The current structure of the container shipping alliances [2M, THE and Ocean alliances] has been present since April 2017 and will last a few more weeks before new groupings are formed in February 2025.

Danish maritime data analysis firm Sea-Intelligence has used ‘offered port-pairs,’ an important metric, to analyze market trends over the past eight years.

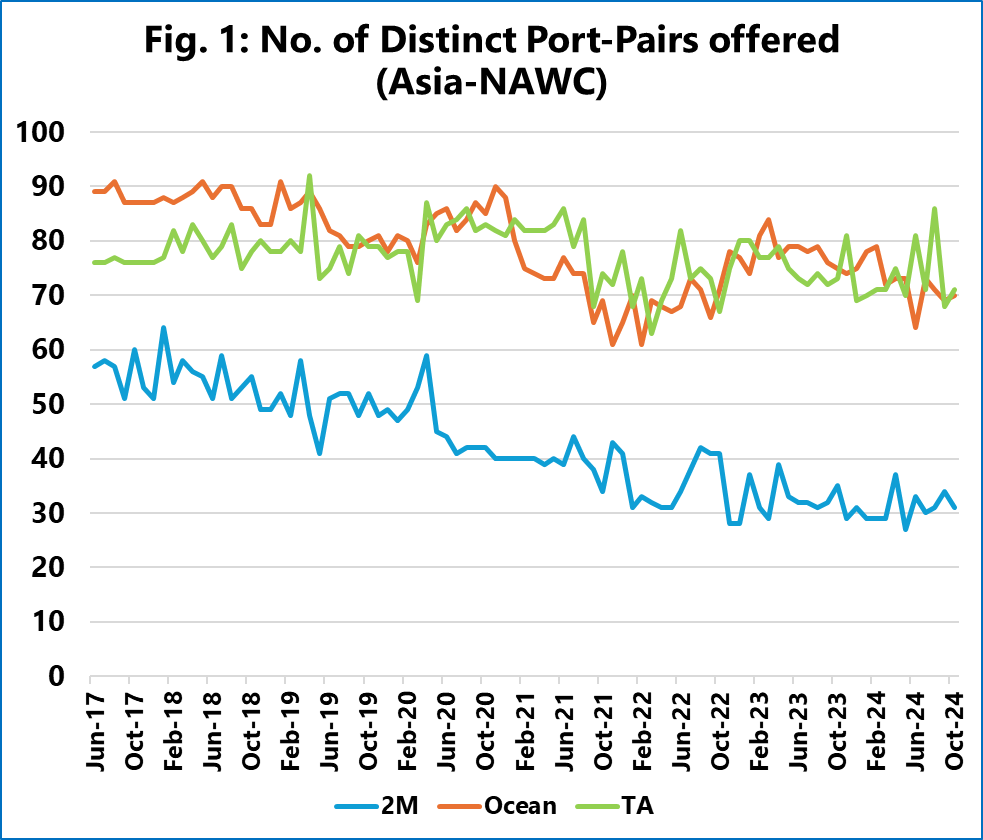

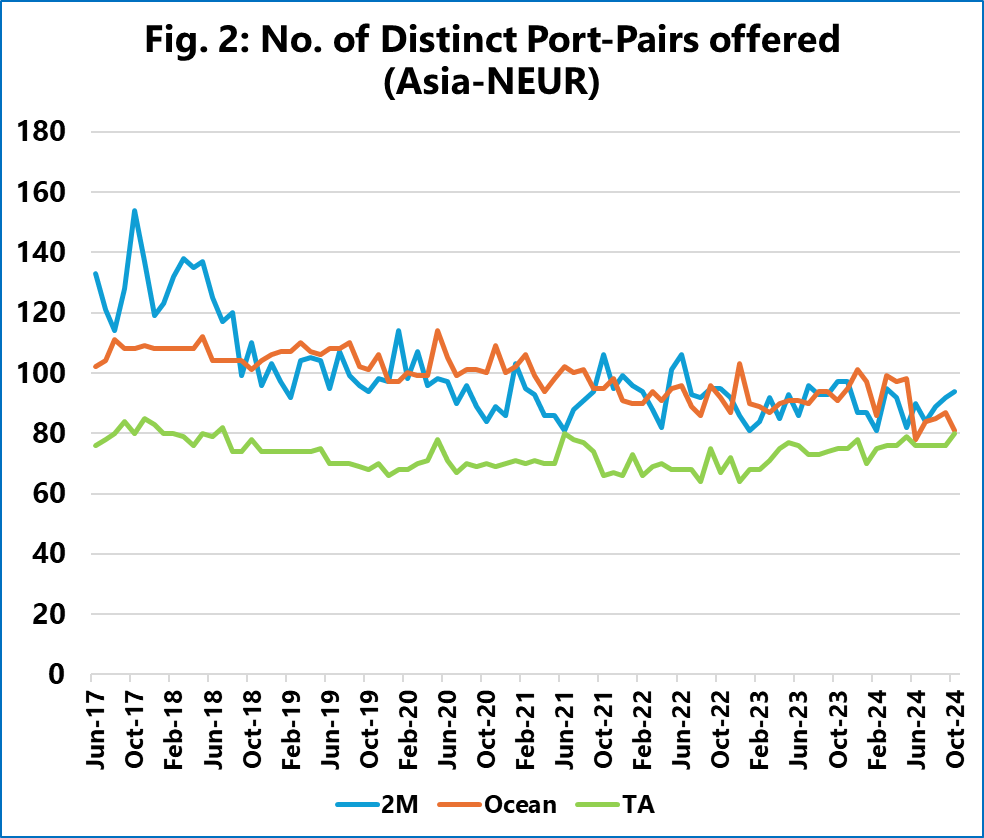

The following figures show the distinct port-pairs offered by each alliance on both Asia-North America West Coast (NAWC) and Asia-North Europe (NEUR) routes. These are all direct port-pair connections and do not include any transhipments.

“By distinct, we are counting each port-pair only once per month, irrespective of how many times that connection was made,” noted Sea-Intelligence.

For Asia-NAWC, the market positioning is quite different for 2M, according to the Danish analysts, as Maersk and MSC offer the fewest direct distinct port-pairs, while Ocean Alliance and THE Alliance have largely been in line with each other.

“This points to very different network design strategies,” pointed out Alan Murphy, CEO of Sea-Intelligence. “Given the relative size of 2M, it seems improbable that they offer a more limited product in comparison, and points towards the broader usage of a hub-and-spoke model i.e., fewer mainliner connections and a greater focus on transshipment.”

For Asia-NEUR, at the start of the analysed period, there was a clear difference in strategies, according to the report, while in recent months, that difference has more or less eroded, with all three carrier alliances offering port-pairs within a much narrower range.

According to Murphy, two key observations stand out over the eight-year period: first, there has been no change in market dynamics between alliances regarding this metric throughout their current life cycle; and second, the Red Sea crisis did not significantly affect the carriers’ networks in terms of distinct port-pair connections.