Following the election of Donald Trump as the next US president, there is heightened interest among shipping industry professionals regarding the economic policies his administration will pursue, particularly in light of the ongoing trade tensions with China.

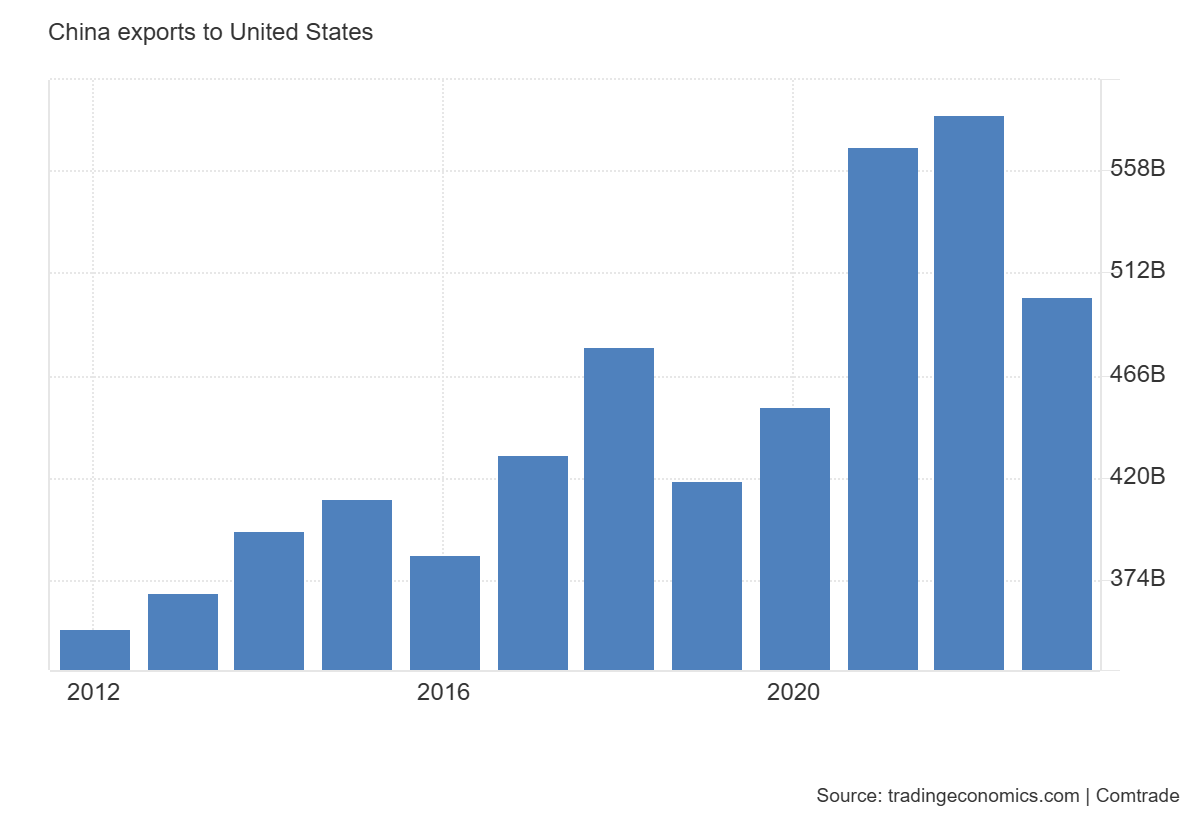

Punit Oza, a respected shipping and geopolitics analyst, remarked on LinkedIn that Trump’s administration would likely encourage Asia, particularly China, to ensure a level playing field for America while also expecting Asia to increase exports to the United States.

This, he suggests, could render Asian imports more viable due to economies of scale. Oza also noted that Trump’s policies favoring increased fossil fuel production in the US might compel trade partners to renegotiate agreements, leading to dynamic and potentially volatile trade flows.

However, Oza also mentioned that while shipping might face volatile times, it could benefit from a US-Asia deal that would increase ton-miles and promote bilateral traffic, which he views as a positive development.

Conversely, a reduction in US-Europe relations might lead to longer shipping times replacing shorter ones.

Lars Jensen, a container shipping industry expert, also shared insights on LinkedIn, predicting a short-term surge in US import demand as shippers anticipate new tariffs by accelerating imports of non-time-sensitive goods. Over the long term, Jensen expects shifts in supply chain patterns due to intensifying U.S. trade conflicts.

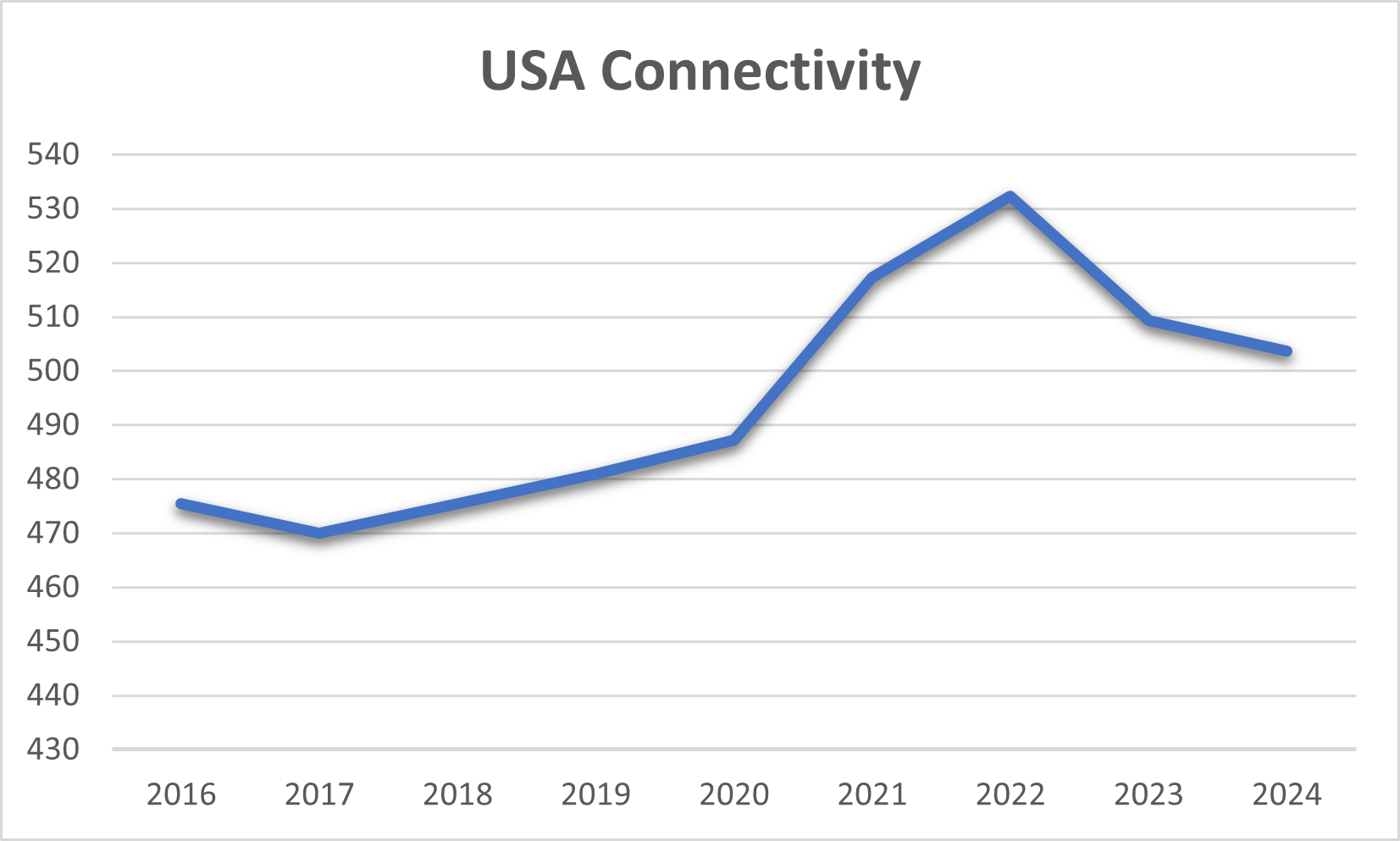

According to Reuters, experts from the shipping and retail sectors anticipate that cargo rates would skyrocket, similar to what occurred during his first term from 2017 to 2021, when ocean container shipping rates jumped by over 70% following the announcement of additional tariffs in 2018.

Economists argue that Trump’s tariff strategy, potentially his most impactful economic policy, would revert US import duty rates to levels last seen in the 1930s, exacerbate inflation, disrupt US-China trade, provoke retaliatory measures, and significantly alter global supply chains.