The visibility platform company for the global supply chain Project44 sees that the container shipping industry continues to experience turbulence in various areas.

While the focus has been on the continued port congestion leading to berthing delays, there is a new concern of decreasing port volumes that could negatively affect global trade.

The San Pedro Bay ports of Los Angeles (POLA) and Long Beach (POLB), the first and second-largest container ports in the US respectively, have been recording a decline in import full container volumes.

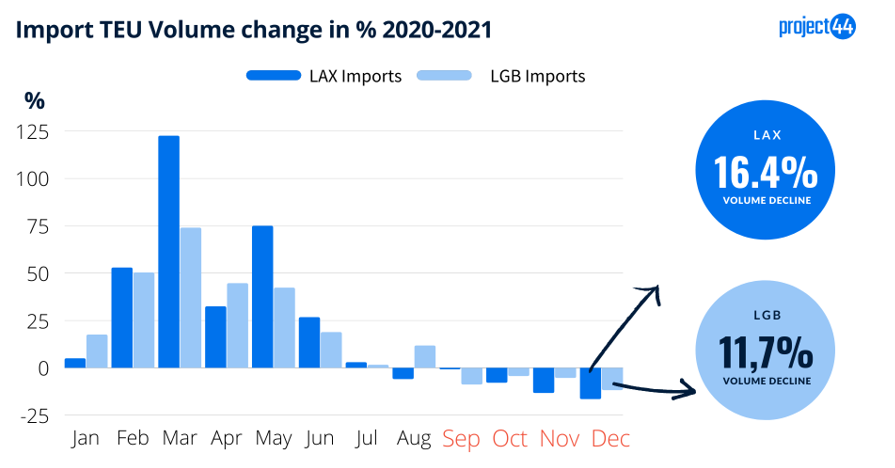

As the year-on-year import TEU volume in March 2021 showed an increase of 122.5% compared to 2020, project44 intelligence has been recording a steady decline in volume at both ports since September 2021, a 16.4% decline in Los Angeles and an 11.67% in Long Beach in December 2021, compared to the same month the previous year.

The decline from Q3 notwithstanding, overall, however, the ports of Los Angeles and Long Beach recorded an increase of 14.22% and 14.59% respectively in full container imports year-on-year in 2021, according to project44’s data.

The San Pedro Bay ports cater for around 40% of the US import volumes and this decline contrasts with the country’s trade deficit in goods, which hit a record high in 2021 topping US$1 trillion for the first time ever, as a result of economic recovery.

The deficit in goods increased by 3% in December 2021 to US$101 billion from US$98 billion in the prior month, according to an advanced government estimate recording the biggest monthly increase on record.

The drop in import volumes in San Pedro Bay ports is linked to blank sailings and reduced TEU capacity, according to Josh Brazil, vice president of data insights at project44.

“Port congestion at Los Angeles and Long Beach is impacting the rotation of these ships back to Asia to load cargo which has resulted in reduced imports,” explained Brazil.

“While the economic indicators show a strong demand in trade, the drop in port import volumes seen over the last quarter could mean that the future volumes may not be fulfilled as a result of port congestion at US ports,” he added.

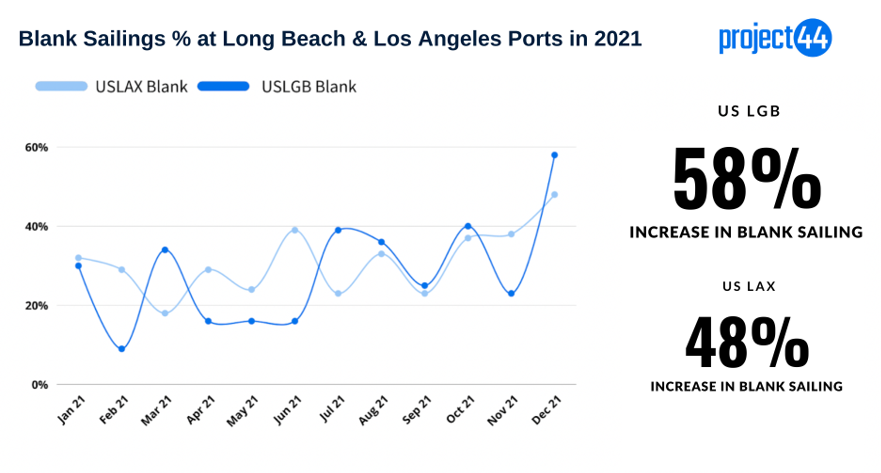

The fact that the demand may not be fulfilled is reflected in the increase in blank sailings at POLA which increased from 23% in September 2021 to 48% in December 2021 and POLB increased from 25% in September to 58% in December.

Blank sailings are a concern for ports particularly as carriers’ schedule reliabilities are already a problem.

Vessel schedule disruptions and blank sailings have led to a noticeable drop in shipping capacity deployed for the US twin ports.

In fact, the TEU capacity deployed for Long Beach dropped by 91% between January and December 2021 and by 45% in Los Angeles. While the decline has been consistent in the latter port across the year, Long Beach saw a steady decline from October 2021.

“Sailing schedules need to be adjusted to the situation at the ports,” emphasised Brazil, who went on to point out that the ports, carriers and shippers all need to be working together in a more coherent way to improve the flow of containers.

“Moving into 2022, if the port congestion at these two ports does not ease up, there is a strong chance of the shipping capacity to remain constrained which will affect the gains in the trade deficit,” he added.

While strong imports helped businesses to replenish their stock levels, the impact of the decline in trade volumes from the last quarter of 2021 will be only visible in the first quarter of 2022, according to project44 estimations.

“The number of ships waiting as far as Mexican waters to enter and unload at both ports is close to hundred and we’ll probably not see any meaningful improvements until summer,” concluded Brazil.