Sea-Intelligence has published a report about the capacity market shares of the three carrier alliances, 2M Alliance, Ocean Alliance and THE Alliance, and well as the non-alliance services, on the Transpacific and Asia-Europe trades aiming to see how the alliance market shares have developed in the longer term, as well as across the 2020-2021 period.

The biggest takeaway, according to Sea-Intelligence analysis, was the sharp increase in the capacity market share of the non-alliance services on Asia-North America West Coast, eating away capacity market share from all three carrier alliances.

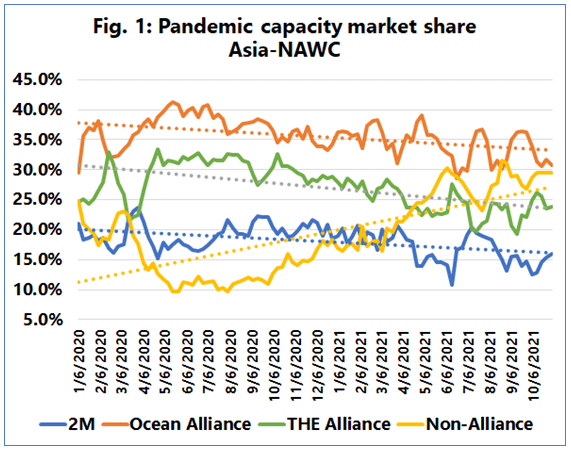

As can be seen in the following figure, since the start of the second half of 2020, carriers have started introducing non-alliance services on the trade lane at a rapid pace, especially after October 2020.

“This increase coincided with a sharp decrease in capacity market share for all three carrier alliances, to the point that the non-alliance services now offer more capacity on the Asia-North America West Coast trade lane than both 2M and THE Alliance, and nearly as much as Ocean Alliance,” said the Danish analysts.

At present, nearly 30% of Asia-North America West Coast deployed capacity is being offered by non-alliance services.

Sea-Intelligence noted a similar pattern on Asia-North America East Coast, although the disruption in the capacity market share by the non-alliance services was not as high, with these services now offering a little under 10% of Asia-North America East Coast deployed capacity.

“That said, both Ocean Alliance and 2M recorded a declining trend, while THE Alliance had a stable capacity market share through 2020-2021,” pointed out the analysts.

On Asia-Europe, the capacity offered by non-alliance services is not consequential in the grand scheme of things, as they were largely under 1% on Asia-North Europe in 2020-2021 and not offered at all on Asia-Mediterranean.

Meanwhile, in terms of the alliances, 2M recorded a declining capacity market share on both trade lanes, with Ocean Alliance seeing a growth on Asia-North Europe while THE Alliance stayed stable.

At the same time, both Ocean Alliance and THE Alliance recorded an increase on Asia-Mediterranean.

- 2M Alliance: Maersk, MSC

- Ocean Alliance: COSCO, CMA CGM, Evergreen

- THE Alliance: Hapag-Lloyd, Yang Ming, Ocean Network Express (ONE), HMM