Oil and fuel prices rose this week after Pfizer announced that its vaccine would be more than 90% effective for the coronavirus, according to the courtesy of Marine Bunker Exchange.

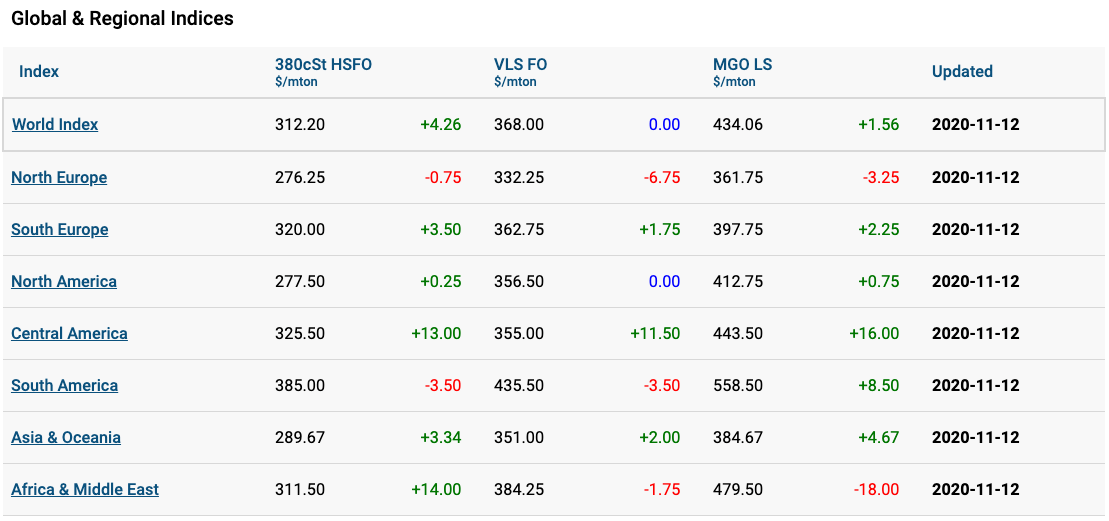

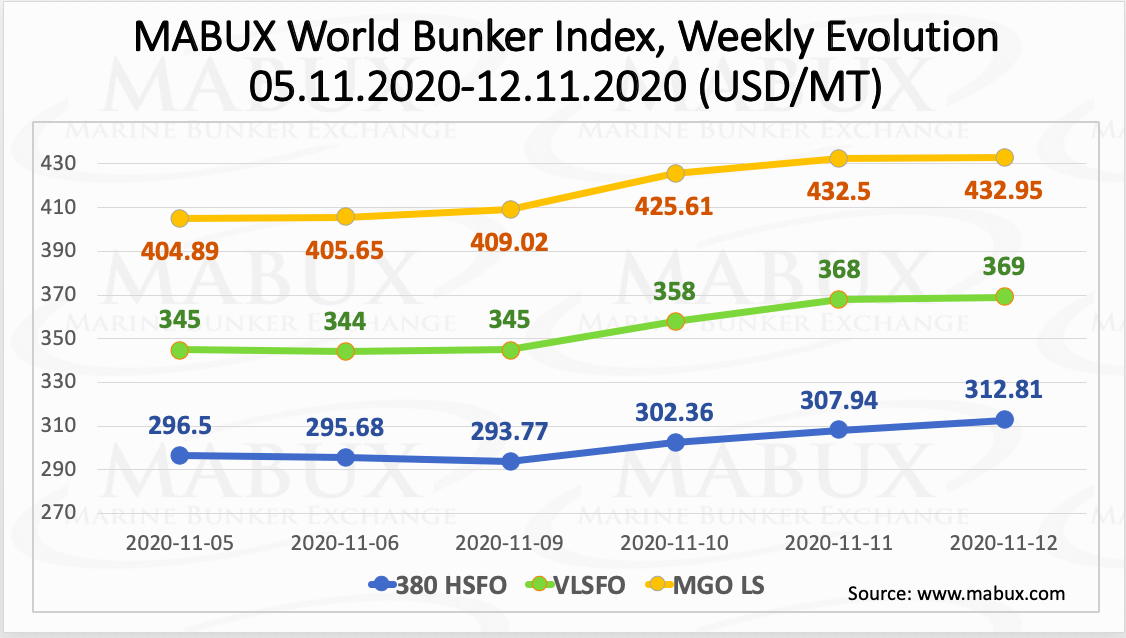

The World Bunker Index MABUX has demonstrated firm upward evolution during the week. The 380 HSFO index rose from US$312.81/tonne to US$368.00/tonne, VLSFO added US$24.00/tonne and reached US$369/tonne while MGO increased to US$432.95/tonne.

At the same time, the global scrubber spread (the price difference 380 HSFOs vs VLSFOs) has widened by US$7.99 USD and averaged US$53.32.

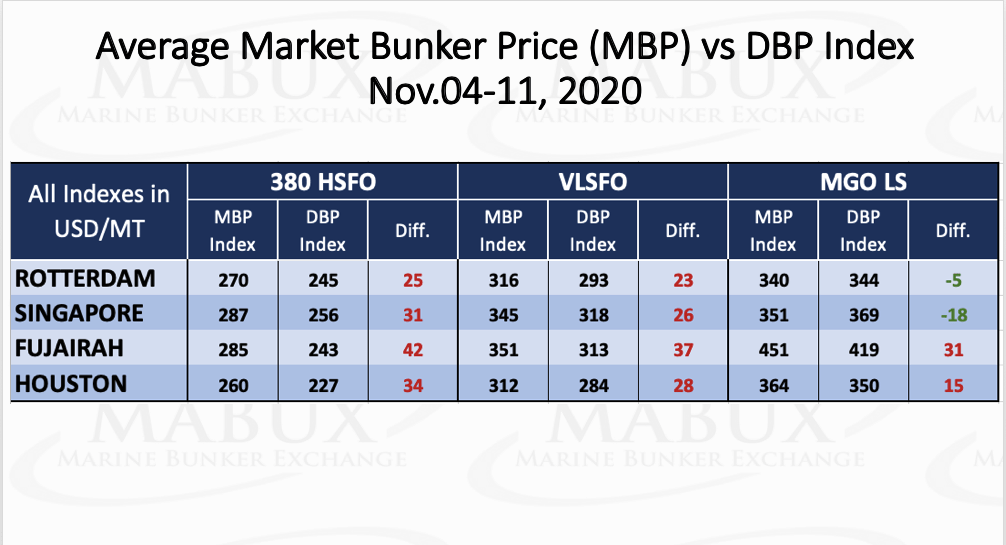

In the meantime, MABUX has presented a new Bunker Price Benchmark, named Digital Bunker Price (DBP), which relates entirely to oil future differentials. Among other features, DBP is a tool to identify overcharge/undercharge bunker prices and shows real-time bunker price trend updating every one minute. The function is available in 35 world major ports.

Comparison of average market bunker prices (MBP) vs the DBP index over the past week shows that bunker fuels are overcharged in almost all four ports used for valuation, Rotterdam, Singapore, Fujairah and Houston.

The overcharge rate of 380 HSFO was between +US$25 in Rotterdam and +US$42 in Fujairah, while VLSFO was between +US$23 in Rotterdam and +US$37 in Fujairah. Additionally, MGO LS was overcharged in Fujairah (+US$31) and Houston (+US$15) but undercharged in Rotterdam by US$5 and in Singapore by US$18.

Diesel consumers are likely to face an uncomfortable fact, according to MABUX which said the capacity to refine crude oil into traditional diesel fuel is starting to shrink in the United States and ultimately the world.

One of the reasons is that there is simply too much refining capacity in the world and there will be efforts needed to cull it. It is expected that worldwide refining capacity cuts to total about 5 million barrels per day (bpd), with about half of that coming from North America. Against a worldwide oil market of about 97 million bpd, down from the pre-pandemic level of 100 million bpd or slightly more, a cut that big is significant.

The Suez Canal Economic Zone (SCEZ) has outlined plans to issue bunkering licenses for overseas operators to begin offering traditional bunker fuels and LNG bunkers within the SCEZ. These will be on a non-exclusive basis, suggesting that several foreign bunker suppliers could be competing for business in Egypt next year. The first bunkering licences to allow bunkering operations within the six ports inside the SCEZ could be issued as early as Q1 2021.