Gemini Cooperation, Premier Alliance and MSC have all unveiled their 2025 service networks. Ocean Alliance has yet to announce its network, but given the stability in its alliance structure, only minor changes are expected.

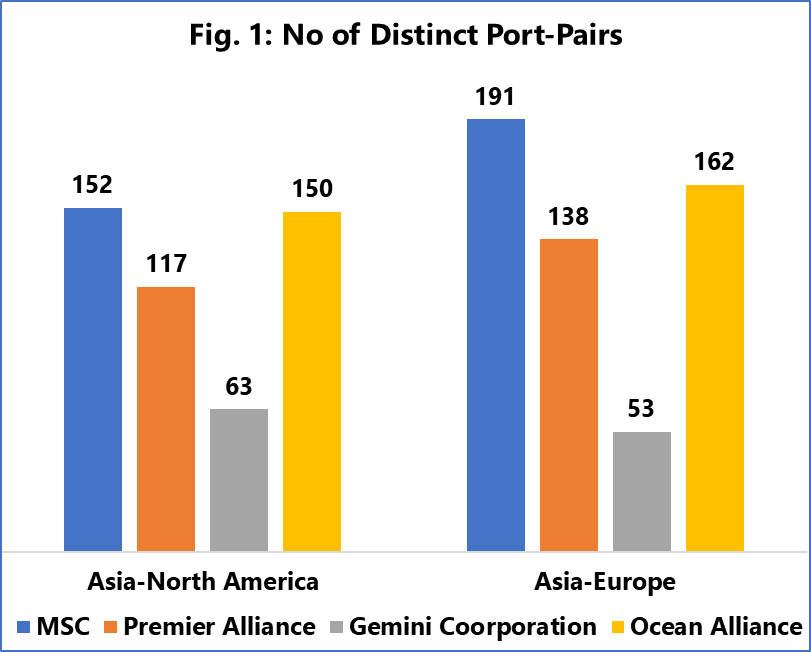

The following figure illustrates the number of distinct port-pairs offered by each alliance (with MSC also grouped as an ‘alliance’ for practical reasons) on both the Asia-North America and Asia-Europe routes.

“It is not surprising to see Gemini offer far fewer direct port-port pairs, as this is a direct result of a deliberate network design strategy by the alliance, with their greater focus on shuttles. On Asia-Europe, MSC clearly will be offering the most direct port-port combinations, followed by Ocean Alliance, and Premier Alliance. On Asia-North America, MSC and Ocean Alliance both offer the same level of direct connectivity, however, Ocean Alliance has a higher call frequency on the port pairs they offer,” stated Alan Murphy, CEO of Sea-Intelligence.

According to the Danish shipping data analysis firm, “distinct” refers to each unique port pair being counted only once, even if multiple services offer the same pair. For shippers, Asia-Europe offers a range of service options, with MSC providing 3.5 times more direct connections than Gemini.

On the Asia-North America route, MSC and Ocean Alliance offer significant competitive pressure with their direct connections, while Gemini appears to be adopting a completely different approach.

“We also calculated the level of competitiveness across the ports being serviced directly. On both trades, half of the direct port-pairs are offered by a single alliance which gives that alliance a unique product. Conversely, 5%-14% of the direct port-pairs are offered by all four alliances, which will result in strong competitive pressure on those port pairs,” added Alan Murphy.