Just before the start of the pandemic, the non-alliance carriers were offering 16,000 TEUs per week on average on the Asia-North America West Coast trade lane, according to Sea-Intelligence.

The Danish maritime data analysis company noted that this number dropped to 10,000 TEUs per week at the onset of the pandemic, followed by a sharp upward swing to 40-50,000 TEUs per week, as the non-alliance carriers poured capacity into the trade lane.

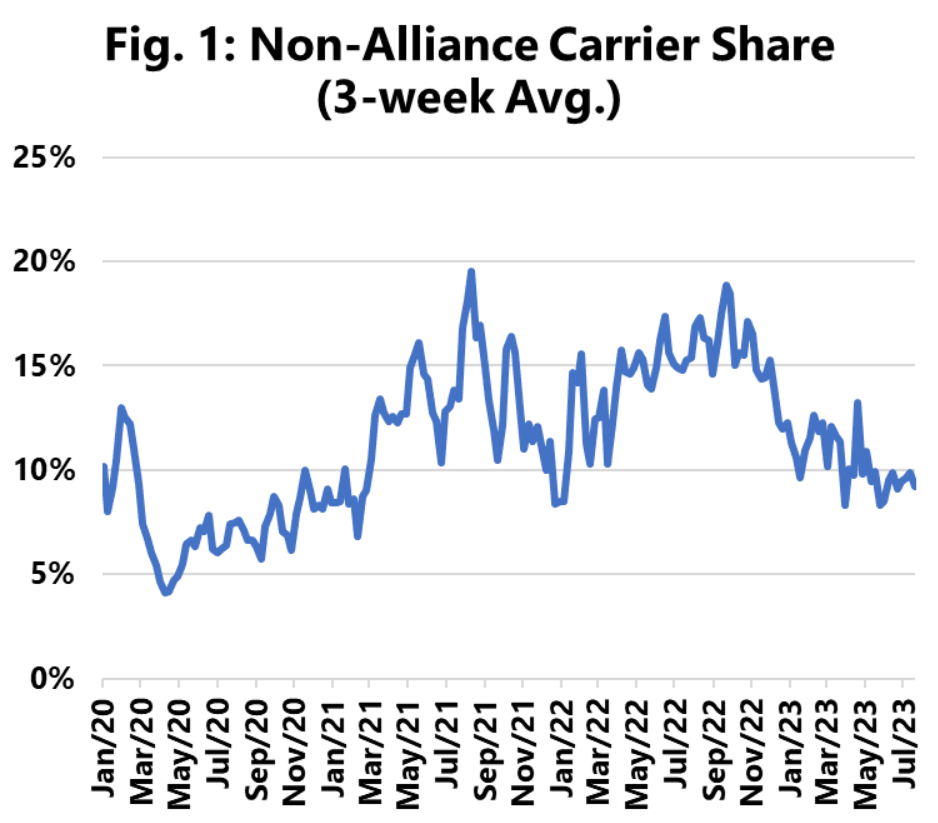

In terms of market share of total weekly deployed capacity on the trade lane, the non-alliance carriers increased from a pre-pandemic figure of 10% to around 15% during the peak.

As freight rates began to normalise and capacity gradually became available again in the market during 2022, the non-alliance market share also began to decline.

In essence, for most of 2023, their share has reverted back to the 10% levels. This is shown in the following figure:

The data shown in the figure above is based on a three-week rolling average, to eliminate the worst of the volatility and to better ascertain the underlying trends.

“If this was not done, the non-alliance would have, in some weeks, offered more than 20% of the capacity in the market,” pointed out Sea-Intelligence.

Based on the totality of the period i.e., from January 2020 to July 2023, there is a clear difference in scale between the carriers, with Wan Hai, Matson, and SM Line substantially larger than the other non-alliance carriers operating on the trade.

“If we however look at the development over time, the pattern becomes a bit more complex,” noted Alan Murphy, CEO of Sea-Intelligence.

Murphy explained, “For example, Wan Hai reacts very sharply to the initial pandemic shock, followed by an equally sharp reaction once the market tightens and freight rates go up. SM Line shows elements of the same behaviour although not to the same degree as Wan Hai.

Coming into 2023, SM Line is consistently offering more capacity in the trade than Wan Hai.

All that said, the plethora of new carriers, who entered the market at the peak of the freight rate bonanza, are mostly equally quick to exit the market, as conditions have been normalising in 2023.”