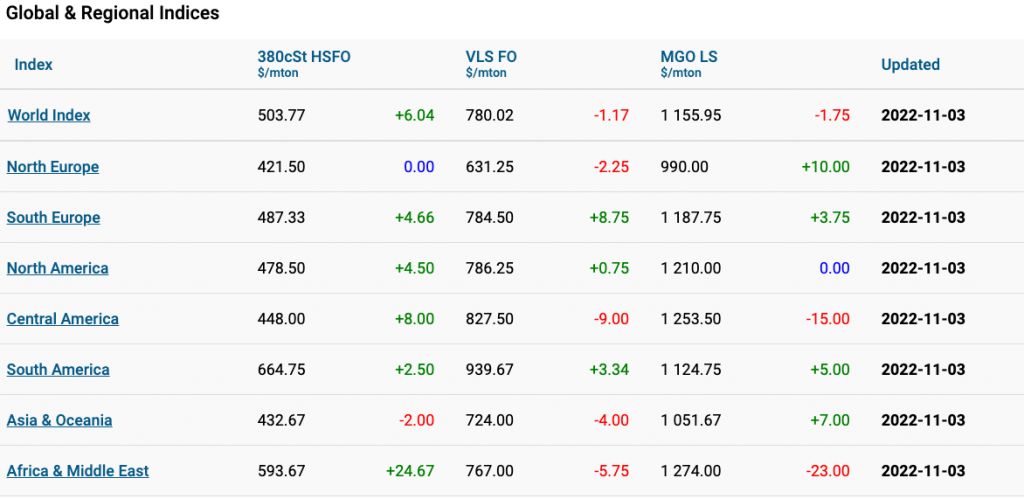

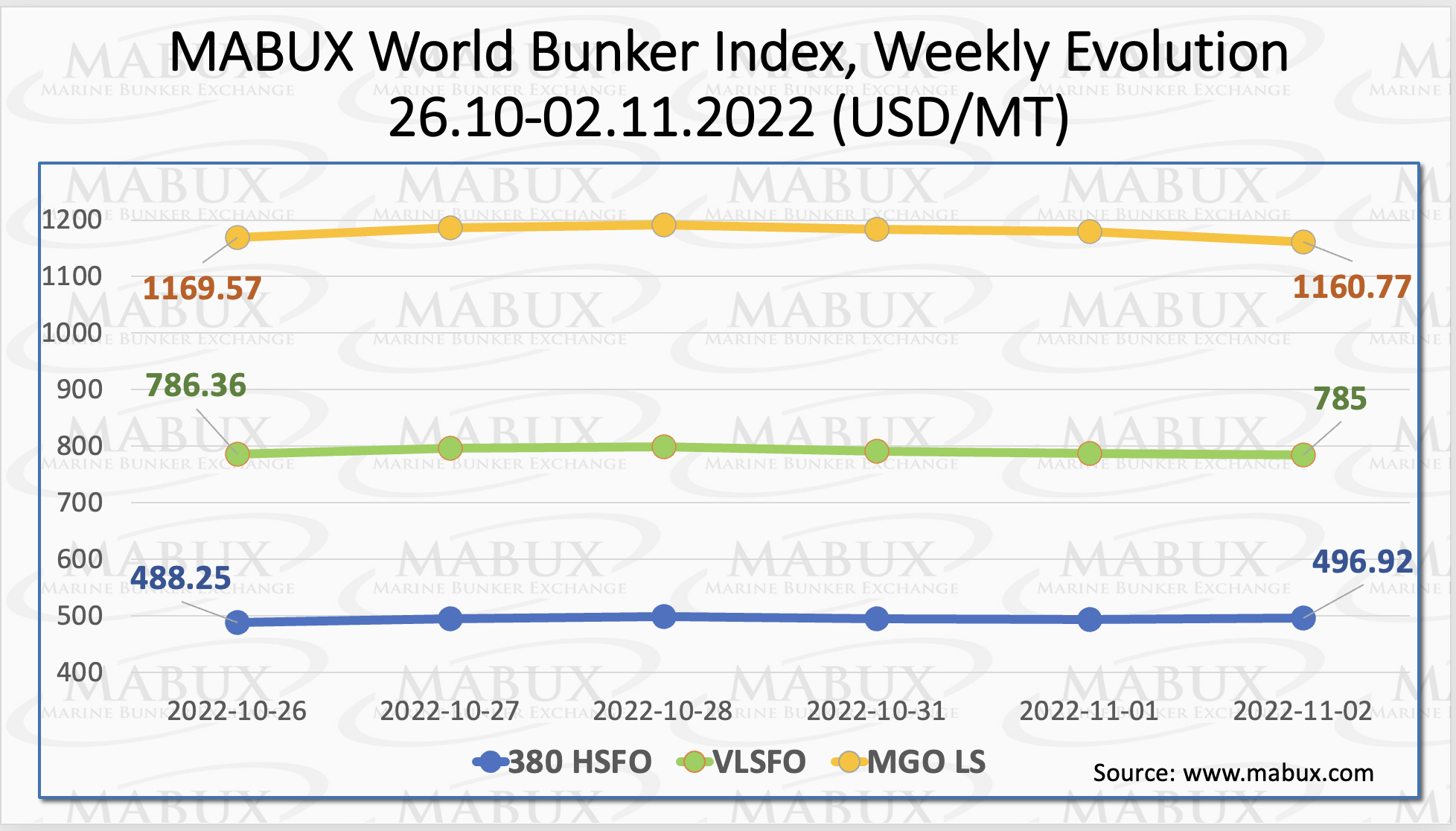

According to the weekly outlook of Marine Bunker Exchange (MABUX) for fuel prices, global indices have not shown a sustainable trend. The 380HSFO index rose to US$496.92/MT, the VLSFO index, in turn, declined to US$785.00/MT and the MGO index dropped to US$1,160.77/MT.

Therefore, during the week, no significant changes in the indicators were recorded, according to MABUX analysts.

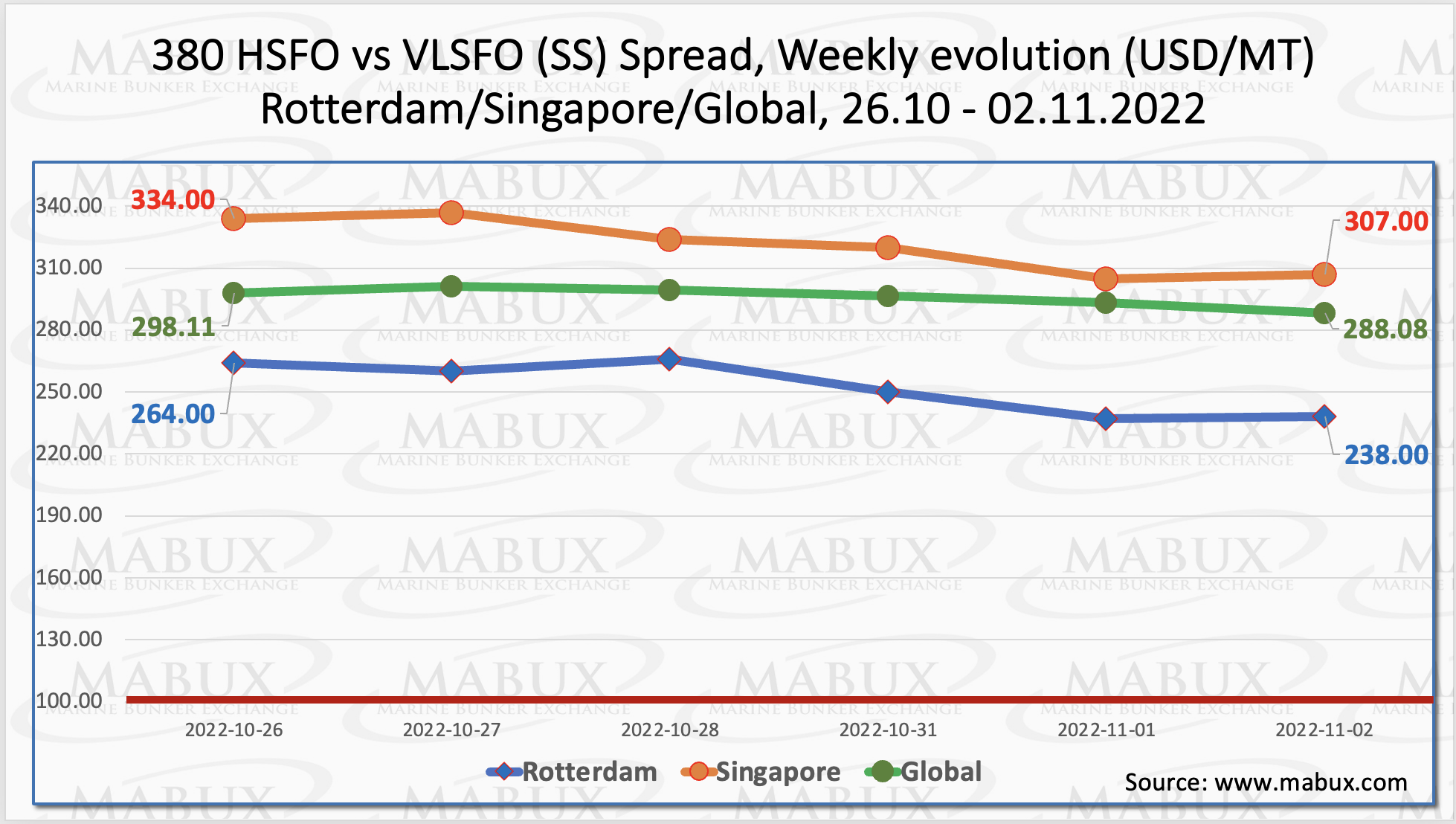

Meanwhile, the Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – continued its moderate decline through week 44 – minus US$3.72, reaching US$296.21.

In Rotterdam, the average SS Spread also fell to US$252.50. In Singapore, the average weekly difference in the price of 380 HSFO/VLSFO decreased more significantly: by US$14.33, to US$321.17.

“It is expected that the moderate reduction of SS Spread will continue next week,” commented a MABUX representative.

The gas supply and demand situation looks more or less under control right now, according to the report of MABUX. Prices in Europe are down significantly, and exports are not rising as fast as they were in early 2022 because Europe’s storage facilities are full.

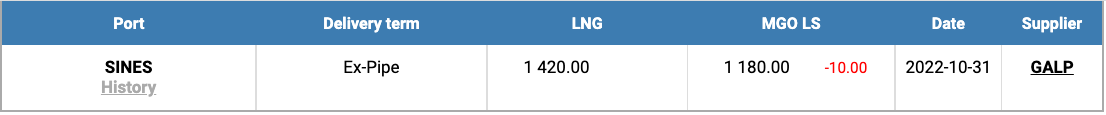

Nevertheless, the price of LNG as bunker fuel in the port of Sines in Portugal showed a moderate increase again on 31 October and reached US$1,420/MT.

Thus, the price of LNG once again exceeded the cost of the most expensive traditional bunker fuel. On 31 October, the price of MGO LS in the port of Sines was quoted at US$1,180/MT.

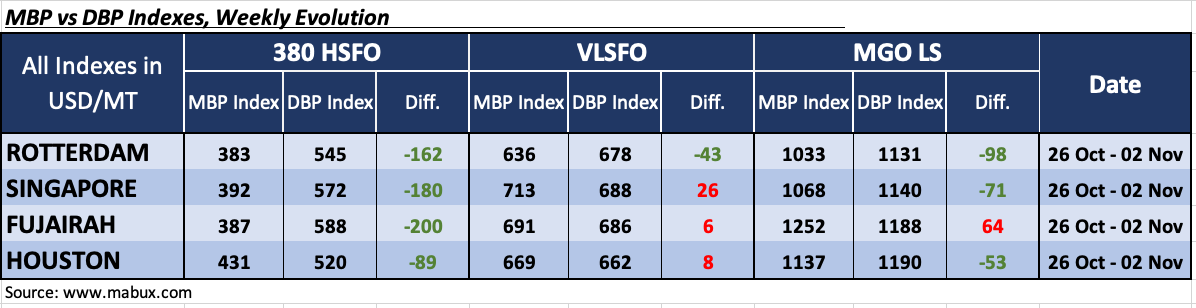

Over week 44, the MDI Index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark) continued to underestimate 380 HSFO fuel in all four selected ports. Underprice ratio changed slightly, in Rotterdam – minus US$162 and Houston – minus US$89. In Singapore and Fujairah, the undercharge premium of this fuel grade has not changed.

VLSFO fuel grade, according to MDI, was overpriced in three out of four selected ports: Singapore – plus US$26, Fujairah – plus US$6 and Houston – plus US$8. Overprice margins continued to decline and approached a 100% correlation with the market prices. The only underestimated port in the VLSFO segment was Rotterdam – minus US$43.

In the MGO LS segment, MDI registered an underestimation of fuel in three ports out of four selected: Rotterdam – minus US$98, Singapore – minus US$71 and Houston – minus US$53. Fujairah remained the only overvalued port in this fuel segment – plus US$64.

“No sustainable trend is registered in the global bunker market so far. We expect irregular

changes of bunker indices to continue next week,” said Sergey Ivanov, director of MABUX.