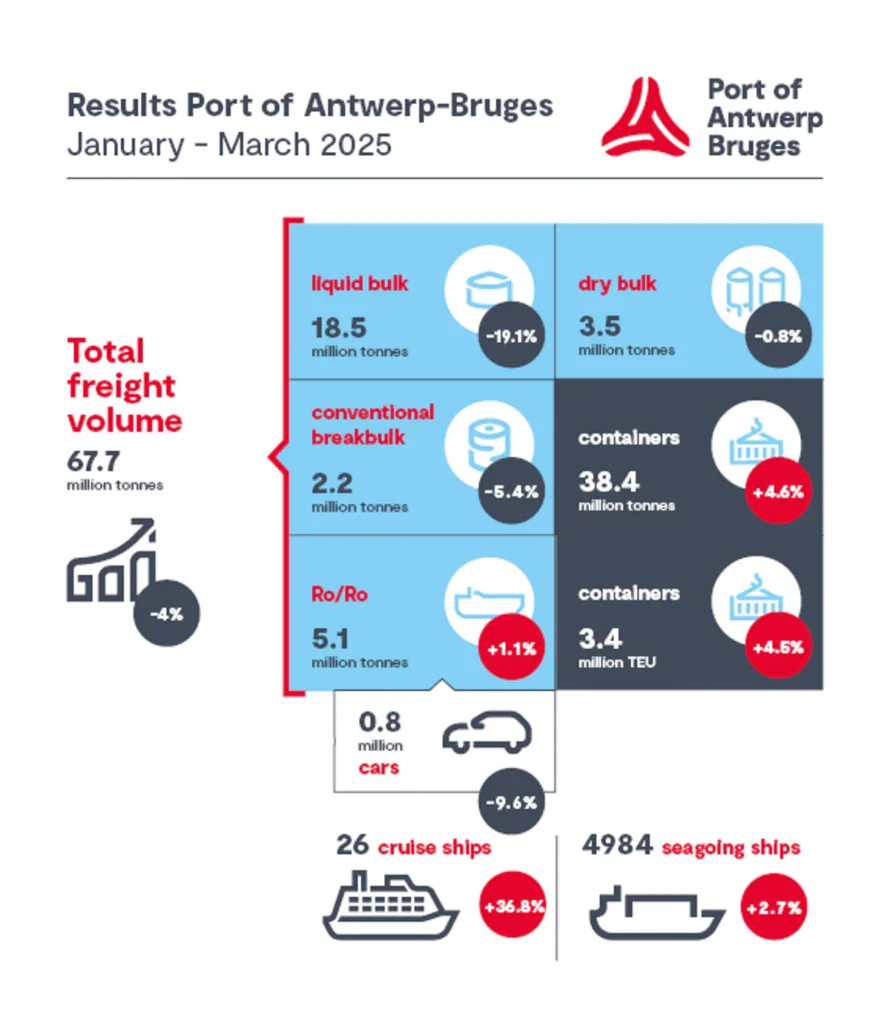

The Port of Antwerp-Bruges reported mixed operational results for the first quarter of 2025. Total freight volume declined by 4% year-on-year, falling to 67.7 million tonnes. Despite the overall drop, key cargo segments—including containers and roll-on/roll-off (Ro/Ro) traffic—registered growth, highlighting underlying resilience in critical areas of the port’s operations.

The Port of Antwerp-Bruges handled 3.4 million TEUs in the first three months of the year, translating to a 4.5% year-on-year increase. In terms of tonnage, container throughput reached 38.4 million tonnes, reflecting a 4.6% year-on-year growth.

According to the port’s statement, the transition to new shipping alliances—combined with strikes and congestion at other ports—led to longer container dwell times, placing additional pressure on terminal capacity.

Port of Antwerp-Bruges’ market share in the Hamburg-Le Havre Range increased to 30.5% in 2024, and on a global level, the port climbed from 15th to 14th place in the ranking of the largest box ports.

At the same time, Ro/Ro traffic at the Belgian hub rose by 1.1%, reaching 5.1 million tonnes. However, the port experienced a notable decline in the car segment, handling 800,000 units in a 9.6% year-on-year decrease.

Furthermore, the Port of Antwerp-Bruges recorded a 19.1% plunge in the liquid bulk sector with 18.5 million tonnes, a 5.4% fall in the conventional breakbulk segment with 2.2 million tonnes, and a 0.8% drop in the dry bulk side with 3.5 million tonnes.

Last but not least, the port reported a 2.7% increase in seagoing vessel traffic, with a total of 4,984 ships calling during the first quarter. Meanwhile, the cruise sector experienced an impressive 36.8% surge, with 26 cruise ships arriving at the port over the same period.

Jacques Vandermeiren, CEO of Port of Antwerp-Bruges, stated: “We are in particularly uncertain times, which makes it difficult to predict what 2025 will bring next. But as in previous crises, our port is showing resilience and operational reliability. That stability is critical, both for our customers and for the broader economy. At the same time, the protectionist measures taken by the United States make it clear that Europe needs to make a stronger commitment to robust economic policies in order to strengthen our industry and anchor its strategic position.”