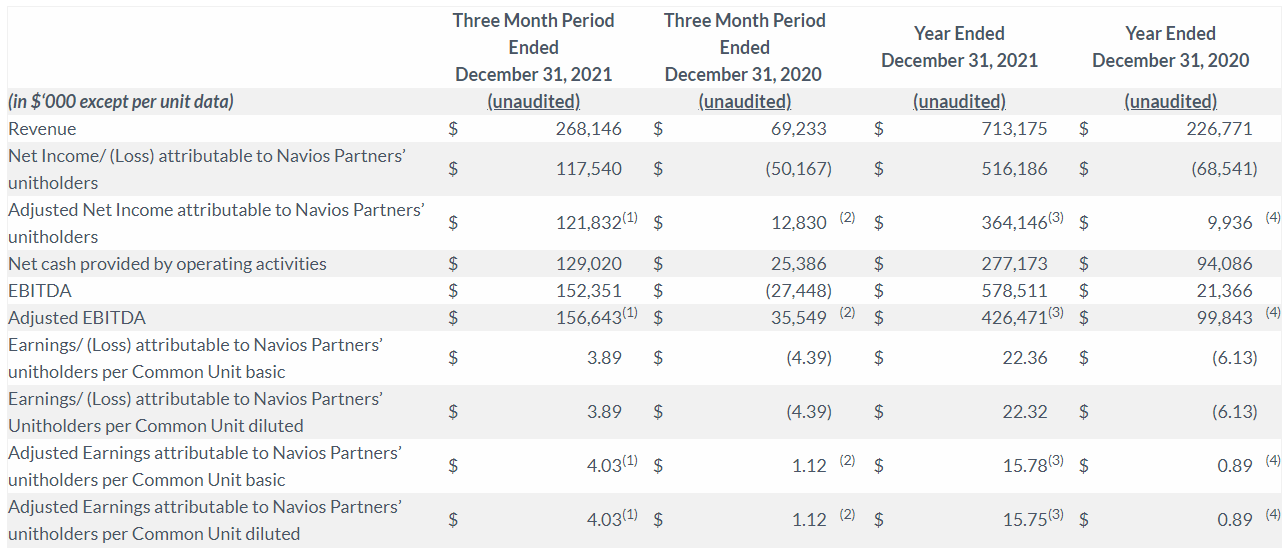

The Greek container vessel owner and operator Navios Maritime Partners (NMP) has achieved remarkable increases in its financial results during 2021, with a revenue of US$713.2 million compared to US$226.7 million in 2020.

At the same time, the company’s net income saw a skyrocketing rise, reaching US$516.2 million over US$68.5 million during the previous year.

Additionally, Navios Partners has also reported adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) of US$426.5 million over US$99.8 million in 2020, while net cash from operating activities totalled US$277.2 million compared to US$94 million during the previous year.

During 2021, Navios Partners has invested approximately US$1 billion to acquire 18 newbuilding vessels, that are expected to be delivered in the company’s fleet through 2024.

More specifically, in November the company acquired four 5,300 TEU new container ships for US$62.8 million each that are expected to be delivered in 2024 and will be chartered out for an average period of 64 months, for US$37,282 per day.

Furthermore, NPM chartered three 4,250 TEU container vessels for an average period of approximately 36 months, at an average net rate of US$50,181 per day.

During the same period, two 3,450 TEU container ships have been chartered-out for an average period of approximately 45 months, at an average net rate of US$44,250 per day, and two 2,750 TEU boxships for approximately 37 months, at a rate of US$41,805.

At the same time, NMP also secured long-term time charters for 11 boxships, which are estimated to generate approximately US$670 million contracted revenue.

“Ιn 2021, we reimagined the public shipping company,” said Angeliki Frangou, Chairman and CEO of Navios Partners, which is one of the US publicly-listed shipping companies diversified across 15 vessel types in three segments, each of them works independently to mitigate volatility from the other, according to Frangou.