Ocean operators are expecting an increase in their income this year as first quarter income looks set to boost returns and demand for capacity has continued to be strong, during the first month of the year.

[s2If is_user_logged_in()]German carrier Hapag-Lloyd reported that the year had got off to an “exceptionally strong” start, with preliminary figures for January showing earnings before interest, tax, depreciation and amortisation (EBITDA) expected to be at least US$1.8 billion, from US$517 million in January 2020.

In a statement, the executive board at Hapag-Lloyd said it expected the EBITDA for the full year to “clearly surpass the prior-year [2020] level”. Even so, the carrier’s board did offer a note of caution that there were considerable unknowns in the mix, including rate volatility, operational challenges including those caused by existing infrastructural bottlenecks and the inability to predict the course and impact of the coronavirus pandemic.

Volatility in freight rates does not look to be an immediate problem, with the Freightos Baltic Index (FBX) showing Pacific rates to both the west and east coasts have been stable since the end of September 2020. Early year indications are that Asia to Europe rates have risen steeply since the end of last year, as have rates to the Mediterranean but there is no sign of a decrease at this time.

“We will see a very strong result in the first quarter, but we anticipate a normalisation as the year progresses. We are still seeing slower container turn times, significant congestion in ports around the globe, capacity constraints in rail and truck, and the risks of the coronavirus pandemic remain. Nevertheless, we do also expect that the result for 2021 as a whole will be significantly higher than the prior-year level,” said Rolf Habben Jansen, CEO of Hapag-Lloyd.

This perception is confirmed with reports from both China and the US suggesting that orders for the post Chinese New Year period are still increasing, though with quarantining drivers in China and “the US supply chain in gridlock,” according to Jon Monroe from Worldwide Logistics it seems that the ingredients for more disruption are in place.

Monroe estimates that there are 306,000TEU on vessels at anchorage outside Los Angeles and Long Beach ports. “Chassis are still a problem and there are delays getting containers on the rail. And often truck drivers complain of 4 to 6 hour waits at the terminal gates and in more than a few cases, by the time the driver arrives at his gate, the appointment is cancelled and he is turned away,” he added.

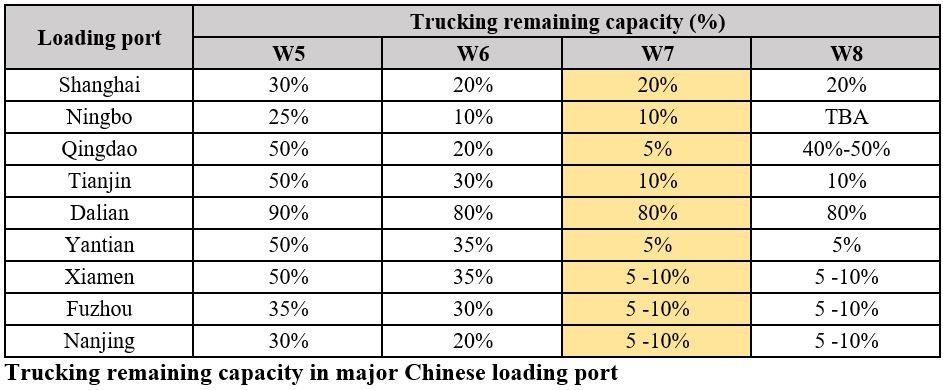

In addition, the trucking situation in China remains critical as Monroe points out, the levels of driver availability are still falling. “The factory situation is not so clear in China. Some factories are closed while others may remain open. The only certainty is that truck capacity is limited and factories may need to pay double and in some cases triple the normal cost to get a truckers attention to pick up and deliver their container.”

[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]