“We are now more than half a year on from the beginning of the Red Sea crisis, and the severe impact on the container shipping industry continues unabated,” pointed out Alan Murphy, CEO of Sea-Intelligence.

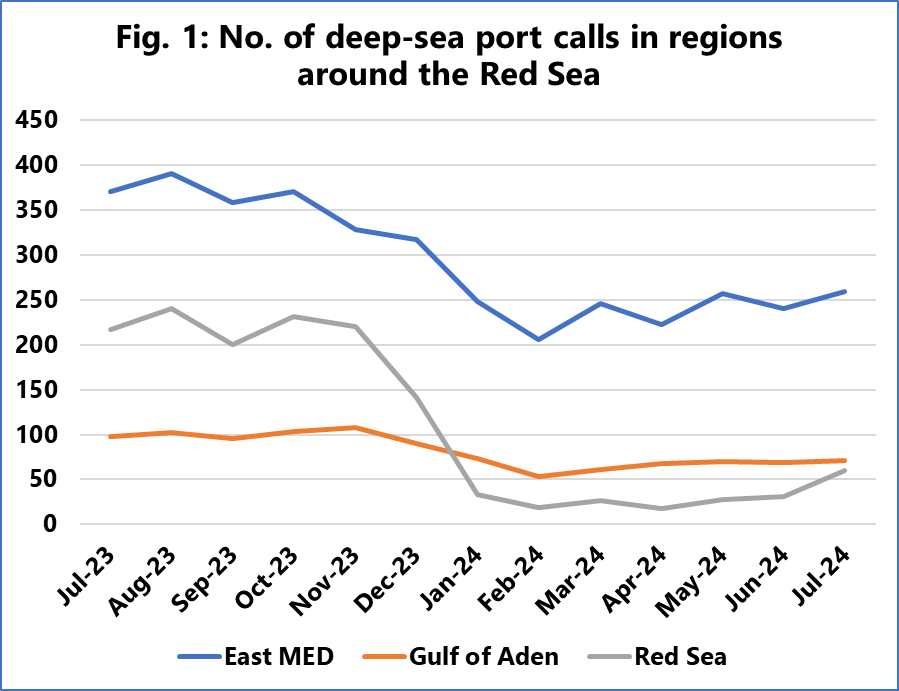

According to the Danish data analysis firm, the following figure highlights the number of deep-sea port calls in the key regions near the Suez Canal—namely the East Mediterranean (East MED), the Gulf of Aden, and the Red Sea.

In the East MED, the total number of monthly port calls had already been declining before the crisis, but January 2024 saw a significant month-on-month drop of 22%.

Compared to the pre-crisis average, the decrease in 2024 reached 33%. A similar decline of 33% was observed in the Gulf of Aden, where monthly port calls fell from around 100 to 60-70 in 2024. Although both regions have shown slow signs of recovery, progress has been limited.

In addition, the Red Sea experienced the most dramatic impact, with an 85% reduction in average monthly port calls in 2024. The number dropped from over 200 calls per month to fewer than 40 between January and June 2024. By July 2024, the figure doubled to 60 calls, but it remains uncertain whether this increase will be sustained or is merely a temporary fluctuation.

In the Red Sea, the ports most affected were Jeddah and King Abdullah Port. From January 2024 onwards, carriers completely stopped including King Abdullah Port in their deep-sea service routes. Jeddah experienced the steepest decline, with a sharp 74% drop in port calls from December 2023 to January 2024.

Although there was a slight recovery in July 2024, Jeddah is still averaging just 37 calls per month, a significant decrease from its pre-crisis average of 135 monthly calls. In the East Mediterranean, Piraeus and Port Said were the hardest hit, while in the Gulf of Aden, Salalah saw deep-sea port calls plummet by nearly 50% between January and February 2024.

In terms of schedule reliability, the Red Sea and East Mediterranean regions have returned to pre-crisis levels, but the Gulf of Aden continues to lag behind. There has also been an improvement in the average delay of late vessel arrivals across all three regions. After spiking to 10-14 days in January 2024, delays have since dropped back to pre-crisis levels of 4-5 days.