Chinese New Year (CNY) in 2025 will fall on 29 January 2025, coinciding with the launch of new carrier alliance networks.

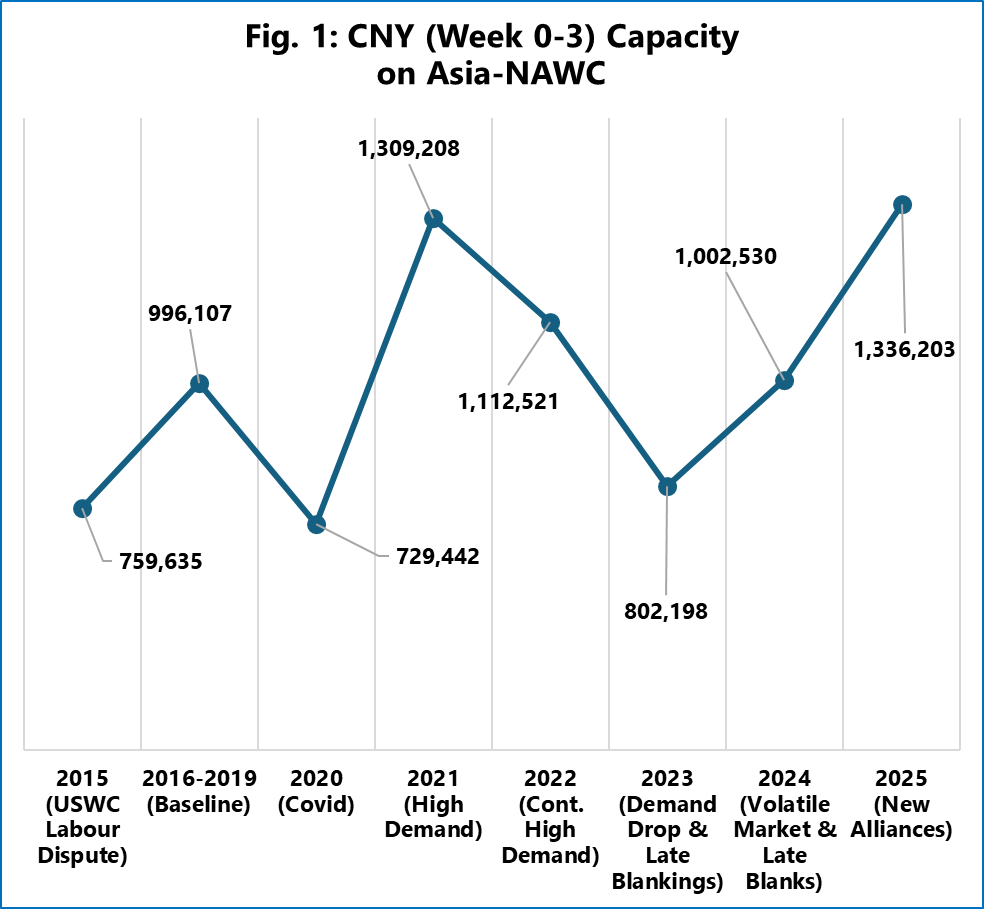

While CNY typically causes disruptions to the supply chain due to blank sailings stemming from reduced demand, the transition from existing alliance services to new ones may exacerbate this impact. For the Asia-North America West Coast route, there is a notable surge in capacity during the four-week CNY period (the week of CNY plus the three weeks following).

In 2025, the capacity for this period is projected to reach nearly 1.34 million TEUs, the highest recorded in the analyzed period, surpassing even the high-demand period of 2021. This represents a 33.3% year-over-year increase and a 34.1% increase when compared to the 2016-2019 average.

In terms of blank sailings, carriers have scheduled only 9% blanked capacity, the lowest in the analyzed period, which stands in stark contrast to the 22.8% blanking in 2024 and the 18.3% average from 2016 to 2019. For context, the blanked percentage during the peak demand of 2021 was 10.7%.

Under normal circumstances, such a significant capacity increase would likely lead to substantial blank sailing announcements in the coming weeks, as carriers would be unlikely to maintain this excess capacity. This could result in a scenario similar to that of 2023 and 2024 when carriers made significant capacity cuts just before CNY.

“However, there is also a potential unknown,” points out Alan Murphy, CEO of Sea-Intelligene. “The phase-in of the new networks by MSC, Gemini Cooperation, and Premier Alliance. This introduces an uncertainty, whereby the carriers might prioritise getting their vessels phased into the new networks, at the expense of not blanking as much capacity as usual.”