The vessel queue outside of ports of Los Angeles and Long Beach (LA/LB) has presently dropped to 66 vessels from 100-105 vessels in the fourth quarter of 2021, according to Sea-Intelligence.

However, while this seems optimistic, the data from Sea-Intelligence’s Trade Capacity Outlook (TCO) database shows otherwise.

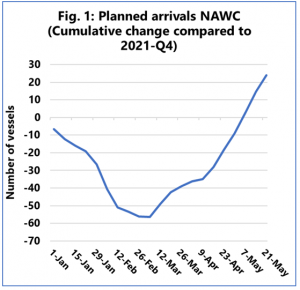

The company modelled an average transit time of 2½ weeks from Asia, to get the expected number of vessel arrivals on the US West Coast each week. Taking the fourth quarter of 2021 as a baseline, Sea-Intelligence calculated the relative cumulative change in the number of vessel arrivals.

As the TCO database is forward-looking, Sea-Intelligence has calculated data until 9 May 2022.

The maximum reduction was reached in the first week of March, with 60 fewer vessel arrivals compared to a situation where the 2021-Q4 flow had continued uninterrupted.

By the end of 2021, the queue outside LA/LB grew from approximately 80 vessels in October to 105, according to the research company’s data.

“Because of the decline in Asian departures, we should expect 60 fewer vessel arrivals by the first week of March,” explained Alan Murphy, CEO, Sea-Intelligence, who went on to add, “If we assume this mainly impacts the LA/LB area, that would lead to a situation where the queue instead of growing to 120 vessels, based on the Q4 steady flow, would decline to 60 vessels, and we are presently seeing a queue of 66 vessels.”

What is more worrying, according to Sea-Intelligence, is that the data would therefore also imply that if there are no other changes, then the queue will be 25 vessels larger than the baseline by the end of May 2022.

The baseline, in keeping with the queue growth in 2021-Q4, would imply a queue of 145 vessels. Adding the additional 25 would bring the queue to 170 vessels.

“This is extremely unlikely to happen, while there are not that many vessels to be had. What will happen instead, is that the sheer shortage of vessels will lead to many more blank sailings,” claimed Murphy.

In January there was a kind of steady balance, between the desire to operate the required vessels and the need to blank sailings, due to the fact that vessels were unavailable.

Hence, Murphy believes that “we might simply be back to the 100-105 vessels in the queue, by the time we get to April.”