Spot rates have experienced a continuous decline over the past several months. In response, shipping lines face two possible strategies.

One option is to increase blank sailings, reducing supply and halting the decline in spot rates. The other would be that despite the decline, spot rates are still much higher than before the Red Sea crisis and the pre-pandemic levels, which would potentially incentivise shipping lines to book as much cargo as possible at current rates, to capitalise on this.

“The latter would dissuade the blanking of sailings but will lead to more rate erosion in the longer term,” said Sea-Intelligence in a report.

In recent weeks, there has been a notable decrease in blanked capacity on the Asia-North Europe, Asia-North America East Coast, and Asia-Mediterranean trade routes. However, the significant volatility in these trade lanes makes it challenging to determine whether this decline represents a new trend or is simply part of the usual fluctuations.

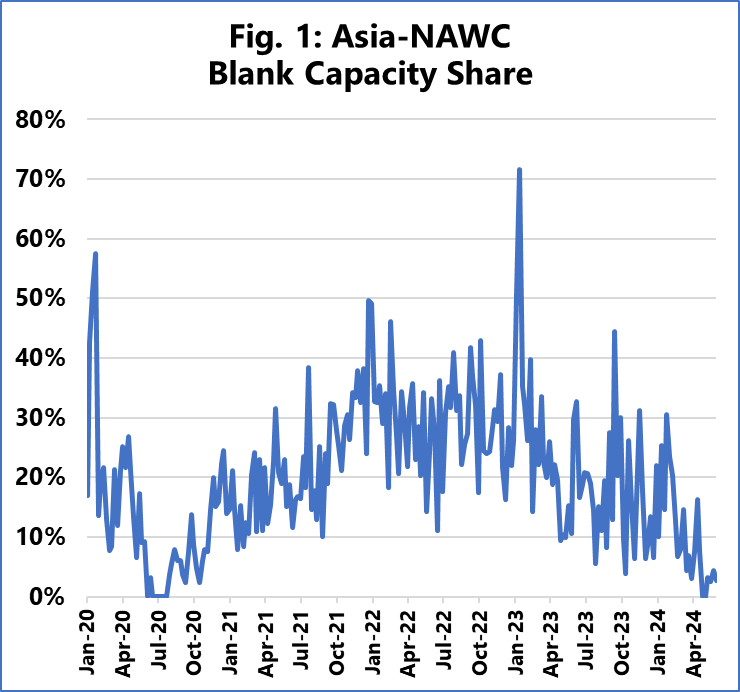

Conversely, on the Asia-North America West Coast route (as depicted in Figure 1), a consistent pattern has emerged since 2022, showing a gradual reduction in blank sailings. This trend has persisted into 2024, with blank sailings now approaching almost zero. Even when applying a 4-week running average to mitigate volatility across all four trades, the underlying trend remains consistent: a sharp decrease in blank sailings in recent weeks.

“This suggests that the spot rate decline in itself is not the focal point, as present spot rates are significantly higher than pre-Red Sea crisis, as well as pre-pandemic. Keeping this in mind, and by looking at the blank sailings data, it seems that in the present market environment, shipping lines are attempting to capitalise as much as possible from the relatively higher rates, by not curbing capacity. The likely result, however, will be a continued downward pressure on spot rates,” stated Alan Murphy, CEO of Sea-Intelligence.