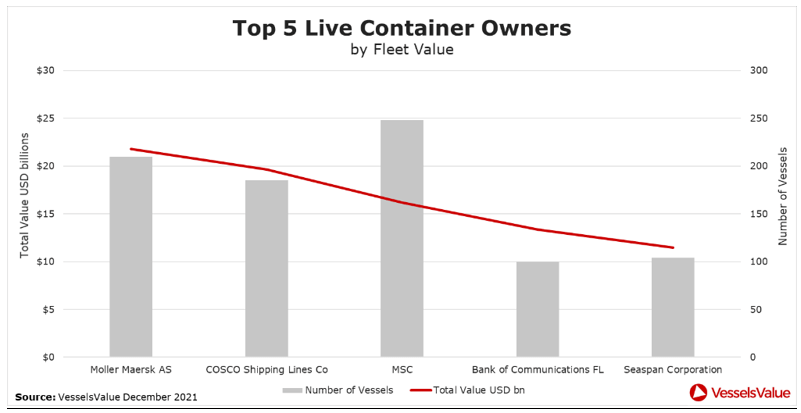

However, Maersk remains the largest owner by total value with their fleet value at a whopping US$21.8 billion, according to VesselsValue data. This is due to the fact Maersk’s fleet is an average of five years younger than MSC’s fleet and has a larger total TEU capacity, giving rise to a higher fleet value.

The change in the top of the liner rankings is likely to happen a few days or weeks after Soren Toft has come to the end of his first year as the Chief Executive Officer of MSC. Toft left the role of the Chief Operating Officer at Maersk to take over the leadership of its Swiss/Italian rival.

The potential achievement of being the largest container line in the world, along with the widening of the gap from CMA CGM and COSCO, which follow at the third and fourth position respectively, could mark this year as successful for Soren Toft and MSC.

The Aponte family established MSC in 1970, climbing to the second rank of the world’s largest container lines in 2004 and after more than 50 years, the company will be considered as the largest container carrier.

Gianluigi Aponte’s decision to trust its biggest rival’s top executive, giving Toft the crucial leadership role of the company’s CEO, seems to have been the key to this success.

It is interesting to see if and how this potential change could affect the financial results of these two shipping giants. In the last three years, Maersk reports revenues in the range of US$39-40 billion, while highly secretive MSC, which as a privately held company is not required to publish its accounts, seems to achieve annual group revenues in excess of US$25 billion, according to Financial Times.

However, with freight rates remaining at record-high levels, the two companies are not expected to face difficulties in their revenues and profits. This is easily seen from the last two Maersk’s quarterly financial reports, in which the Copenhagen-based carrier has announced record earnings for both the second and third quarters of 2021.

[1] VV procedure for reporting newbuilding orders means the new ships have to be confirmed by the owner, have an IMO number, or meet VV’s reliability source threshold.