The main driver for bunker prices this week is the decision by the Organization of the Petroleum Exporting Countries (OPEC)+ alliance regarding further oil production cuts, according to the latest report by Marine Bunker Exchange (MABUX).

[s2If is_user_logged_in()]CNN reported that the group of major oil producers has agreed to extend production cuts for another month despite a recent price surge, choosing to limit supply until the global economic recovery is more firmly established.

OPEC and allied producers said on Thursday, 4 March, that they would largely roll over production cuts during the next month, while Russia and Kazakhstan were granted exemptions to increase their output by a small amount.

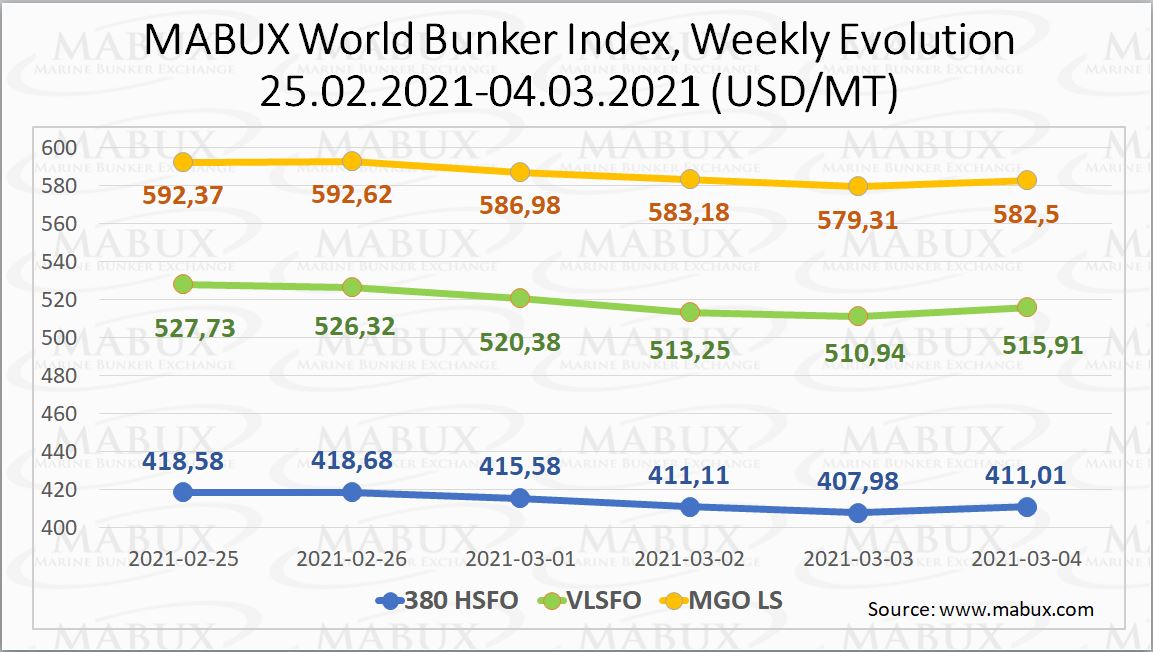

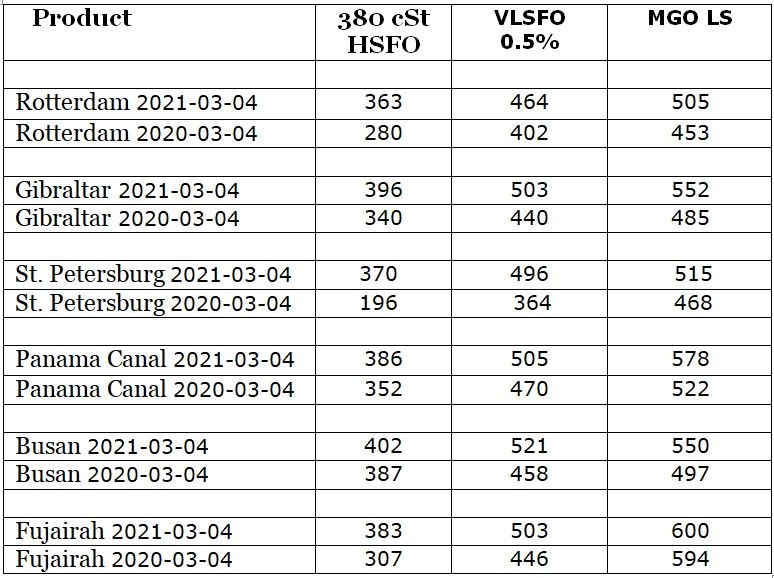

MABUX World Bunker Index has shown a firm downtrend during the week with the 380 HSFO index declining from US$418.58/mt to US$411.01/mt, VLSFO decreasing to US$515.91/mt and MGO LS falling to US$582.50/mt.

At the same time, the global scrubber spread (SS) – the difference in price between 380 HSFO and VLSFO – has not had any drastic changes during the week and averaged US$105.27.

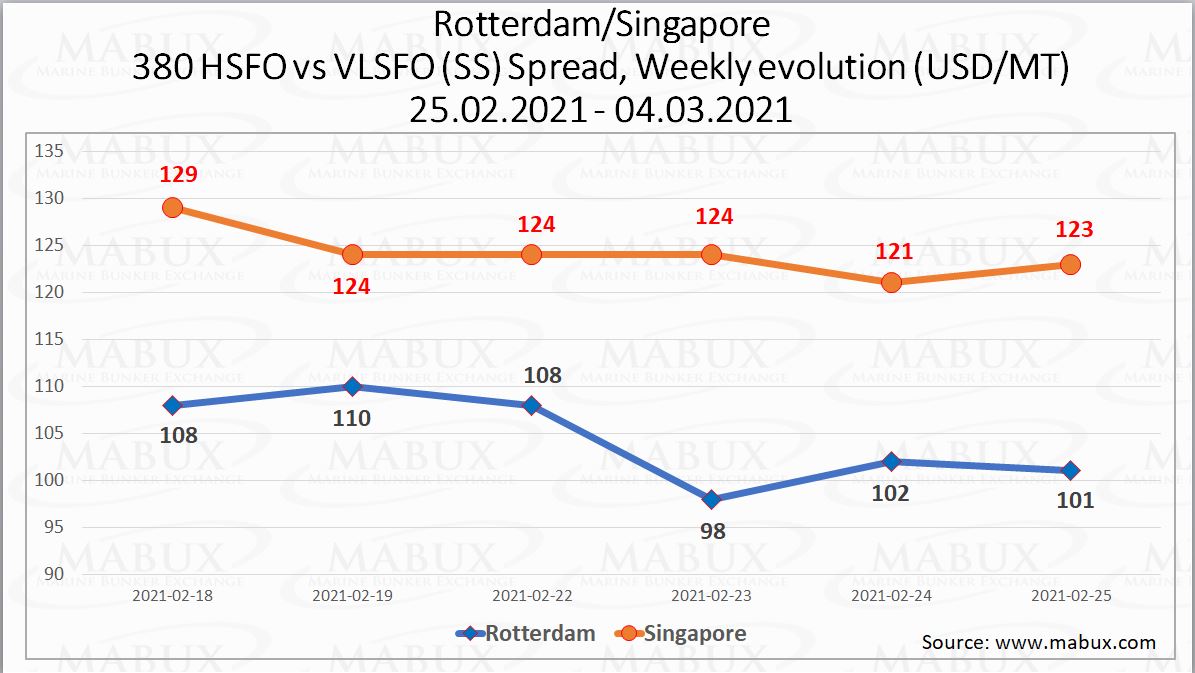

In particular, SS in Rotterdam narrowed during the week to US$101, while the average SS for the week has decreased by US$6 to US$104.50. Additionally, in Singapore, SS has declined during the week to US$123, while the average weekly SS index has fallen to US$124.17.

“Now it is visible, that the SS has turned into a downward correction in the short term,” commented MABUX.

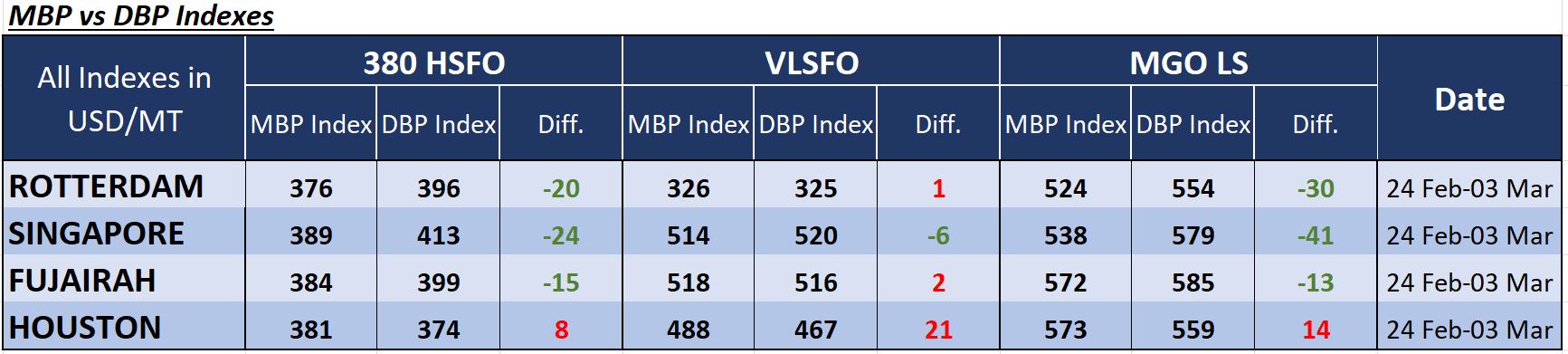

The correlation of MBP Index (Market Bunker Prices) vs DBP Index (MABUX Digital Benchmark) in the four global largest hubs during the past week showed that 380 HSFO and MGO LS fuels remain undervalued in all selected ports except Houston where that kind of fuel are overcharged by US$8 and US$14, respectively.

According to DBP Index, 380 HSFO was undercharged on average from US$15 in Fujairah to US$24 in Singapore. The MGO LS was also underpriced ranging from US$13 in Fujairah to US$41 in Singapore. In the meantime, VLSFO, according to DBP Index, is overvalued in Rotterdam by US$1, Fujairah by US$2 and Houston by US$21, while it is undercharged in Singapore by US$6.

MABUX said it expects the OPEC+ group of producers to ease supply cuts by about 500,000 barrels per day (bpd) from April. OPEC’s major influence in Saudi Arabia is also expected to partially or fully end its voluntary production cut of an additional 1 million bpd.

Moreover, MABUX said that bunker indexes were also supported US official data that showed a record drop in domestic fuel inventories from the aftermath of a deep freeze that shuttered refineries in several states. US gasoline inventories tumbled last week by the most since 1990 after a polar blast wiped out more than 5 million barrels a day of refining capacity in late February along the US Gulf Coast.

Crude stockpiles swelled with refineries still shut, added MABUX in its report, meanwhile, much of the crude production hit by the cold temperatures have been restored. Crude supplies grew by a record 21.56 million barrels, signalling weak demand from refiners at the time.

[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]