The supply chain visibility platform Project44 has received an investment of US$420 million from a syndicate led by the private equity companies Thoma Bravo and TPG as well as the investment banking company Goldman Sachs.

The syndicate with participation from Emergence Capital, Insight Partners, Chicago Ventures, Generation Investment Management, Sapphire and Sozo Ventures has acquired equity interests, resulting in a pre-money valuation of US$2.2 billion, and Sixth Street committed to making available additional funding, in support of the company’s strategic acquisition program and product development activities.

When combined with its US$202 million equity raise in May of 2021, Project44 has set a funding record for Logistics Tech enterprise Software as a service (SaaS) companies.

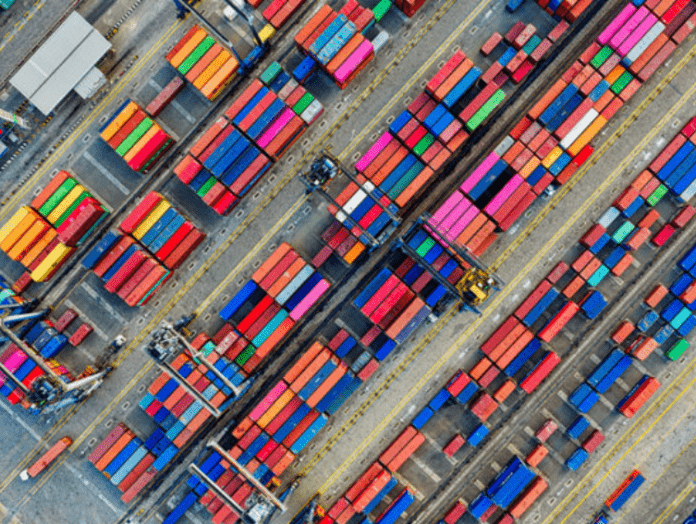

These investments position the visibility start-up to accelerate its mission to help leading brands optimise the movement of products across supply chains, delivering better resiliency, sustainability and value for their customers.

Jett McCandless, founder & CEO of project44 stated, ”With ongoing support from our investors, we can offer even more value to our customers and solidify our position as the global network that powers the future of the supply chain.”

Additionally, Robert (Tre) Sayle, Partner at Thoma Bravo, said that “supply chain visibility has become increasingly important as shortages, delays and bottlenecks ramp up,” and he went on to add that Project44’s potential to solve even the most complex of these issues is unparalleled.

“By continuously evolving to meet customer needs, Project44 has developed a revolutionary platform that adds significant value to the entire global supply chain,” noted Sayle.

Throughout 2021, Project44 cemented its position as the leading company in supply chain visibility with global “port-to-door coverage” across all modes of transportation. It now generates more than US$100 million in annual recurring revenue (ARR), according to a statement.