All major shipping lines that report on their financial figures have recorded sharp year-over-year revenue drops in the third quarter of 2023, according to the latest Sea-Intelligence analysis.

With the smallest contraction being -51.8%, it does sound alarming, but at the same time, we have to remember that the Y/Y comparison is against a period of high rates.

“To counter this volatility, we instead compare 2023-Q3 against 2019 on an annualised basis and see that the contraction in 2023-Q3 is an artefact of the abnormal growth in 2021-2022, and the revenues are now really only dropping down to the pre-pandemic levels,” say Danish analysts.

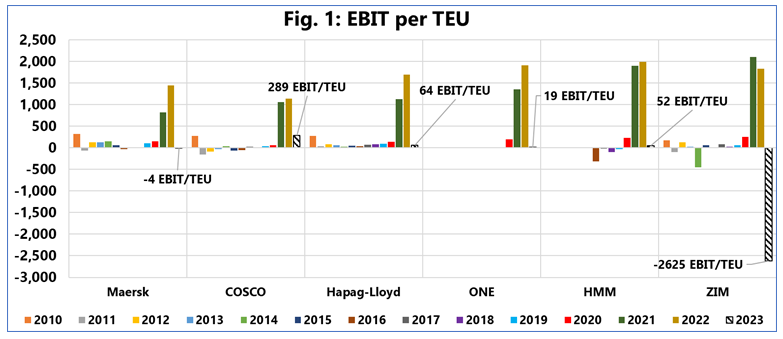

According to Sea-Intelligence data, after the extraordinary highs of 2021-2022, in the thrid quarter of 2023, we see EBIT/TEU drop in line with the pre-pandemic years.

COSCO has been doing well, recording the largest EBIT/TEU of US$289/TEU, followed by Hapag-Lloyd with US$64/TEU, and HMM with US$52/TEU. Maersk recorded the smallest negative EBIT/TEU of – US$4/TEU, whereas ZIM recorded a significant negative EBIT/TEU of – US$2,625/TEU (with an EBIT loss of US$2.28 billion).