Sea-Intelligence has analysed the impact of the lockdown in Shanghai on blank sailings, noting that Shanghai is different than for example the lock-down in Yantian in 2021, as the port remains open and operational, whereas the problematic part relates to closed manufacturing sites and warehouses, as well as a reduction in available trucking capacity.

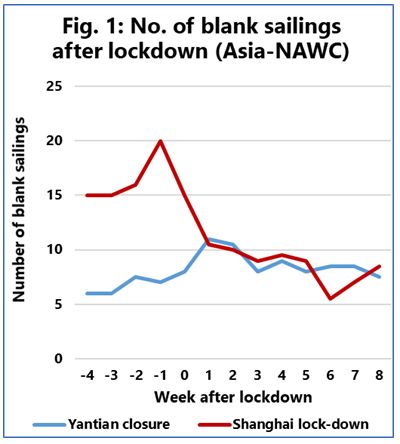

Sea-Intelligence explained that “removing the blank sailings on account of the Chinese New Year (CNY), we compared the blank sailings around the port closure of Yantian in 2021 and during the lockdowns in Shanghai in 2022 as a running 2-week average.”

For Asia-North America West Coast, the result is shown in the following figure:

The figure shows that the number of blank sailings in 2022 was coming down from a more elevated level, whereas in the Yantian case in 2021, blank sailings increased as a consequence of the Covid impact.

“This also implies that even though the level of blank sailings right now basically matches the number seen in 2021 following the Yantian impact, it cannot be concluded that the impact on the market is the same,” said Alan Murphy, CEO of Sea-Intelligence.

Murphy added, “Quite the contrary, there has not yet been any material impact on blank sailings, beyond the normal state of affairs – to the degree than that market prior to the Shanghai lockdown can be called ‘normal’.”

The Danish analysts used the same methodology for other trades as well and saw no impact on Asia-North America East Coast compared to the Yantian impact, whereas on Asia-Europe, the impact of the Shanghai lockdowns is very similar to that of Yantian in 2021.

“That said, it should however be clearly noted that we could still be in an early phase of the Shanghai lockdown, and if the factory closings persist, it is highly likely that the number of blank sailings will begin to increase in the coming weeks,” concluded Murphy.