The Danish research and analysis company Sea-Intelligence has examined the increased congestion related to both container terminals, as well as intermodal congestion related to terminals, using the congestion updates published by HMM from 16 November 2020 to 16 December 2021.

The data is split into terminals and intermodal, and for each, a traffic light is provided. Hence, green means “good”, yellow means “slight problem”, and red, “serious problem”.

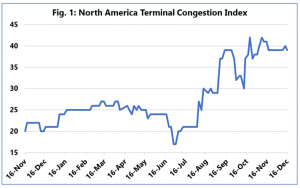

To quantify the dataset, Sea-Intelligence has converted it into a scoring system, with green lights assigned the value of “0”, yellow assigned the value “1”, and red assigned “2”, to calculate a total score for terminals and intermodal congestion.

“The higher the score, the more problems are seen,” noted Alan Murphy, CEO of Sea-intelligence.

“Since the congestion data used from HMM from 16 November 2020, to 16 December 2021, there is no guarantee that the experience of the specific company is perfectly representative of all other carriers globally, but as a major global carrier and a member of THE Alliance, it should be reflective of the wider market as a whole, according to the Danish analysts.

The Terminal Congestion Index for North America shows a development where congestion peaks in the middle of September 2021, and then there is a brief temporary improvement in early October.

This improvement, however, is quickly reversed, bringing congestion to a record-high sustained plateau.

“Despite the extensive focus on congestion issues, and the aim for resolution of the same, the reality experienced by HMM is that terminal congestion issues are worsening in Europe and are sustained at a historically high level in North America, with no indication of an improvement,” pointed out Murphy.

In terms of intermodal congestion, this continues to get worse in North America, and in Europe, there are also recent signs of a slight worsening of the situation.

“As we are heading into the pre-Chinese New Year rush (over the next six weeks), it is very likely that this condition will get worse before it gets better,” concluded Sea-Intelligence’s CEO.