Box lines are tradionally using blank sailings to manage supply in relation to demand, but during the pandemic, shipping lines were forced to blank sailings despite high demand and high freight rates, as endemic port congestion created a shortage of available vessel capacity.

The current round of blank sailings is also driven by a shortage of vessel capacity, as the idle container vessel fleet was at a very low 0.9% in April, according to Sea-Intelligence report.

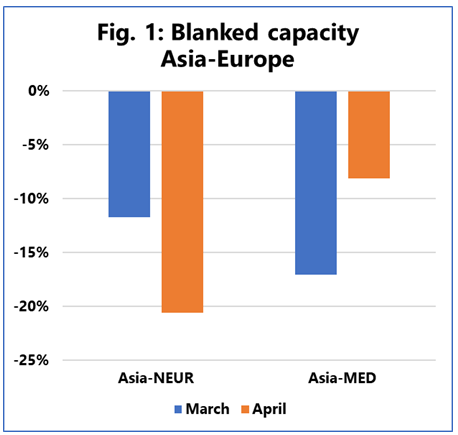

The Danish analysts said, “We analysed the actual capacity deployment of March and April 2024, and compared it to what the shipping lines had scheduled in mid-February 2024, for the Asia-Europe and Transpacific trades.”

As shown in the figure, on Asia-North Europe, the ratio of blanked capacity essentially doubled from March to April, from a -12% blank share to -21%. For Asia-Mediterranean we see the opposite, as the share of blank capacity goes from -17% in March to -8% in April.

On Transpacific, we see a much more stable development, with a capacity reduction of around -14% to the West Coast, and -11% to the East Coast, for both March and April 2024.

“This indicates a much more unstable operating environment in Asia-Europe than on Transpacific,” pointed out Alan Murphy, CEO of Sea-Intelligence.

He went on to add, “With virtually no idle vessels, and with spot rates increasing sharply in recent weeks, this increase in blank sailings is driven by the Red Sea crisis. Port congestion is worsening in key hubs in both Asia and Europe. And as was clearly seen during the pandemic, port congestion soaks up supply and leads to potential capacity shortages.”

Murphy concluded, “As we have said since the start of the Red Sea Crisis: There is sufficient capacity to divert vessels around Africa, but not enough additional slack to deal with other major disruptions. Port congestion therefore needs to be brought under control, or spot rates could escalate even further, and quite quickly.”