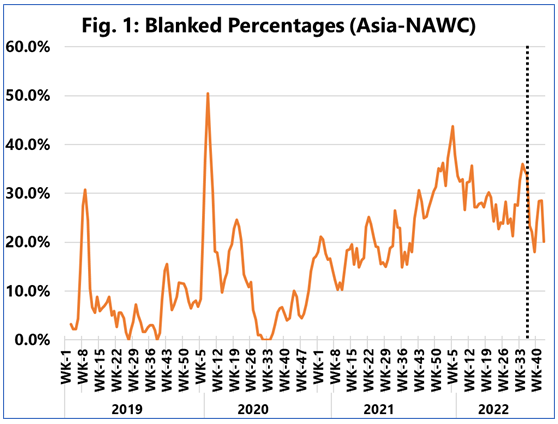

Danish maritime data company Sea-Intelligence analysed blank sailings data from the leading container lines. The analysts said that blank sailings have for long been the carriers’ preferred way of matching supply with demand. “This is what we would call tactical blank sailings,” pointed out Sea-Intelligence.

However, for much of 2020 and 2021, ocean carriers have struggled to maintain capacity in line with the stresses of demand, which meant that vessels were chock full, leading to terminals and ports starting to fill up (as containers could not be moved fast enough), and vessels started to get stuck outside of port, according to Sea-Intelligence’s analysis.

“This level of port congestion meant that carriers could not fulfill their weekly departure obligations, resulting in forced or operational blank sailings,” noted Alan Murphy, CEO f Sea-Intelligence

In the past few months, however, the Danish analysts noticed that demand growth has stalled, vessels are not fully utilised, and freight rates have been dropping consistently and considerably.

“This is where the carriers would naturally resort to tactical blank sailings, to the stem the bleeding in freight rates,” said Murphy, who went on to explain, “With Golden Week coming up (starting on 1 October), it presents carriers with the golden opportunity to blank more sailings than they historically would, and likely come under less pressure from cargo owners, for artificially managing freight rates by cutting capacity short.”

On the Transpacific, capacity reductions are slated to be 22%-28% of deployed weekly capacity in the weeks following Golden Week, whereas the peak reduction in those weeks was 15%-17% in 2019, and an average of 9%-11% in 2014-2018, according to the report.

“We see higher numbers on Asia-North Europe as well, with the peak capacity reduction following Golden Week at a little under 20%, which, while in line with 2019, is higher than the 2014-2018 average. Asia-Mediterranean on the other hand, is the only trade lane of the four to see capacity reduction during Golden Week 2022, in line with 2014-2019,” noted the analysts.