“With the USEC port strike now over, Sea-Intelligence observes that the impact is much less severe than initially feared. However, the three-day closure did lead to vessel queues, which is expected to negatively affect capacity availability in the origin regions.”

In the most optimistic view, according to the Danish analysts, the impact is limited to the three days of striking, but realistically, as it will take some time to clear the backlog of vessels and containers, Sea-Intelligence believes the impact is likely to be closer to a week of capacity loss.

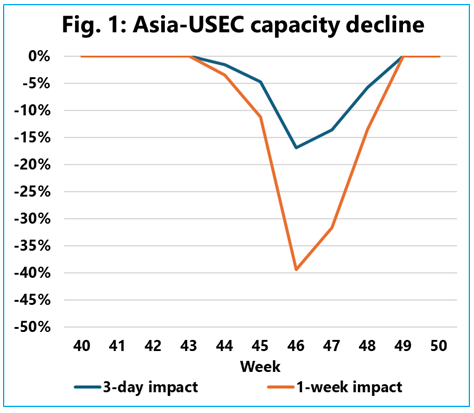

The figure shows the relative capacity loss for Asian exporters, where a three-day and an one-week impact, are compared against a baseline scenario where there is no strike.

“Here we see a 17% drop in capacity offered from Asia to US East Coast in the 46th week, if the impact is limited to the minimum of vessels being stuck in the US East Coast for just three days, while if it takes a full week to get the vessel backlog cleared, then we approach a 40% capacity loss for a short period,” explains Alan Murphy, CEO of Sea-Intelligence.

Similarly, for North Europe to the US East Coast, exporters should prepare for a capacity reduction of 14% in week 44, rising to 30% if clearing the congestion takes a full week. On Mediterranean to US East Coast, a three-day impact leads to a 10% capacity loss in week 43, increasing to 25% for a week-long impact.

Murphy wonders, “Will the shipping lines take action to mitigate this capacity shortfall?” only to conclude, “We find this to be quite unlikely.”

Murphy said, “To do so, would require speeding up the vessels quite substantially – especially on the shorter Transatlantic trades – and this would be in a market environment, where the ending of the strike, would likely mean a continuation of the rate declines we have seen recently. Exporters, especially in Asia, North Europe, and the Mediterranean, should therefore prepare for a temporary, short-term crunch in capacity.”