The Shanghai Containerized Freight Index (SCFI) took a 2% tumble to settle at US$1,031.42, its lowest-ever quote since July 2020, settling just a tad higher than the three-year historical low of US$1,022 recorded in January 2020.

While there is a talk of normalisation on the cards, with rates nearing the pre-pandemic levels, the advent of the Chinese New Year will most likely see the index hitting the pre-pandemic mark as the demand scenario is negative with inbound volume into the US recording negative growth.

Technically though, the SCFI had seen better quotes way back in 2012, an event that coincided with the high crude prices which trickled towards higher shipping costs.

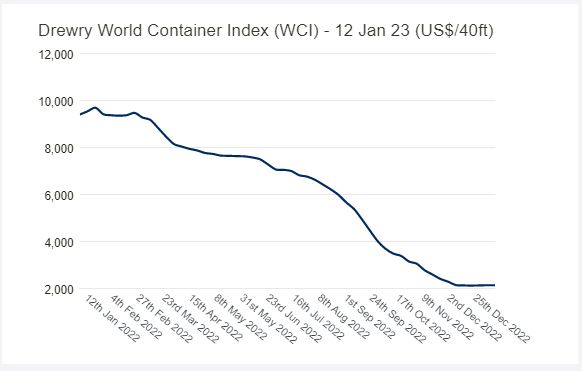

The Drewry’s saw some stabilising yet again after the 43-week falling streak for the index snapped during the first week of January 2023.

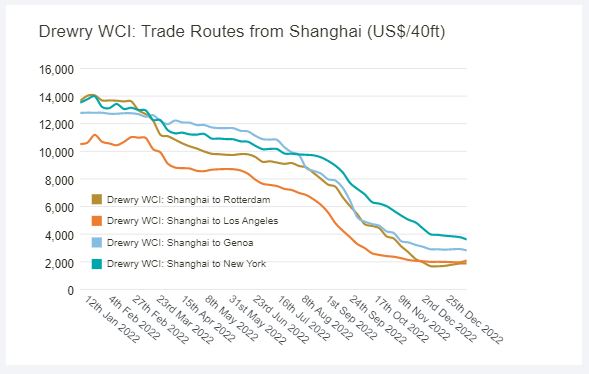

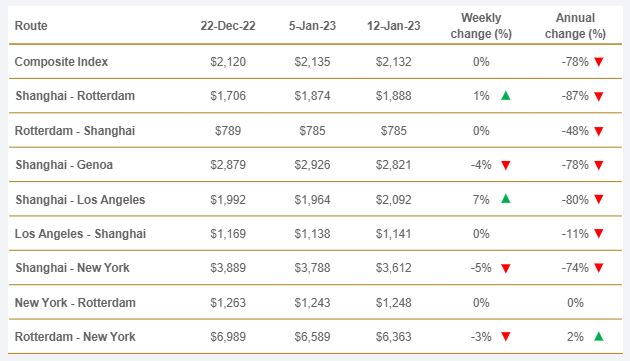

The key transpacific routes in China-Europe and China-US East Coast saw green ticks with the trade routes witnessing weekly price rises of 1% and 5% respectively. The China-US West Coast which had witnessed a relatively lesser correction extended its losses, as rates slackened another 5% for the trade lane.

However, the transatlantic route, which saw prices appreciate and remain at a high despite the spot rate falls, saw prices on the Rotterdam-New York trade lane edge to their lowest since February 2022. The rates for China- South America (East Coast) have also shed 90% from their highs, according to the courtesy of the Xeneta Shipping Index (XSI-C). Ocean trade experts and analysts have already pitched for an exciting 2023, on the cards.

Spot freight rates by major route – Drewry’s assessment across eight major East-West trades:

Author of the article: Gautham Krishnan

Gautham Krishnan is a logistics professional with Fluor Corporation, in the area of project logistics and analytics, and has worked in the areas of Project Management, Business Development and Government Consulting.