The Danish provider of research & analysis within the global supply chain industry, Sea-Intelligence has conducted a survey showing that due to the demand boom in North America and the resulting port congestion, carriers are struggling to meet their weekly vessel departure obligations, resulting in vessel delays, rolled schedules and blank sailings.

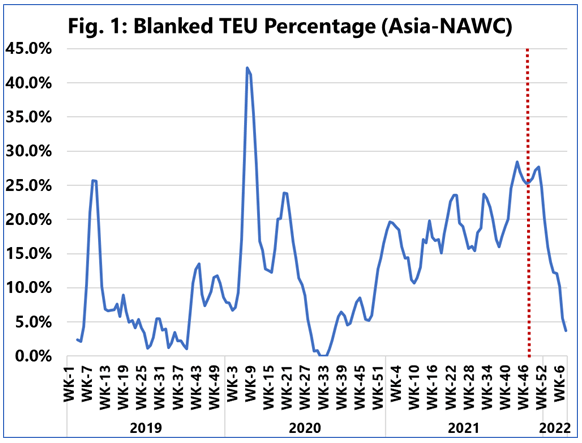

Sea-Intelligence has also analysed the impact of these blank sailings on deployed capacity on major East/West trades, with the research indicating that the largest impact currently is on the Asia-North America West Coast (NAWC) trade lane, as shown below.

The red dotted line indicates where the future outlook starts, based on the carriers’ current deployment schedules for the next 12 weeks.

“The initial impact of the pandemic can be seen with the extraordinarily high peak in early 2020, as we basically saw an extension and doubling of Chinese New Year,” commented Alan Murphy, Sea-Intelligence’s CEO.

Since then, blank sailings dropped considerably, as demand picked up and capacity was ramped up. What then followed is what the Danish analysts call the “congestion-induced blank sailings.”

With a blow-up in demand levels since the second half of 2020, carriers struggled to deploy enough capacity. That happened due to the overwhelmed powers and the subsequent congestion, which made carriers struggle to maintain weekly sailing schedules, and as a result, they were forced to blank sailings.

“This trend has been increasing in recent weeks, with 28.4% of the total Asia-North America West Coast capacity blanked in week 44. This cannot be attributed to Golden Week either, as it fell in week 39/40,” noted Murphy.

For the upcoming 12 weeks, the percentage of capacity blanked is scheduled to decline sharply. This is normally expected for the Danish analysts because these blank sailings are not due to capacity management, but rather due to the carriers being forced to blank sailings, as a result of port congestion.

“This means that sailings will mostly not be blanked in advance, but will rather be the operational result of vessel congestion and delays, which cannot be known that well in advance, especially on a trade with a relatively short roundtrip time,” pointed out Murphy.