The visibility platform company for the global supply chain, Project44 has conducted an investigation, indicating that dwell times for most ports have changed a little month-on-month, and that port congestion declined in December after some ports implemented related measures.

The end of the year is typically a slower period for the global ocean freight market. Retailers usually spend the summer months building up inventories for the holiday season at the end of the year, while manufacturers replenish raw materials to manufacture the goods for retailers and wholesalers to purchase and to begin the cycle, once more, of inventory building to satisfy customers’ requests.

However, keeping up with customer requests in the midst of a global health crisis is a major task, said Project44, which recently announced it has received an investment of US$420 million from a group of companies, including Thoma Bravo, Texas Pacific Group and Goldman Sachs.

The US start-up firm added that “lately, inventories struggle to keep up with demand and variants of Covid-19 spread through supply chains.”

The Covid-19 pandemic has undermined supply chains, changed purchasing habits, and has extended the average peak season of just a few months to one that is stretching for two years. There is no longer a typical pattern for the movement of inventory and other goods.

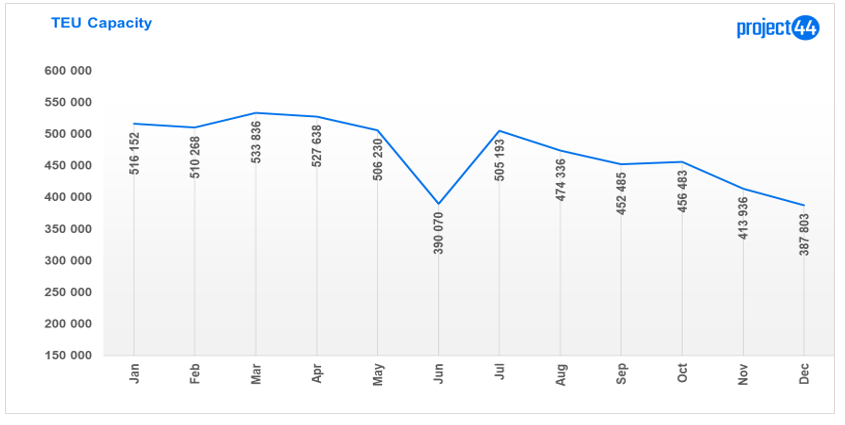

Despite a steady decline in TEU capacity that occurred during the second half of 2021, port conditions deteriorated and US retailers, in particular, began to warn that inventories may not be available in time for the end of the year holiday season, according to Project44.

Indeed, Mark Tritton, CEO of retailer Bed, Bath & Beyond told analysts on 6 January, “The customer experience was compromised as strong demand wasn’t met with strong product availability, which resulted in approximately US$100 million in lost sales versus the demand, or a mid-single-digit impact of the quarter and an even higher impact on December.”

But, during December, there were green shoots of optimism that supply chains were beginning to return to some sort of “normalcy”.

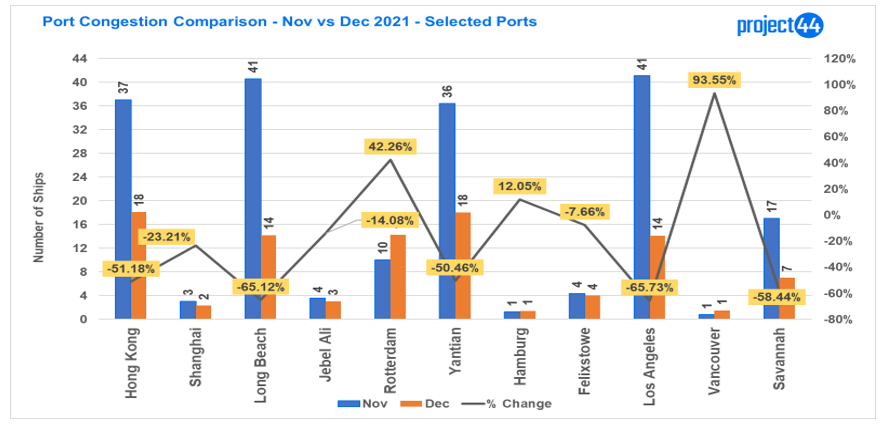

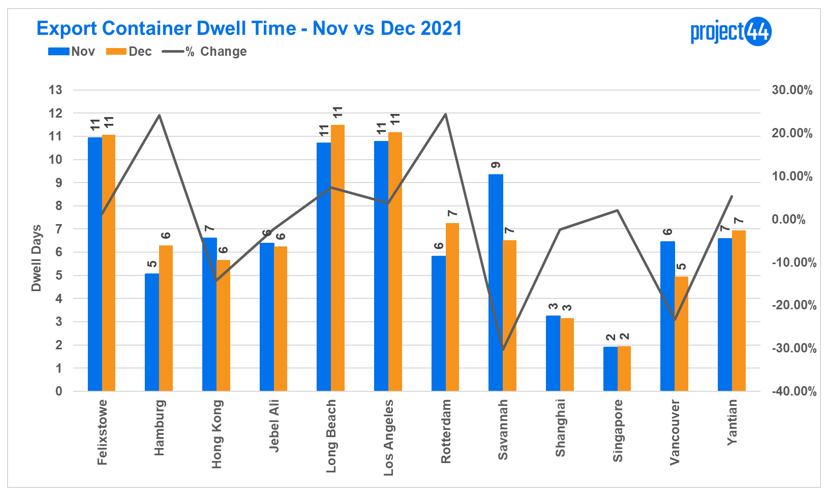

Port congestion at various ports such as Hong Kong, Los Angeles, Long Beach and Yantian declined noticeably during December compared to November, according to Project44 data.

However, congestion at Rotterdam actually increased in the last month of the year, as it continued to grapple with full storage capacities and connection delays with the European inland.

“We don’t see any major changes in the current situation until at least the end of 2022,” said the port’s commercial vice president, Emile Hoogsteden in a statement.

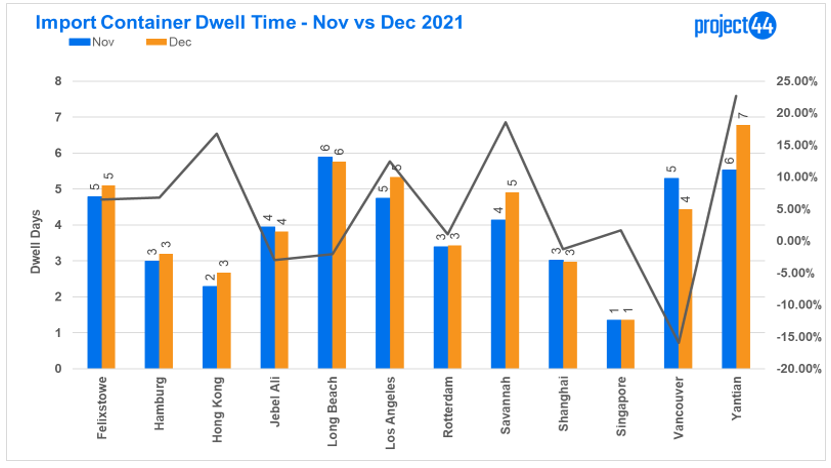

Late in October, the ports of Los Angeles and Long Beach announced a Container Dwell Fee. Although this charge has not yet been implemented and has been postponed until 29 April. The “threat” of such a fee is credited with freeing up space for inbound containers but did little to reduce import dwell times.

“In fact, other ports in Europe and Asia saw little to no change in import container dwell time from November to December,” pointed out Project44 analysts.

Little changes in export container dwell times from November to December were also noted. Among the exceptions was Savannah which reported a two-day decline.

The Georgia Port Authority opened pop-up storage lots across the state and extended container pick-up times to later in the evenings, helping free up container space for exports.

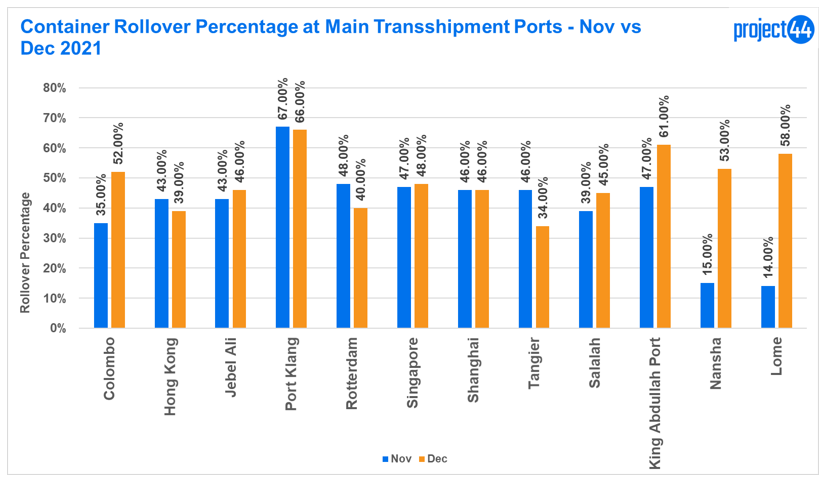

Month-to-month, the Middle East and African ports, Salalah, King Abdullah, Nansha and Lome recorded percentage increases in container rollovers in December, while Tangier recorded a decline.

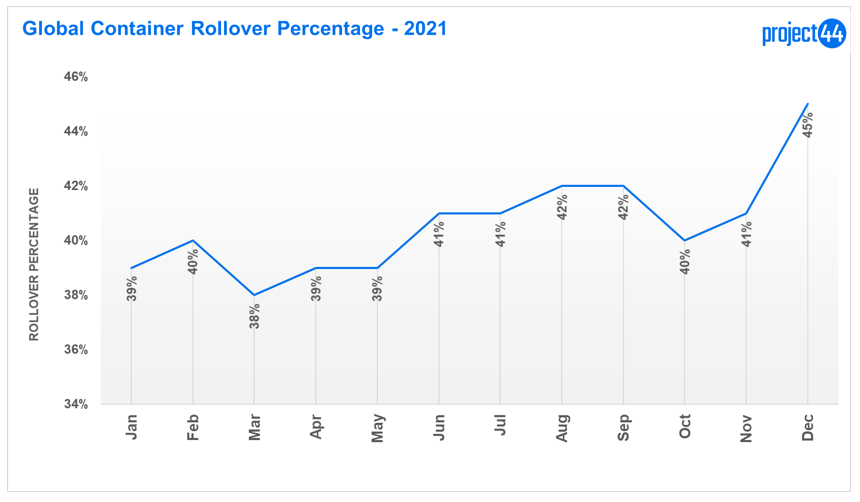

Global container roll-overs increased sharply from November to December, reaching 45% for December, due to port congestion and Asian manufacturers’ need for empty containers to fill and export in January and post-Lunar Chinese New Year.

After a “topsy-turvy” 2021 with numerous ships lined up at sea to enter ports, ocean freight spot rates reaching record highs and some shippers either shifting ocean freight to air freight or opting to charter vessels to ensure timely deliveries, there were some improving signs for the ocean freight market in the back-half of the year.

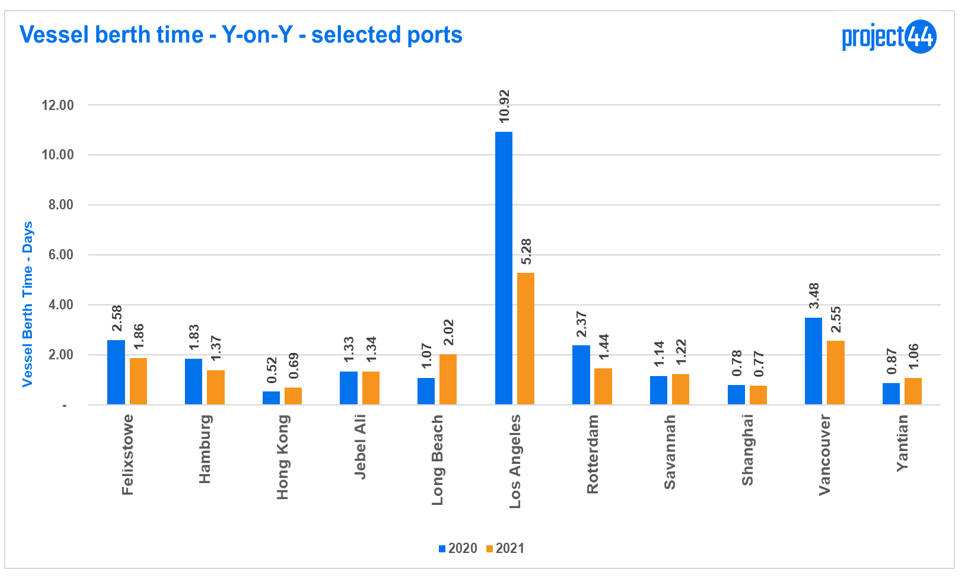

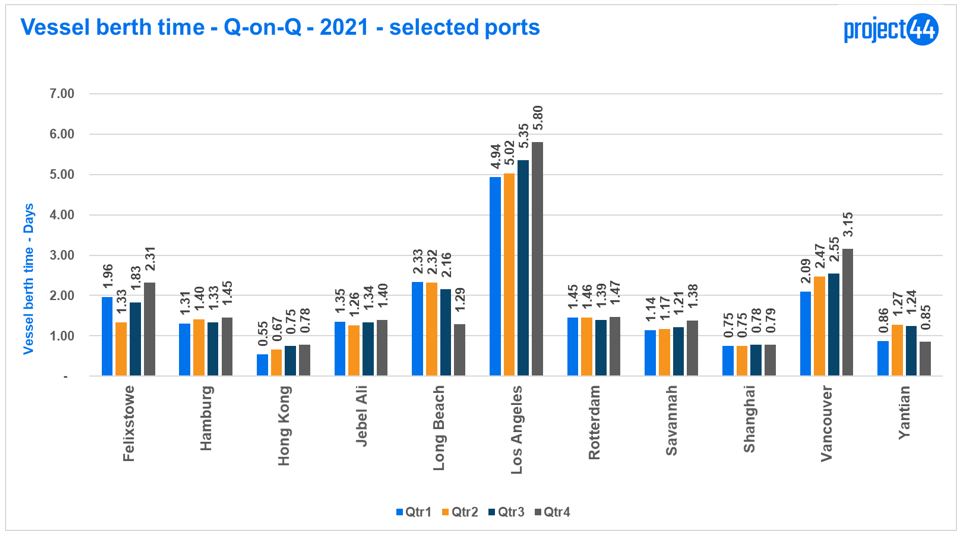

For example, vessel berth time declined in December, year-over-year for most ports, except for Long Beach. This trend could potentially continue into 2022, allowing for containers to be cleared from port yards, according to Project44 estimations.

While December’s year-over-year berth times are lower for most ports, berth times still remain high, most notably Los Angeles at 5.8 days during the fourth quarter compared to 4.94 days in the first quarter.

“Reducing berth times will depend on a number of factors including potential impacts of the Omicron variant of Covid-19 and the availability of supply chain partners, such as truck drivers, rail operators and warehousing space,” explained the software company.

The short-term outlook for the ocean freight market is one of stabilisation. Project44 intelligence estimates that supply chain extremes have levelled off and the market will return to a more normalised demand.

However, the company sees that volumes will remain high “to satisfy customers’ continued willingness to purchase goods, big and small.”

For the month of January, the Port of Los Angeles expects year-over-year TEU volume increases through mid-month, before declining an estimated 48% through the third week of January.

This trend will likely be seen at other ports around the world as we approach the Chinese Lunar New Year, which is on 1 February and a period in which many Asian manufacturers shut down for a couple of weeks.

“The wild card, of course, is Covid-19 variants,” highlighted the Chicago-based company. Omicron, for example, is a fast-moving variant and is negatively impacting supply chains from Asian manufacturers to the final mile.

How long Covid-19 impacts on supply chains will last remains to be seen but it has resulted in many shippers developing risk management solutions, such as diversifying ports, as well as for some larger retailers, including Home Depot and IKEA, chartering ships.