Container freight rates have a strong seasonal tendency to weaken in the period following the Chinese New Year (CNY), according to Sea-Intelligence’s analysis.

In 2025, however, the decline in spot rates is significantly more negative, than what can be explained by just seasonality.

“This could be the result of an aggressive commercial price war between shipping lines, potentially due to the switch-over to the new alliances, a weakening of the supply/demand balance, or a combination of both,” explains Alan Murphy, CEO of Sea-Intelligence.

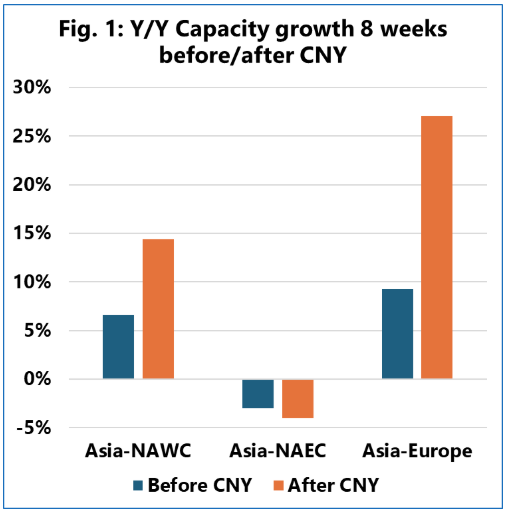

“While container demand data for February is not yet available, we do have supply-side data from our Trade Capacity Outlook database. We looked at the Y/Y capacity growth for the eight weeks on either side of ‘Week 0’, which we have defined as the week during the CNY period, in which the lowest total nominal capacity departed Asia,” said Murphy.

Looking at the eight weeks prior to week 0, Asia to North America West Coast (NAWC) capacity increased 7% Y/Y, while it increased 14% Y/Y in the eight weeks after CNY. On Asia to North America East Coast (NAEC), there is a smaller supply contraction of 3% Y/Y before CNY and 4% Y/Y after CNY. On Asia-Europe, the Y/Y capacity growth in the eight weeks prior to CNY was 9%, while in the eight weeks following CNY, Y/Y capacity growth is a substantial 27%.

“Especially for Asia-Europe, it is clear that a highly significant capacity growth is a key parameter in explaining the current spot rate weakness,” noted Murphy. “Spot rates to NAWC, however, started to drop later than to Europe, which makes sense, given that the high level of capacity injection also started later into NAWC than it did into Europe.”

If the shipping lines are to be successful with the General Rate Increases (GRIs) they have already announced for April, they will have to blank more scheduled sailings, according to Sea-Intelligence’s boss. “MSC has now announced blank sailings on some services on the Transpacific, but this is not (yet) being done by the other shipping lines,” added Murphy.