As an industry, the maritime sector, has become used to the litany of data revealing the extent of the damage the Coronavirus is wreaking on globalised economies, in Europe, North and South America, Asia and Africa at different intensities and in sequence as the viral tide sweeps out from its Asian epicentre.

It’s taken just four months of this year for us to get used to this latest standard, that will, we are told, change the world. In reading shipbroker Braemar’s quarterly market report what struck home was not the new normal, which already seems to be old hat, but the apparently forgotten old chestnuts.

Newbuildings, overcapacity and the demand forecasts remain the foundation of containerisation. Supply and demand is the bread and butter standard on which containerised cargo moves, too much capacity and rates fall an increase in demand and rates rise, it is as mechanical, predictable and monotonous as the piston in an internal combustion engine.

Since the advent of Covid-19 the basics of the container market have not been forgotten but are perhaps being ignored as the focus first turned to production in China and then the levels of consumption elsewhere. It is worth reminding the industry that when the viral crisis is over the maritime sector will still need to turn a buck and may also have to find a new standard, from within pre-established parameters.

Making predictions, they say, is very difficult, especially when they’re about the future. It is some surprise then that Braemar can make projections in this volatile climate. Planning is, however, a key prerequisite for the industry, particularly as the lead times for new capacity can be long, two years or more.

Planning from within the industry has not always appeared, from the outside, well thought out. Whether that is a factor of the economics and nature of the business or a feature of the characters within it, historically and in the present is another question. The fact is that the industry has chased economies of scale for many years and that has changed the industry from the inside, while the drivers for these economies were external.

Over the last 30 years the drive has been towards ever greater globalisation, the free movement of goods and labour across the globe. Well at least goods move freely, labour was more problematic, with the mature economies literally nursing aging populations and the developing world looking for work. Cheap labour was available in the new global, free societies.

In the case of China, the mature economies, rather than bringing labour to work in their own countries, decided to move the jobs to China. The focus of so much production in one region was a huge economic boost for China and an enormous boost for consumers elsewhere as cheap goods flooded our hitherto pricey markets.

Container shipping facilitated these changes offering comparatively cheap and fast transportation for goods, just-in-time logistics was born, and capitalism was set fair. To manage the huge volumes of cargo being transported out of China eastwards to North America and to Europe in the west the container shipping industry built ever larger ships.

By 2000 these vessels had reached the massive capacity of 6,000TEU, three or more steps later and the era of ultra large container ships was born, with the latest vessels on the water a massive 24,000TEU, at an average of 13tonnes/TEU that would total in excess of 300,000tonnes of cargo. Maersk Line has been a driver of the economies of scale launching the first 16,000TEU and 18,000TEU ships, with all the carriers looking to drive down costs as they were squeezed by powerful, globalised shipper interests such as Walmart, Nike and IKEA, amongst many others.

Many of the readers of Container News will recognise this historical review, and may well be asking where it is leading? It is a fair question. Container lines moved with the times and that meant as the ships became larger the carriers shifted their service offerings from direct calls to the hub and spoke system.

The latter required an armada of smaller container vessels to carry cargo to regional ports. As the ships had increased in size the vessel operators cascaded their older vessels into smaller trades, including the feeder services. In the late 1990’s, a feeder was considered to be a vessel with a capacity of up to 1,000TEU. Today, by Braemar’s definitions, the feedermax is up to 3,000TEU and the regional trader, which sounds suspiciously like a feeder by another name, is up to 4,000TEU.

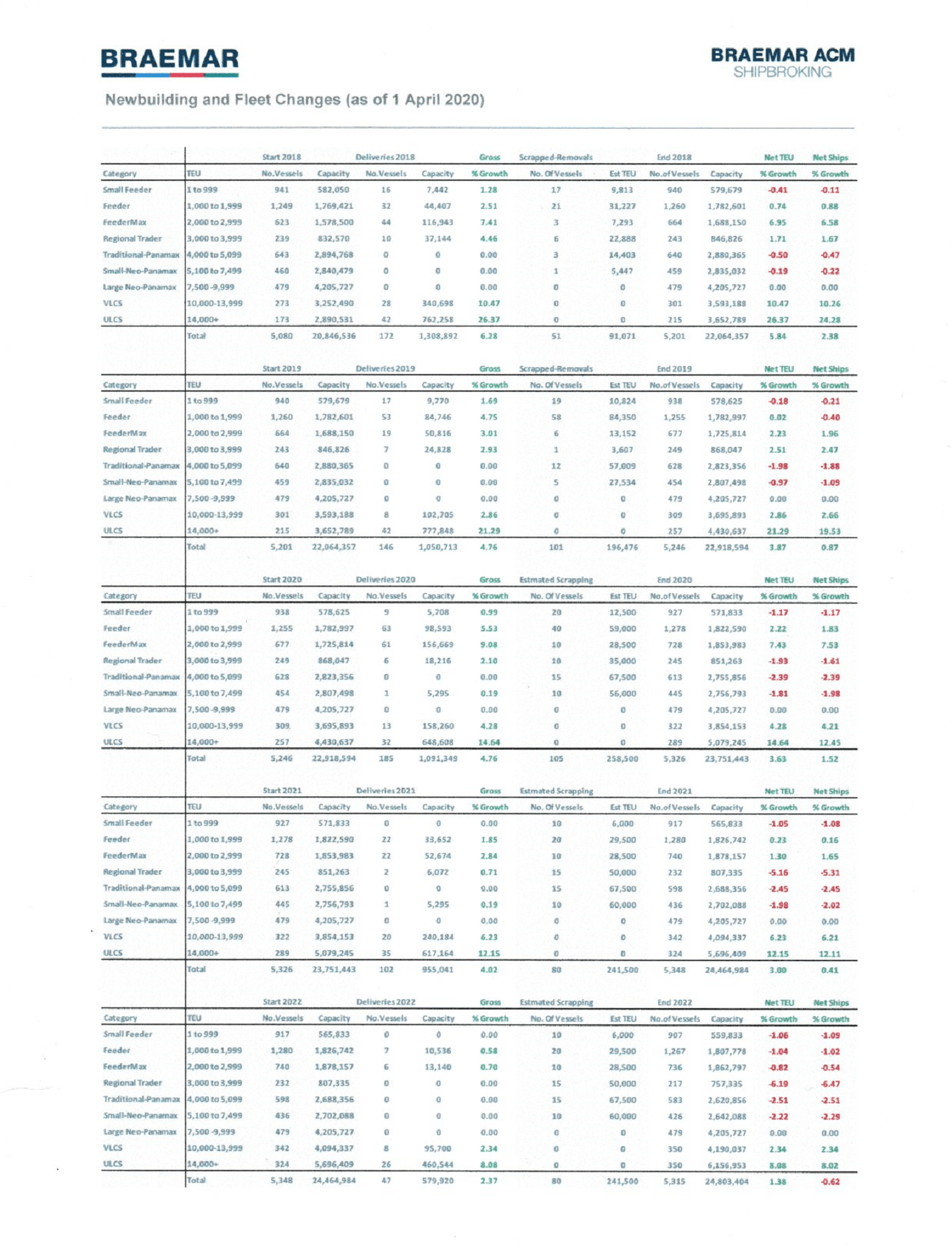

Looking at Braemar’s charts (see below) it is striking that the older vessels are largely these smaller ships, and the younger models are the so-called plus sizes. Nothing unusual about that.

However, the industry has become so enthralled by these larger vessels that few of the feeder ships are being built. The theory goes, and it’s not a new theory, that the cost of feeders will increase substantially as the increase in demand for the smaller ships increases.

That demand must come as the mega-ships can only call at the larger hub ports, and so will require smaller ships to play a key Lilliputian role to the Herculean behemoths.

It would make sense then to see the growth of the feeder sector at least match that of the larger sector, and in keeping pace would be able, in theory to handle the growth in trade.

If Braemar’s projections are to be believed by 2022 the net level of feeder capacity will be contracting while the net levels of very large and ultra large container ships will be increasing. In the preceding two years, net growth of the two largest sizes of containers ships has far exceeded that of the four smallest sizes, in both the number of ships and the capacity. In the next three years, including 2020, the net differential between the smaller and larger vessels is expected to accelerate, not so much by the building of new large ships, but by the contraction in size of the small ship fleet.

As the Covid crisis has increased in intensity as well as its geographical spread the economic effects are expected to be profound. The unprecedented nature of the Covid event makes any projections more difficult than usual. So much so that companies such as Kuehne + Nagel and the Japanese carrier Ocean Network Express (ONE) have been reticent to make forward looking statements, normally a standard statement in any company’s quarterly results reporting.

One of the mooted changes caused by the viral crisis is that production will shift from its concentration in China to regional centres. The view is that the new normal will see societies rebuilt with the environmental concerns of much of the global population and many governments implementing a green shift to sustainable industries.

That shift would, however, first see many workers unemployed, a phenomenon that is already being experienced in major economies such as the US and in Europe. In April the US reported more than 20 million newly unemployed staff. In the UK the Bank of England warns the economy could shrink by 14% this year, if there is no second wave of the pandemic after lockdown is lifted.

European projections see a rebound in 2021 with the EU contracting 7.5% this year, with the effect of the slowdown hitting hardest in the Mediterranean economies, while the northern European states expect a quicker recovery.

The Guardian’s economics editor Larry Elliot wrote in early May that a snapback into the old ways remains unlikely. In the past one area of the economy has been affected, but with Covid all areas of the economy have been hit at the same time.

The lifting of the lockdown will not automatically mean a return to the pre-lockdown economy. Workers will have lost their jobs, others will preserve what money they have while businesses, currently relying on government support will lose that prop soon and as the government reins in its borrowing, and spending, so companies will make furloughed staff unemployed, according to Elliot.

He added, “As the dole queues inevitably start to lengthen, even those fortunate enough to have escaped a cut in wages will get anxious. They will save more and spend less for fear that they could soon lose their jobs as well.”

In the US consultant Jon Monroe asks “are shopping malls dead?” According to Monroe there are around 112,000 malls in the US that are mostly populated by non-essential retailers such as Sears, Maceys and JC Penney.

“The problems caused by the mall retail closures are hardest hit in the southern states where retail is a larger sector of employment for their economy. The impact of Covid-19 will not be felt evenly across the country,” said Monroe.

If these changes lead to the kind of relocalisation of production that some are expecting, or at least hope to see, will there be a need for the large cargo carriers? Will sustainable production mean sustainable transportation too? And if so all the experts are telling the industry that smaller vessels, travelling shorter distances are more likely to be able to meet the International Maritime Organization’s carbon targets, cutting emissions by 50% of 2008 levels.

Fundamental changes to global production were achieved in a few years as factories moved from the mature economies to low labour cost regions. Now environmental concerns and a global pandemic offer an opportunity make profound changes to the global economy again, that will require strong political leadership, enforceable regulation and commitment from industry.

Do world leaders have the authority and charisma to effect these changes? Only time will tell. As mentioned earlier, predictions are difficult, especially when they’re about the future.

Nick Savvides

Managing Editor