Sea-Intelligence has analysed the capacity deployed on Transpacific and Asia-Europe in the 12 weeks after the Chinese New Year (CNY) period, since 2017.

“Since CNY falls in different weeks in different years, to make each year comparable, we took capacity figures for the 12 weeks after CNY for each respective year,” explained Alan Murphy, CEO, Sea-Intelligence.

On the Asia-North America West Coast, deployed capacity is scheduled to be higher in nearly all of the post-CNY weeks in 2022, with some weeks reaching an excess of 100,000 TEU over the 2017-2019 average, according to Sea-Intelligence.

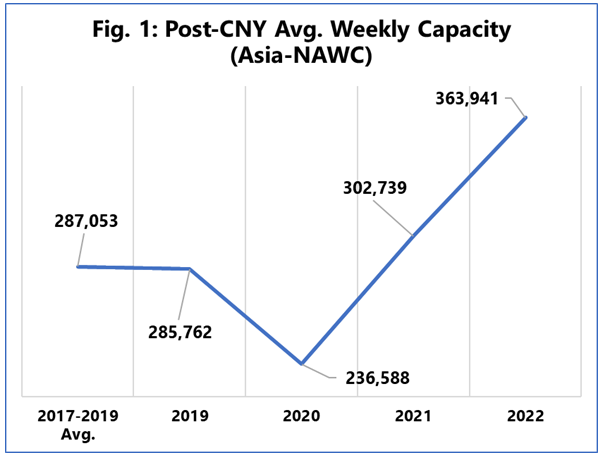

The “biggest issue”, however, is described in the following figure, which shows the average weekly capacity deployed on the trade lane across the 12-week period.

The figure indicates how much capacity has been flowing towards the West Coast ports in both 2021 and 2022 in the 12 weeks after CNY.

The 2017-2019 average weekly capacity for those 12 weeks was 287,000 TEU, whereas in 2021, this figure jumped to 302,700 TEU, according to Sea-Intelligence’s data.

For 2022, the company’s analysts believe that this figure is anticipated to increase by another 60,000 TEU per week, forming a new peak of 363,900 TEU.

“With no slowdown in deployed capacity during CNY in 2022, this high level of average weekly capacity in the 12 weeks that follow, will put even more stress on the West Coast ports,” highlighted Murphy.

There is a similar trend on Asia-North America East Coast, with the figure increasing from 163,000 TEU in 2021 to 228,300 TEU in 2022, and on Asia-North Europe, with the figure increasing from 272,000 TEU to 324,500 TEU, according to Sea Intelligence.

“Asia-Mediterranean was the only trade lane out of the four to stay in line with historical trends,” said the company’s analysts.

“In terms of growth, 2022 will see capacity grow by 20.2% annualised over 2019 in the 12 post-CNY weeks, while Asia-North America East Coast will see a staggering 40.1% increase, rising the likelihood that the East Coast ports will also start to feel the stress of additional cargo,” claimed Murphy.