The US GDP fell by 1.4% in the first quarter of 2022, which does not leave unconcerned the economists and the analysts.

Vibrations were making their way across the Trans-Pacific corridor as talk of a freight recession and a cooling ocean freight spot rates came to the fore.

The US recorded extremely high import volumes in the first quarter of 2022, up 4.77% from the already high-record fourth quarter of 2021 due to previous orders and consumer demand.

At the same time, the situation with the Covid-19 pandemic in China continues to deteriorate as production, truck activity and port handling remain “paralysed”.

With Beijing on the brink of a similar situation, the Chinese mainland may be struggling to return to its former smooth flow of cargo. This is reflected in the volumes of cargo from China slipping in May and shippers believe the situation will remain murky for a while.

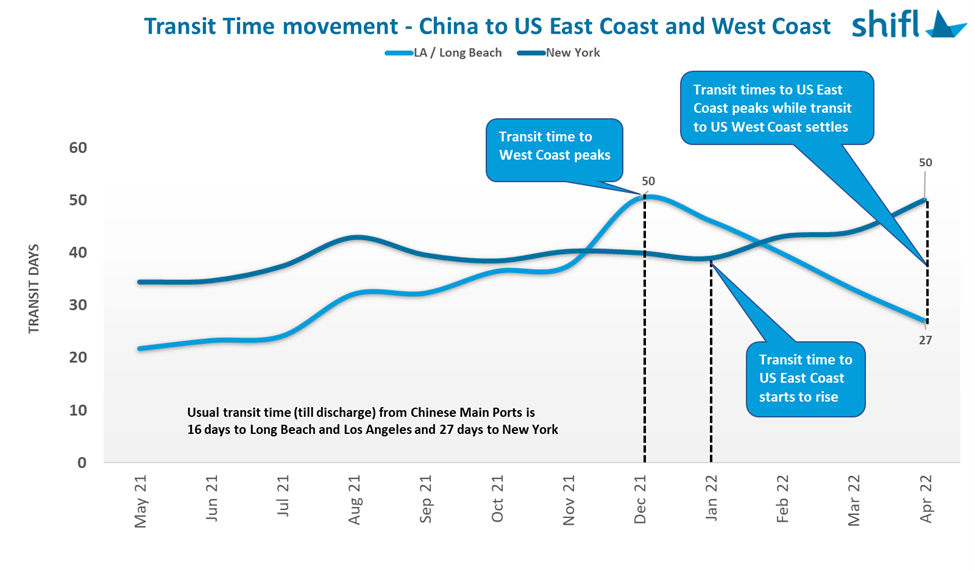

Transit times were drastically reduced

The current drop in demand and lockdowns in China helped the US West Coast ports recover from the congestion recorded and led to a reduction in total transit time to West Coast ports in April 2022.

The current drop in demand and lockdowns in China helped the US West Coast ports recover from the congestion recorded and led to a reduction in total transit time to West Coast ports in April 2022.

More specifically, transit time from China to Los Angeles and Long Beach was reduced by 85% from 50 days in December 2021 to 27 days in April 2022. However, it is still above pre-pandemic levels.

At the peak of congestion on the West Coast, customers transferred deliveries of future orders to East Coast ports, with the result that the congestion shifting to the East Coast. New York port traffic increased from 40 days to 50 days, representing a 20% increase over the same period and an 85% increase from pre-pandemic levels.

“We however expect a relief in the East Coast congestion in the near future as the impact of blank sailings created by the decrease in demand and China lockdowns will be felt in New York, albeit little later than West Coast ports due to the naturally longer transit time,” said Shabsie Levy, founder and CEO of Shifl.

But there is an unbalanced factor.

The unknown outcome of labor negotiations between the International Longshore and Warehouse Union (ILWU) and marine terminal operators is due to begin on 12 May 2022.

There has been market concern that if negotiations do not go well, US West Coast operations could be disrupted and add to the East Coast congestion.

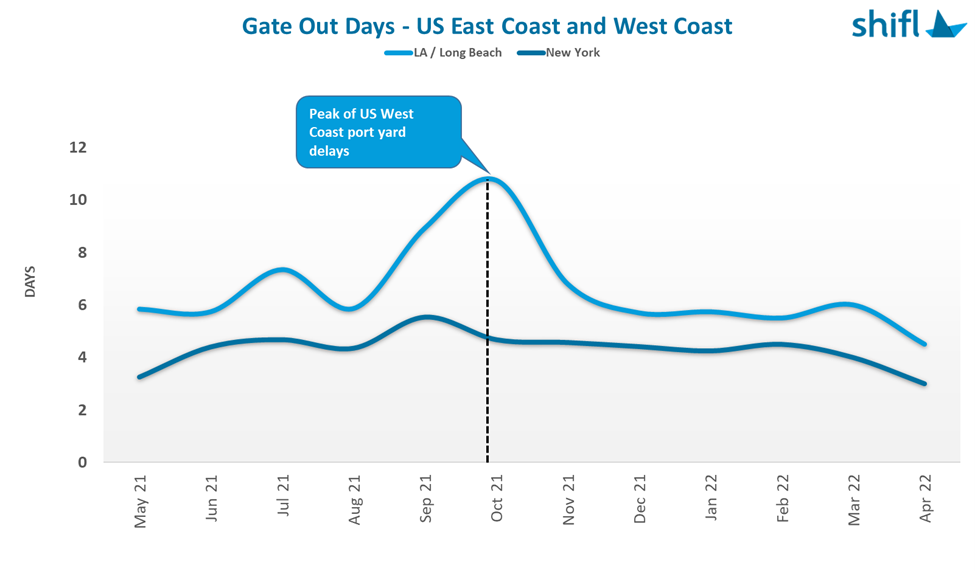

Container Gate Out times are improving across both coasts

Regardless of the congestion, exit times from the container gate are improved on both shores. Los Angeles / Long Beach entry times improved by 28%, down from 5.74 days in January 2022 to 4.5 days in April 2022, while New York had a 47% drop in the container gate from 4.25 days in January 2022 to 3 days in April 2022.

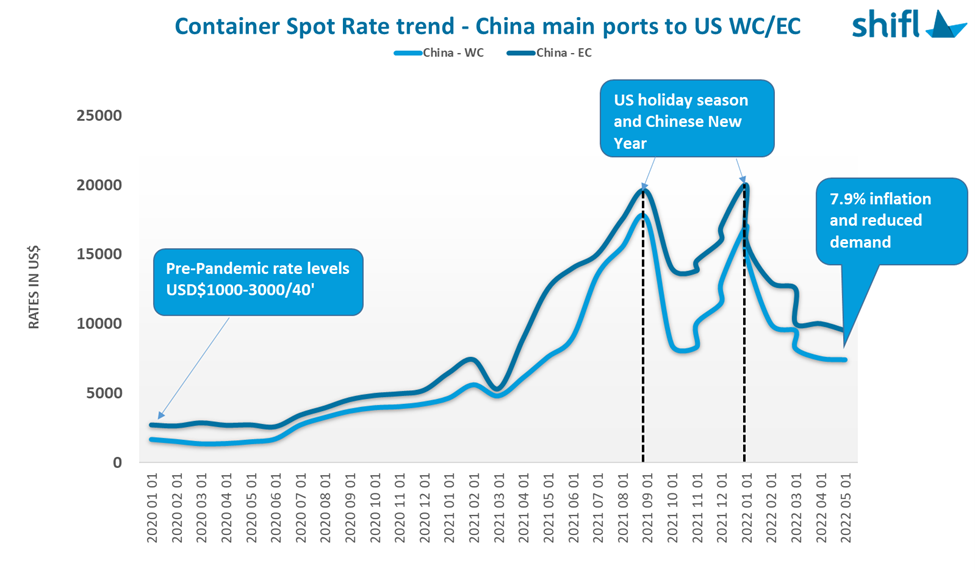

Container spot rates are greatly reduced

Container spot rates are greatly reduced

Restrictions on the movement of trucks and workers have reduced China’s industrial activity with exporters finding it difficult to deliver export containers to the port of Shanghai. This resulted in lower flow volumes on the China-US trade routes.

Container spot rates fell sharply due to the impact of declining demand in the US and Chinese exports affected by the pandemic caused by the Shanghai shutdowns.

“The core reason for the continued drop in spot freight rates as we predicted previously is the reduced demand in the US which we are seeing from our customers’ data as well. The price of a 40’ container continued to drop in April 2022 to US$7-8,000 for the China-US West Coast and around US$9-10,000 for the China-US East Coast,” commented Levy.

“The core reason for the continued drop in spot freight rates as we predicted previously is the reduced demand in the US which we are seeing from our customers’ data as well. The price of a 40’ container continued to drop in April 2022 to US$7-8,000 for the China-US West Coast and around US$9-10,000 for the China-US East Coast,” commented Levy.

“Carriers have been trying to manage this drop in spot rates by implementing blank sailings while trying to lock shippers on longer-term contracts riding on the previous highs in hopes of extending their honeymoon period,” added Levy.