The Danish research and analysis company Sea-Intelligence has conducted a survey about the fuel prices, which have been under constant upwards pressure in recent months.

Looking at the IFO380 fuel prices, the current bunker fuel price environment has basically reverted back to the same level as the highpoint of late 2018, but still much lower than the higher plateau seen in 2011-2014, according to the company’s report.

However, the International Maritime Organization’s (IMO) 2020 rules changed to Very Low Sulphur Fuel Oil (VLSFO) from January 2020, and a price index for VLSFO had to be created.

At the start, the VLSFO price spiked due to early distribution and availability issues of VLSFO, reaching a height of US$686.50 per ton. The recent increases have, however, led to a new record level of US$694 per ton, on 14 January.

“This means that not only are VLSFO prices now in record territory, but it also means that for the 70.5% of vessel capacity, which is not equipped with scrubbers, we are now in a situation equal to the high oil-price environment of 2011-2014,” explained the Danish analysts.

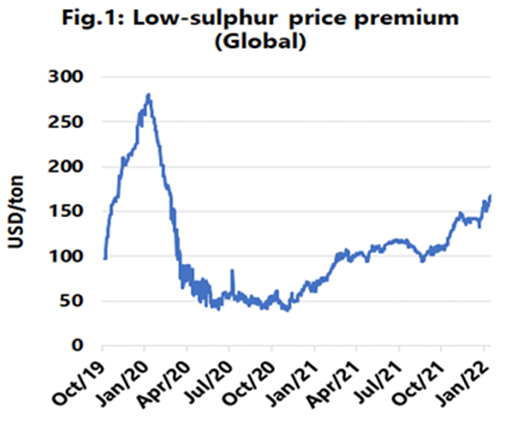

“Given the split in the fleet, where 29.5% of the capacity does indeed have scrubbers and hence can use IFO380, the spread in pricing between the two fuel types is also important,” commented Alan Murphy, CEO of Sea-Intelligence.

Concerning the development in this spread between IFO380 and VLSFO as seen below, it is registered that even though VLSFO prices are at a new record, the spread in pricing is not at such a record.

This means that the previous pricing spike was clearly driven by specific supply issues in the bunkering locations, whereas the price spike now is underpinned by a stronger oil price in itself.

It also indicates that the rapid decline in VLSFO pricing in February 2020 was due to alleviation of such physical supply issues, which in turn means that a similarly rapid decline should not be expected this time, as any potential decline would have to come from global oil prices, according to the analysis.

In the near term, more increases are anticipated in bunker surcharges, due to the fact that such Bunker Adjustment Factor (BAF) formulas are linked to VLSFO prices and that these are now at record levels, according to Sea-Intelligence estimations.