More than 20 countries around the world including Australia, Belgium, Canada, Chile, Costa Rica, Denmark, Fiji, Finland, France, Germany, Ireland, Italy, Japan, Morocco, Netherlands, New Zealand, Norway, Spain, Sweden, the United Kingdom and the United States, have signed the Clydebank Declaration to develop at least six green shipping corridors between two or more ports by 2025 and more by 2030.

Corridors would arise from partnerships between willing ports and operators to decarbonise specific shared maritime routes, according to the declaration.

Voluntary participation by operators was a significant element for successful green shipping corridors while over 200 businesses across the shipping value chain had committed to scaling and commercialising zero-emission vessels and fuels by 2030.

On the demand side, Amazon, Ikea, Michelin, Unilever and Patagonia have announced that they will only buy zero-carbon freight from 2040.

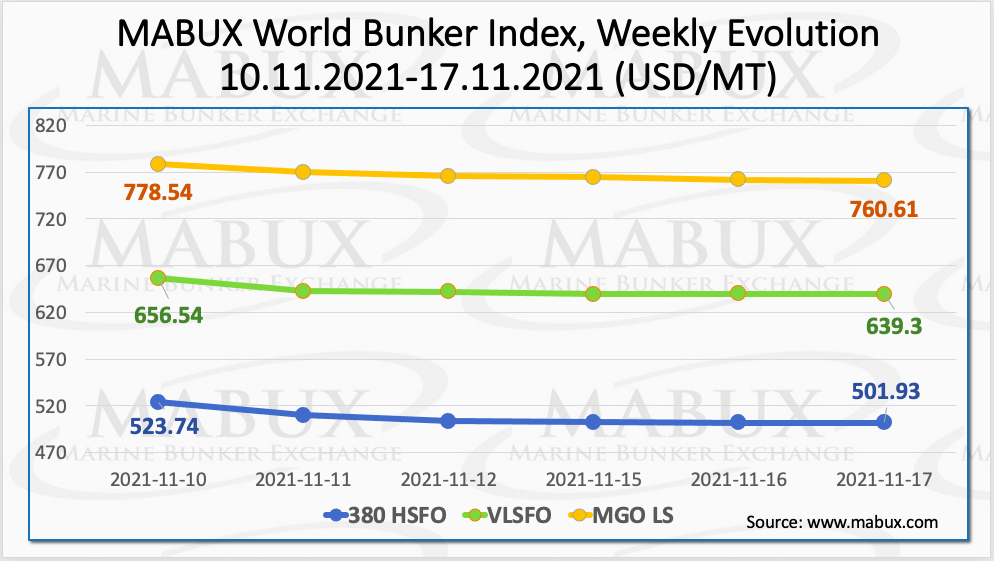

Meanwhile, the Marine Bunker Exchange (MABUX) World Bunker Index demonstrated a firm decline on week 46. The 380 HSFO Index dropped to US$501.93/MT. The VLSFO index also fell to US$639.30/MT, while the MGO index declined to US$760.61/MT.

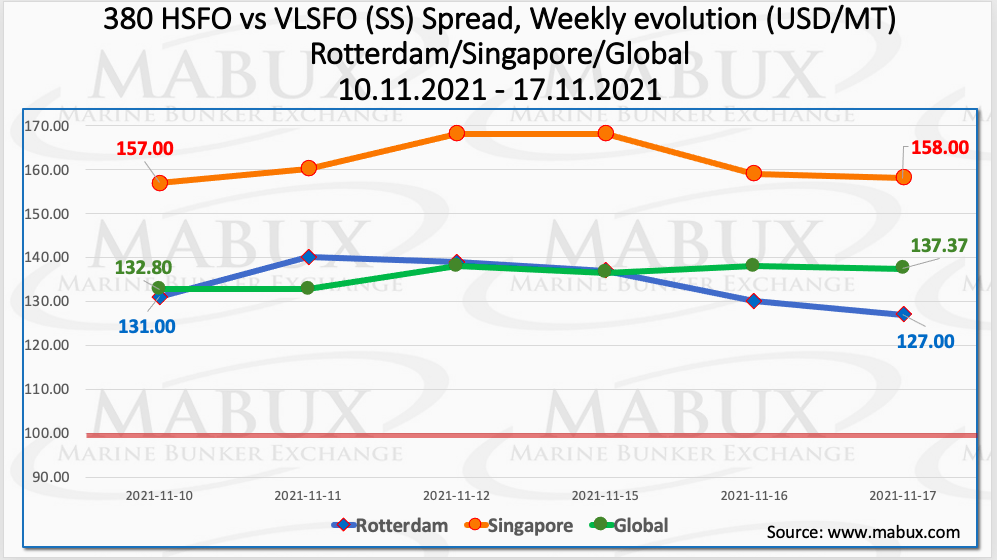

The weekly average Global Scrubber Spread (SS) which shows the difference in price between 380 HSFO and VLSFO continued to rise during the week and reached US$135.92.

At the same time, the average SS Spread in Rotterdam remained practically unchanged, lingered at the level of US$134, and the average SS Spread in Singapore, on the contrary, rose to US$161.67.

The gradual growth of SS Spread and the steady surpassing of the psychological mark of US$100 have increased the profitability of scrubber retrofits, said MABUX.

According to DNV GL, the total number of vessels with scrubbers both in operation and on order will be 4,584 in 2021, compared to 4,368 in 2020 and 3,167 in 2019.

In the meantime, the European gas prices remain unstable. The recent upward driver came from Gazprom with no booking additional gas transit capacity via Ukraine or via the Polish section of the Yamal-Europe pipeline for December, while the company has booked short-term transit capacities and started refilling its European storage facilities last week.

Additionally, extra supplies promised by Russia have so far been negligible and Norwegian flows have been reduced because of heavy maintenance. “The future of Nord Stream-2 is still unclear,” noted MABUX.

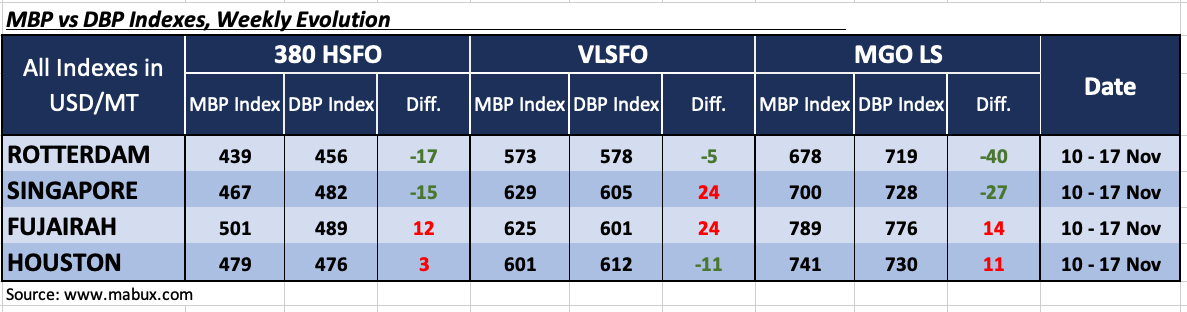

Furthermore, Correlation MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel was undervalued in two out of four ports: Rotterdam with a minus of US$17 and in Singapore, with minus US$15.

However, in Fujairah and Houston, the MABUX MBP / DBP Index recorded an overcharge of plus US$12 and plus US$3, respectively.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, has been overpriced in two out of four ports: in Rotterdam by minus US$5 and in Houston by minus US$11. Regarding Singapore and Fujairah, an overpricing by US$24 was recorded for each port.

Moreover, MGO LS, the MABUX MBP / DBP Index continued to register overpricing of this fuel grade in two ports: in Fujairah by plus US$14 and in Houston – by plus US$11. In Rotterdam, however, MGO LS is still undervalued with minus US$40 and in Singapore with US$27 minus.

“Overall, the MABUX MBP / DBP Index correlation shows that a firm trend for all fuel grades is still in the stage of formation,” commented MABUX.