Research conducted by Sea-Intelligence has shown that it takes more time to handle two 5,000TEU vessels than it does to handle one 10,000TEU vessel in a congested environment, as a minimum due to the extra time going to and from the berth.

One of the effects of the pandemic has been a sharp increase in the number of extra vessels per week, according to Sea-Intelligence, the provider of research and analysis within the global supply chain industry.

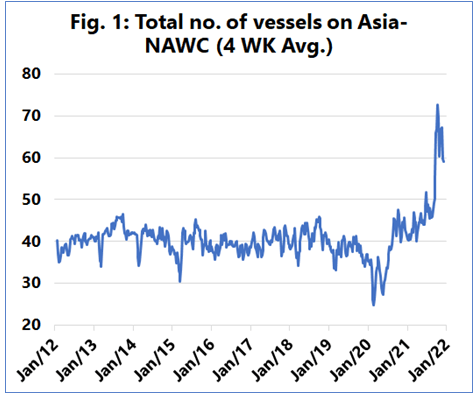

This trend had already appeared in 2020, then also came to Asia-Europe one year later and has escalated very sharply in the 2021 peak season.

According to the Danish analysts, on Asia-North America West Coast, the 2012-2019 average number of extra vessels on the trade was 1.9 vessels per week, increasing to five in 2020 when the pandemic struck, with the 4-week average currently standing at 14 additional vessels.

In addition, the figure above highlights the 4-week average of the total weekly vessel departures, clearly showing the extreme developments of 2020-2021.

“The additional spike in 2021 driven by a combination of poor schedule reliability is causing the sliding of vessel departures, as well as the insertion of a number of additional vessels,” commented CEO of Sea-Intelligence, Alan Murphy.

The development on the Asia-North America East Coast trade lane was similar, although the magnitude of the 2021 spike was a little smaller than seen on Asia to North America West Coast, according to Sea-Intelligence analysts.

On Asia-North Europe, under normal circumstances, very few such extra vessels are deployed. The initial impact of the pandemic was also very small, starting to increase in 2021 and worsened due to the Suez Canal blockage.

The pattern seen on Asia-Mediterranean was not different from that on Asia-North Europe, with a limited impact of the pandemic in 2020, but a sharp increase in 2021 starting before the Suez Canal blockage, noted the Danish researchers.

“The consequence of this is that the ports have to handle a much larger number of vessels than they were used to before the pandemic, in turn worsening the bottleneck problems,” pointed out Murphy.