In its latest report, the maritime data analysis company Sea-Intelligence said that not every service received the same treatment when it came to blank sailings on Asia-North Europe.

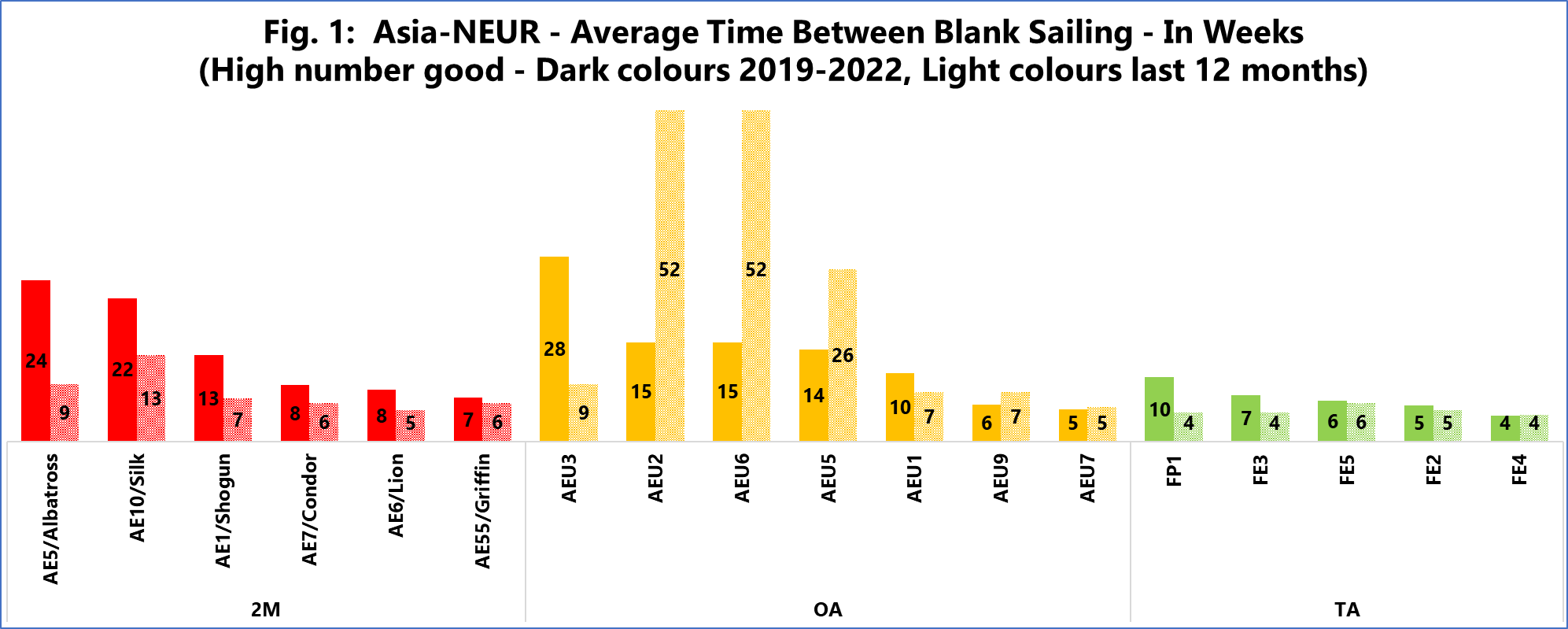

To see how susceptible a service is to blank sailings, the Danish analysts introduced a measure called ATBBS (average time between blank sailings). This is basically the average number of weeks between a blank sailing on each respective service.

Looking at the 2M Alliance service, for example, AE5/Albatross and AE10/Silk were blanked once every 22-24 weeks (9-13 weeks in the last 12 months), whereas the AE55/Griffin and AE6/Lion were blanked every 7-8 weeks (5-6 weeks in the last 12 months).

The same goes for Ocean Alliance, where AEU2 and AEU6 were hardly blanked in the last 12 months, while AEU7, AEU9, and AEU1 were blanked every 5-7 weeks in the same time period. There was very little to choose from across THE Alliance services, as they were all blanked quite frequently, while there were similar patterns across Asia-Mediterranean as well.

“While the general understanding might be that blank sailings are made across the board, the reality is that carriers favour certain services, either by virtue of choice and the value of cargo on board certain routes, by virtue of the ports that they call, or any other external factor,” commented CEO of Sea-Intelligence, Alan Murphy.

He went on to add, “Having this information then serves as a very good guide for the shippers, as knowing which services are more likely to be blanked (should similar operational issues arise in the future) would help them limit the additional disruption to their supply chain.”

Blank sailings have been traditionally used as a tactical tool to manage supply to bring it down in line with demand, said Sea-Intelligence in its report and highlighted that “over the course of the pandemic, as demand plummeted, carriers resorted to blank sailings once again to ensure that vessels were not deployed empty.”

However, as we saw above, this was not the case across every alliance service.