Freight rates on the Asia-North America West Coast (NAWC) trade lane have skyrocketed to record-breaking levels, according to shipping analysts at Sea-Intelligence, who point out that the current demand increase and the high freight prices indicate a big opportunity for carriers to not only fill up vessels on existing liner services but also to launch new services.

Following a dip in the number of distinct services on Asia-NAWC due to the pandemic, there was a steady increase in the trade lane, with 39 weekly liner services offered in August 2020, rising to 42 by December 2020, and finally to 53 from August 2021 onwards.

“This is the highest that this figure has been on the trade lane in the 2012-2021 period,” highlighted Sea-Intelligence.

The Danish researchers found that this increase is driven by the non-alliance services, which increased sharply from 9-11 weekly services in 2017-2020 to 23 in August 2021.

From a pre-pandemic base of 10 weekly non-alliance services, 13 new non-alliance services have been launched in the trade lane, 12 of which made the first departure in 2021, according to the Sea-Intelligence report, which said that all of these services were standalone services.

“The operating carrier has a full allocation of the capacity on board each vessel, with three of these services offered by newcomers on the trade, two by CU Lines and ane by BAL Container Lines,” explains Sea-Intelligence.

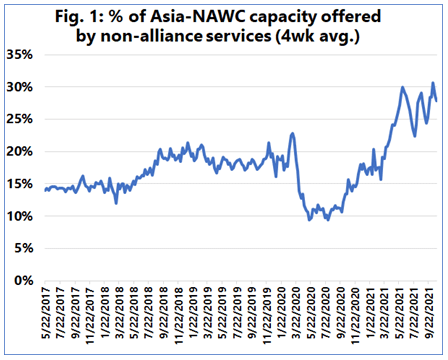

The figure shows the capacity deployed by non-alliance services as a percentage of the total trade lane capacity.

The share of the deployed capacity is currently at 28.6%, higher than pre-pandemic record of 22.8%.

Furthermore, the figure is slated to hover between 28%-31% in the coming weeks, meaning that nearly a third of Asia-NAWC capacity is being offered by non-alliance services.

“With container supply unable to match demand, and freight rates at the heights they are currently at, there is an obvious benefit to be had by the carriers,” noted Sea-Intelligence, which went on to add, “Our analysis showed that carriers are perhaps looking to benefit from the current environment, offering standalone services, knowing that not only will they be able to fill up the vessels, but will also be able to get very high freight rates for them.”