Since the onset of the pandemic, there has been considerable focus on the concept of nearshoring, where production is brought closer to the consumers, countervailing the strong trend of production offshoring seen over the previous decades, according to Sea-Intelligence.

A side-effect of nearshoring would be a shortening of supply chains as some production will move closer to the end-consumer, but not so close as to fully eliminate the need for container shipments.

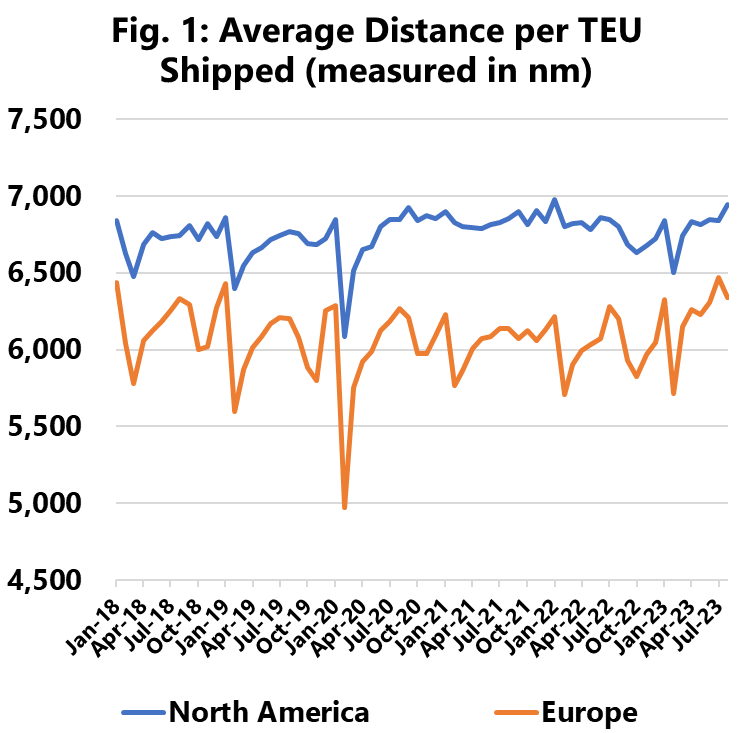

“This should therefore show up as a reduction in the average sailing distances,” pointed out Sea-Intelligence.

The figure shows the average sailing distances of containers imported into North America and Europe. The large downward spikes are seasonally caused by Chinese New Year and Golden Week. For North America, we see that the sailing distance has increased compared to a pre-pandemic baseline, hence giving no support to the notion of nearshoring.

For imports into Europe, although a marginal decline can be seen early in the pandemic period, this has been reversed and it would be more correct to conclude that over the past year, there has been a gradual increase in the sailing distance for cargo coming into Europe.

“When analysing container trade volume data from Container Trade Statistics, we find that intra-Europe container volumes, as a share of total European container imports, have been gradually declining since the height of the pandemic,” said Alan Murphy, CEO of Sea-Intelligence.

“While only a small share of intra-North America cargo moves on container vessels, intra-North America container volumes, as a share of total North America container imports, have almost halved since the pre-pandemic, from an average of 1.2% in 2019 to 0.6% in 2023 YTD. In conclusion, the available container volume trade data does not support a notion of increasing nearshoring,” added Murphy.